Instructions for reading the origin of use on 2nd page of LURC in Vietnam

What are the instructions for reading the origin of use on 2nd page of LURC in Vietnam? - Quoc Khanh (Tien Giang)

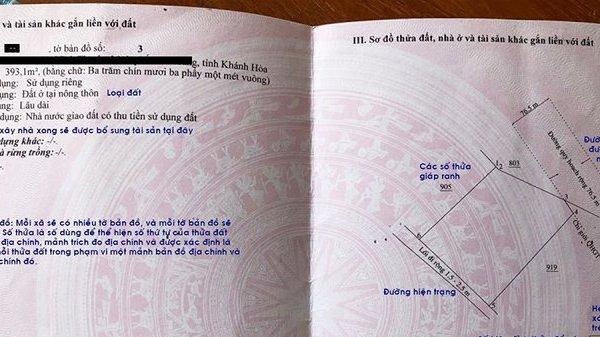

Instructions for reading the origin of use on 2nd page of LURC in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Instructions for reading the origin of use on 2nd page of LURC in Vietnam

According to Clause 8, Article 6 of Circular 23/2014/TT-BTNMT (amended in Circular 33/2017/TT-BTNMT), origin of use on page 2 is written under the following provisions:

- In case of being allotted land from the State without land use fees, write “allotted land from the State without land use fees”;

- In case of being allotted land from the State with land use fees (including the cases of land allotment through the auction of land use right; buying of building apartment and in case of being allotted land from high-tech industrial park or economic zone management board and in case of being reduced or exempted from financial obligations), write “the State allots land with land use fees”.

- In case of leasing land from the State with one time payment of rental for the whole duration of leasing (including the cases of land allotment through the auction of land use right; and in case of being allotted land from high-tech industrial park or economic zone management board and in case of recognition of land use right in the form of land leasing with one time payment of rental and in case of being reduced or exempted from financial obligations), write “the State leases land with one time payment of rental”;

- In case of leasing land from the State with annual payment of rental and in case of being reduced or exempted from financial obligations), write “the State leases land with annual payment of rental”;

- Where the land use right is recognized by the State but the payment of land use fees must be made, including households and individuals using land for the non-agricultural purpose as per the regulation on land allotment with land use fees under the regulations of law on land but not have to make payment or being reduced or exempted from financial obligations, write “Recognition of land use right as land allotment with land use fees”;

- Where the land use right is recognized by the State under the regulation of land allotment without land use fees, write “Recognition of land use right as land allotment without land use fees”;

- In case of issuance of Certificate from separation or combination of land lot or re-issuance or issuance or change of Certificate without change of purpose of land use, write the origine of land use as recorded in the Certificate first issued and specified in compliance with the provisions in Circular 23/2014/TT-BTNMT.

Where the issued Certificate has no origin of land use recorded, based on the dossier for issuance of Certificate previously approved and regulations of law on land at the time of issuance of Certificate, the origin of land use shall be identified under the provisions in this Circular;

- In case of transfer of land use right and issuance of Certificate to the receiver of transfer of right, write the form of receipt of transfer of right (such as conversion, assignment, inheritance, donation, capital contribution, auction winning, mortgage debt processing, dispute settlement, complaint or denunciation settlement, implementation of decision (or judgment) of the Court; implementation of decision of judgment enforcement;…) and write the origin of land use as recorded in the Certificate first issued and specified in compliance with the provisions in Circular 23/2014/TT-BTNMT. Ex: “Receipt of transfer of land allotted by the State with land use fees”.

In the case of receiving the transfer of land use rights for other purposes, the procedures for changing the land use purpose must be carried out, and then the origin of land use must be written in the form specified at Points a, b, c, and d of Clause 8, Article 6 of Circular 23/2014/TT-BTNMT in accordance with the form of financial obligation to the state after the land use purpose is changed.

In the case of recognition of land use rights with respect to the original land, where the lawful land use right is transferred from another person and this land is subject to the land allocation regime with collection of land use levy in accordance with the land law, then write "Recognition of land use rights as land allocation with collection of land use levy".

Example: Organization A has received the transfer of residential land use rights of households and individuals before 2005, which has not yet been granted a certificate, and is now used for production and business purposes. When recognizing the land use right, it will be written on the certificate as "Recognition of land use right as land allocation with collection of land use levy;

In case of receiving the land use right for different purposes but the procedures must be done for transfer of purpose of land use, write the origin of land use in the form specified under Points a, b, c and d of Clause 8, Article 6 of Circular 23/2014/TT-BTNMT in accordance with the form of compliance with financial obligations with the State after the transfer of purpose of land use;

- In case of transfer of purpose of land use with the issuance of Certificate, write under the regulations for case of land allotment with land use fees from the State (if the land user makes payment of land use fees for the transfer of purpose); write under the regulations for case of land leasing from the State (if the land user transfers to land leasing or continue the land leasing as before transfer of purpose); write as before the transfer of purpose of land use for case where the land use right is recognized by the State without making payment for transfer of purpose and without transfer to land leasing;

- In case of land leasing, land sub-leasing from enterprises investing in infrastructure in industrial parks, industrial clusters, export processing zone, high-tech parks and economic zones in the form of one time payment, write “Land leasing with one time payment of from enterprises investing in industrial infrastructure (or industrial cluster, export processing zone,…)”.

In case of land leasing, land sub-leasing from enterprises investing in infrastructure in industrial parks, industrial clusters, export processing zone, high-tech parks and economic zones in the form of annual payment, write “Land leasing with annual payment of from enterprises investing in industrial infrastructure (or industrial cluster, export processing zone,…)”.

- Where the land parcel includes the areas with different origin of land use, write each type of origin and area with its attached origin.

- In case of reduction or exemption form financial obligations under regulations of law, write the reduction or exemption in the Certificate as stipulated in Article 13 of Circular 23/2014/TT-BTNMT.

2. Instructions for recording the contents of debt, reduction and exemption from financial obligations in Vietnam

Instructions for recording the contents of debt, reduction and exemption from financial obligations in Vietnam according to Article 13 of Circular 23/2014/TT-BTNMT as follows:

- The debt, reduction and exemption from financial obligations are indicated in the Note of page 2 of the Certificate; the certification of cancellation of debt of financial obligations is recorded in section “IV. Changes after issuance of Certificate” of the Certificate.

Where the debt, reduction and exemption from financial obligations cannot be recorded in the Note, then write in section “IV. Changes after issuance of Certificate” of the Certificate” of the Certificate; the land registration office, branch of land registration office or land use right registration office shall write the date, month and year, sign and specify the full name and position of the signer in the column “Certification of the competent authorities”.

- The contents of debt, reduction and exemption from financial obligation are recorded as follows:

= In case of debt of financial obligation upon issuance of Certificate with the debt amount defined under regulations of law, write “Debt…(specify the debt of financial obligation, debt amount in figure and letter) according to…..(specify name, number, signing date and organ signing the paper showing the debt amount)”.

In case of recording the debt of financial obligation upon issuance of Certificate without defining the debt amount under regulation of law, write “Debt….(specify the debt of financial obligation)”;

= In case of debt cancellation, write “Debt is cancelled….(specify the cancelled debt of financial obligation) according to….(specify name, number, signing date and organ signing the document of debt cancellation)”.

In case of making full payment of financial obligation, write “Fulfilled financial obligation according to…(specify name, number, signing date and organ signing the voucher of payment of financial obligation”;

= Where the State allots land with land use fees but allows the exemption from payment of land use fees, write “Exempted from land use fees according to….(specify name, number, signing date and organ signing the document confirming the payment exemption)”.

In case of reduction in land use fees, write “Land use fees reduced:….(specify the reduced amount or the percentage) according to….(specify name, number, signing date and organ signing the document confirming the reduction)”;

= In case of land leased from the State but exempted from land leasing fees for the whole duration of leasing, write “Exempted from land leasing fees according to…(specify name, number, signing date and organ signing the document confirming the exemption)”;

In case of reduction in land leasing fees, write “Land leasing fees reduced:…(specify the reduced amount or the percentage and the number of year of reduction if any) according to…(specify name, number, signing date and organ signing the document confirming the reduction)”

- Key word:

- LURC

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents