Legal consequences of unilateral termination of insurance contracts in Vietnam

What are the legal consequences of unilateral termination of insurance contracts in Vietnam? - My Duyen (Long An)

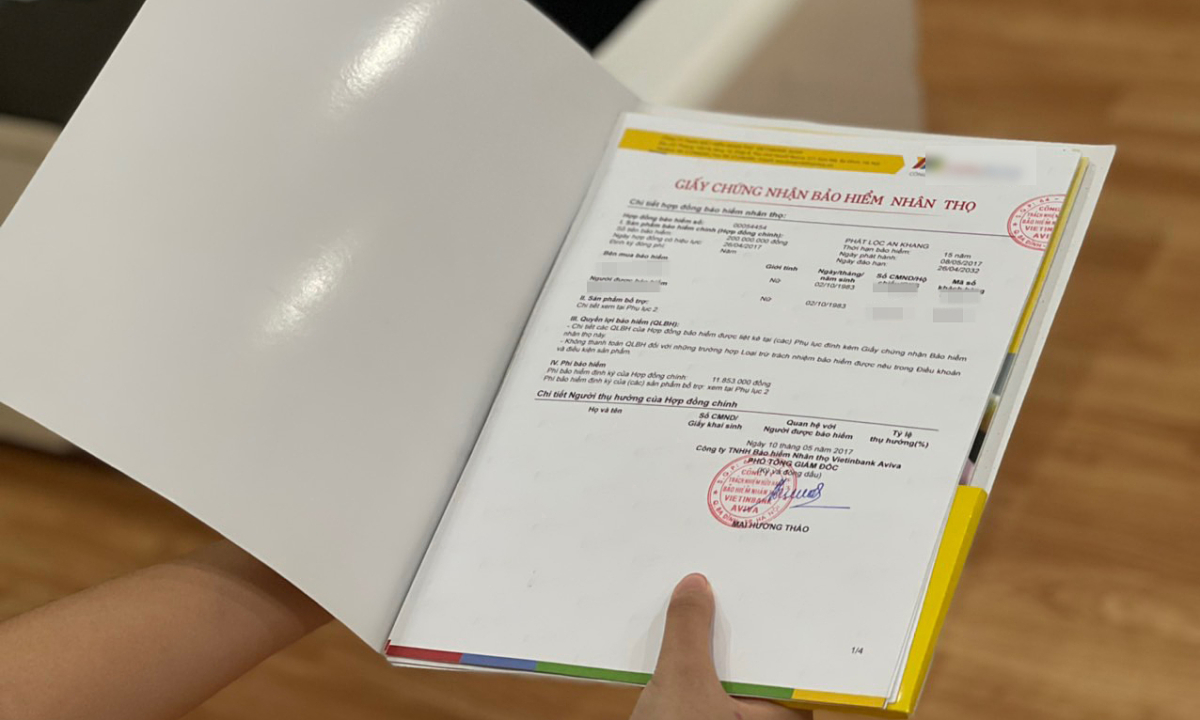

Legal consequences of unilateral termination of insurance contracts in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Legal consequences of unilateral termination of insurance contracts in Vietnam

Legal consequences of unilateral termination of insurance contracts according to Article 27 of the Law on Insurance Business 2022 are as follows:

- In case of unilateral termination of an insurance contract prescribed in clause 1 of Article 26 of the Law on Insurance Business 2022, the following actions shall be taken as follows:

+ Insurance premiums remain to be paid in full by the policyholder till the time of unilateral termination of the insurance contract. This regulation shall not apply to life insurance contracts and health insurance contracts, except group insurance contracts;

+ When unilaterally terminating a life insurance contract or health insurance contract in this case, the insurer or the foreign non-life insurer’s branch shall be responsible for paying insurance to the insured if the policy event occurs before the time of unilateral termination of the insurance contract, and may deduct insurance premiums paid till the time of unilateral termination of the insurance contract;

+ When unilaterally terminating a property insurance contract, a property damage liability insurance contract or a liability insurance contract, the insurer or the foreign non-life insurer’s branch shall be responsible for indemnifying the insured if the policy event occurs before the time of unilateral termination of the insurance contract, and may deduct insurance premiums as agreed upon in the insurance contract.

- When unilaterally terminating an insurance contract as provided in clause 2 and 3 of Article 26 of the Law on Insurance Business 2022, the insurer or the foreign non-life insurer’s branch shall be responsible for refunding insurance premiums paid in advance for days left to the expiry date of the insurance contract as agreed upon in the insurance contract.

The insurer or the foreign non-life insurer’s branch shall be responsible for paying insurance indemnity or coverage as agreed upon in the insurance contract if the policy event occurs before the time of unilateral termination of the insurance contract.

- When unilaterally terminating a life insurance contract involving cash surrender value in the cases stipulated in clause 1 and 2 of Article 26 of the Law on Insurance Business 2022, the insurer shall be obliged to pay the policyholder the cash surrender value agreed in the insurance contract, unless otherwise agreed by contracting parties.

- When unilaterally terminating an insurance contract as stipulated in clause 4 of Article 26 of the Law on Insurance Business 2022, the policyholder may be refunded the cash surrender value or insurance premiums that he/she already pays in advance in proportion to the days left to the expiry date of the policy term, depending on specific types of insurance products.

Where the property value is less than technical provisions in the transferred portfolio of insurance contracts, the refund that the policyholder receives shall be calculated according to the proportion of property value to technical provisions in the transferred portfolio of insurance contracts.

2. Cases eligible for unilateral termination of insurance contracts in Vietnam

According to Article 26 of the Law on Insurance Business 2022, the insurer, the foreign non-life insurer’s branch or the policyholder may unilaterally terminate the insurance contract in the following cases:

- The policyholder defaults on insurance premiums or does not pay insurance premiums in full by the agreed due date or after the extended due date;

- The insurer, the foreign non-life insurer’s branch or the policyholder does not accept the request for change in the level of insurable risk under Article 23 of the Law on Insurance Business 2022;

- The insured fails to apply safety measures to protect subject matters insured as provided in clause 3 of Article 55 of the Law on Insurance Business 2022;

- The policyholder disagrees to transfer the portfolio of insurance contracts prescribed in clause 4 of Article 92 of the Law on Insurance Business 2022.

- Key word:

- insurance contracts

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents