Principles of indemnification for compulsory civil liability insurance by motor vehicle owners in Vietnam

What are the principles of indemnification for compulsory civil liability insurance by motor vehicle owners in Vietnam? - Thanh Chuong (Thanh Hoa)

Maximum coverage for damage to health and life caused by motor vehicles in Vietnam

Pursuant to the provisions of Article 6 of Decree 67/2023/ND-CP, the maximum coverage for damage to health and life caused by motor vehicles is as follows:

- The maximum coverage for damage to health and life caused by motor vehicles is VND 150 million/individual/accident.

- Maximum coverage for damage to property:

+ If the damage caused by motorcycles; motorized tricycles; mopeds (including electric mopeds) and similar vehicles according to Law on Road Traffic, the maximum coverage shall be VND 50 million/accident.

+ If the damage caused by automobiles; tractors; trailers and semi trailers towed by automobiles and tractors according to Law on Road Traffic, the maximum coverage shall be VND 100 million/accident.

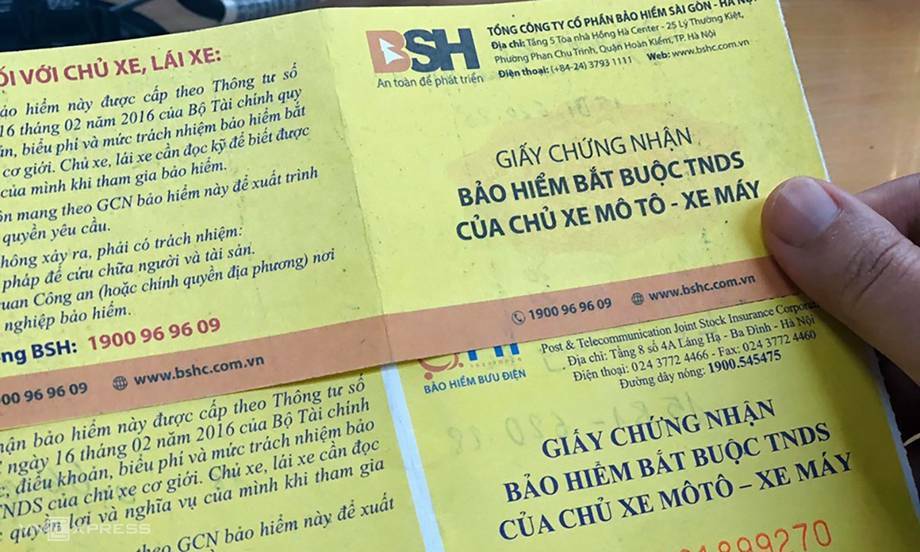

Principles of indemnification for compulsory civil liability insurance by motor vehicle owners in Vietnam (Internet image)

Principles of indemnification for compulsory civil liability insurance by motor vehicle owners in Vietnam

According to Article 12 of Decree 67/2023/ND-CP, insurer shall consider and settle an insurance claim as prescribed by law on insurance business and the following principles:

(1) In case of an accident, the policyholder and the insured shall:

- Immediately notify the insurer via hotline to cooperate in providing treatment in order to cure and limit damage to health, life and property, protect the accident scenes.

- refrain from moving, dismantling or repairing property without consensus of insurers; except for cases in which such activities are necessary to ensure safety, prevent damage to health, life and property or comply with requests of competent agencies.

- collect and provide documents required under an application for insurance claims within responsibilities of the policyholder and the insured for the insurer according to Article 13 of Decree 67/2023/ND-CP.

- enable the insurer to verify documents provided by the policyholder and the insured.

(2) Within 1 hour after receiving notification of the accident, the insurer must inform the policyholder, the insured of safety measures to minimize damage to life and property, provide guidelines on the application and procedures for filing an insurance claim;

Closely cooperate with the policyholder, the insured, third party and relevant parties within 24 hours in organizing assessment of damage to determine causes and levels of damage which serve as the basis for settlement of the insurance claim.

(3) Within 3 working days after being notified by the policyholder or the insured about the accident, the insurer must provide advance indemnity for damage to health and life, to be specific:

- In case the accident has been identified to be covered by insurance:

70% of estimated indemnity per person in case of fatalities.

50% of estimated indemnity per person in case of bodily injuries.

- In case the accident has not been identified to be covered by insurance:

30% of the maximum coverage per person in case of fatalities and estimated whole person impairment (WPI) of 81% or more.

10% of the maximum coverage per person in case of estimated WPI of from 31% to less than 81%.

After providing advance indemnity, insurers may request MVIF to reimburse the advance payment if the accident is an insurance exclusion or not covered by insurance.

(4) Within 5 working days from the date on which accidents occur except for force majeure or objective obstacles, policyholders or the insured must send notice of accidents in writing or electronically to insurers.

(5) If an accident occurs within the maximum coverage, the insurer must reimburse the insured for the payment that has been made or will be made to the accident victims by the insured.

In case the insured is dead or incapacitated according to a judicial decision, the insurer shall directly provide indemnity to the accident victims or victims’ heirs (in case the victims are dead) or victims’ representatives (in case the victims are incapacitated according to judicial decisions or underage as prescribed by the Civil Code).

(6) Indemnities:

- Specific indemnities for loss of health and life are determined according to corresponding types of injury or damage under Schedule for health and life indemnities under Annex I attached to Decree 67/2023/ND-CP or according to agreements (if any) between the insured and victims or victims’ heirs (in case the victims are dead) or victims’ representatives (in case the victims are incapacitated according to judicial decisions or underage as prescribed in the Civil Code) but must not exceed the corresponding indemnities specified under Annex VI attached to Decree 67/2023/ND-CP.

In case judicial decisions are made, judicial decisions shall prevail as long as the corresponding indemnities specified under Annex VI attached to Decree 67/2023/ND-CP are not exceeded.

In case the damage to health and life is caused by multiple motor vehicles, indemnities shall be determined by degrees of fault of motor vehicle owners as long as the total indemnity does not not exceed the maximum coverage.

For accidents which are entirely caused by third party as determined by competent authorities, indemnities for health and life insurance coverage rates for the third party shall equal 50% of the indemnities specified under Annex VI attached to Decree 67/2023/ND-CP or agreements (if any) between the insured or victims’ heirs (in case victims are dead) or victims’ representatives (in case victims are incapacitated according to judicial decisions or underage) but must not exceed 50% of the indemnities specified under Annex VI enclosed with Decree 67/2023/ND-CP.

- Specific indemnity for an accident is determined based on actual damage and degree of fault of motor vehicle owner but must not exceed the maximum coverage.

(7) Insurers may reduce up to 5% of indemnities for damage to property in case policyholders or the insured fail to notify insurers about accidents according to (4) or insurers detect that policyholders and the insured fail to notify in case of changes to factors which serve as the basis for calculating insurance premiums during execution of policies, thereby increasing insured risks after insured events occurred.

(8) Insurers are not obliged to pay for excesses of the maximum coverage according to regulations herein, except for cases in which motor vehicle owners participate in voluntary insurance policies.

(9) In case multiple compulsory civil liability insurance policies are concluded for a single motor vehicle, indemnity shall be determined only according to the first concluded policy. Insurers must refund 100% of paid insurance premiums for the remaining insurance policies.

(10) Policyholders and the insured shall notify victims or victims’ heirs or representatives of the paid amounts for each case of damage to health or life according to regulations in Point a Clause 6 of Article 12 of Decree 67/2023/ND-CP.

(11) Insurers shall notify policyholders, the insured and victims of indemnities for damage to health or life prescribed in Point a Clause 6 of Article 12 of Decree 67/2023/ND-CP and pay them.

Mai Thanh Loi

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents