Hanoi-Vietnam: Newest guidelines on calculating lump-sum social insurance payout in 2020

Currently, many employees in Vietnam wish to receive their lump-sum social insurance payout instead of the monthly pension when they reach retirement age. Below is the newest method for calculating the lump-sum social insurance payout.

Hanoi-Vietnam: Newest guidelines on calculating lump-sum social insurance payout in 2020 (Illustrative Image)

Calculation of lump-sum social insurance payout

Under Clause 2, Article 60 of the Law on Social Insurance, Article 19 of Circular 59/2015/TT-BLDTBXH, the lump-sum social insurance payout is calculated based on the number of years of social insurance premium payment as follows:

- 1.5 months average monthly salary serving as the basis of social insurance premium payment before 2014;

- 2 months average monthly salary serving as the basis of social insurance premium payment from 2014 onwards;

- 22% of the monthly salary has been paid for social insurance, up to a maximum of 2 months average monthly salary if the the number of years of social insurance premium payment is less than 1 year.

Note: The lump-sum social insurance payout does not include the voluntary social insurance premium payment funded by the state, unless the employee is suffering from a life-threatening disease.

Specifically, the lump-sum social insurance payout is calculated as follows:

Benefit level= (1.5 * Average Monthly Salary * the number of years of social insurance premium payment before 2014) + (2 * Average Monthly Salary * the number of years of social insurance premium payment from 2014 onwards)

Where:

- Regarding the social insurance participation period:

- If the number of years of social insurance premium payment has odd months, from 01 – 06 months is counted as half a year, from 07 – 11 months is counted as 01 year.- Before January 1, 2014, if the number of years of social insurance premium payment has odd months, those odd months will be transferred to the social insurance premium payment period from January 1, 2014 onwards for the calculation of lump-sum social insurance payout.

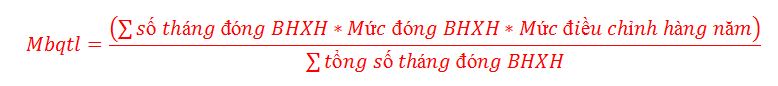

- Regarding the average monthly salary:

Note: The annual indexation rate is stipulated in Circular 35/2019/TT-BLDTBXH, which specifies the indexation rate for the monthly salary and income serving as the basis of social insurance premium payment as follows:

- Indexation rates for compulsory social insurance participants:

| Year | Before 1995 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 |

| indexation rate | 4.85 | 4.12 | 3.89 | 3.77 | 3.50 | 3.35 | 3.41 | 3.42 | 3.29 | 3.19 | 2.96 | 2.73 | 2.54 | 2.35 |

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| indexation rate | 1.91 | 1.79 | 1.64 | 1.38 | 1.26 | 1.18 | 1.14 | 1.13 | 1.10 | 1.06 | 1.03 | 1.00 | 1.00 |

- Indexation rates for voluntary social insurance participants:

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| indexation rate | 1.91 | 1.79 | 1.64 | 1.38 | 1.26 | 1.18 | 1.14 |

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| indexation rate | 1.13 | 1.10 | 1.06 | 1.03 | 1.00 | 1.00 |

Specific Example:

Mr. M, 40 years old, participated in social insurance from October 2017 to April 2019, as follows:

- From October 2017 - December 2017: Salary of 4,000,000 VND/month.- From January 2018 - March 2019: Salary of 4,500,000 VND/month.- April 2019: Salary of 6,000,000 VND/month.

Mr. M's social insurance participation period is 1 year and 6 months (1.5 years), he is not of retirement age and wishes to receive a lump-sum social insurance payout. The period eligible for submitting the application for the lump-sum social insurance payout is from March 2020.

Thus, the lump-sum social insurance payout is calculated as follows:

- Mr. M's social insurance participation period after January 1, 2014, is 1 year and 6 months (1.5 years).

- Average monthly salary:

- Thus, the lump-sum social insurance payout is: 4,642,778 * 2 * 1.5 = 13,928,334 VND

Additionally, employees should note the following related matters when receiving a lump-sum social insurance payout:

Regarding the conditions for receiving a lump-sum social insurance payout

According to Clause 1, Article 60 of the Law on Social Insurance, Vietnamese employees who are required to participate in social insurance shall be entitled to a lump-sum social insurance payout if they fall into one of the following cases:

- Reach retirement age as prescribed but have not completed 20 years of social insurance premium payment;

- Female workers who are full-time or part-time officials at communes, wards, or commune-level towns who participate in social insurance and retire with 15-20 years of social insurance premium payment and are 55 years old;

- Move abroad for permanent residence;

- Suffer from one of the life-threatening diseases such as cancer, poliomyelitis, cirrhosis with ascites, leprosy, severe tuberculosis, HIV infection that has progressed to AIDS, and other diseases as prescribed by the Ministry of Health;

- Officers, professional soldiers in the People's Army; officers and technical non-commissioned officers in the People's Public Security; cipher workers receiving salaries like military personnel; non-commissioned officers and soldiers in the People's Army; non-commissioned officers and soldiers in the People's Public Security serving under a term; military, public security, cipher students who are studying and receiving living stipends upon demobilization, discharge, or resignation but do not meet the conditions for retirement pension.

- Additionally, Article 1 of Resolution 93/2015/QH13 of the National Assembly on implementing the policy of lump-sum social insurance payouts for employees also stipulates that employees who participate in compulsory social insurance after 01 year of leaving work, and voluntary social insurance participants who after 1 year continue not contributing and have not completed 20 years of social insurance premium payment when requested.

Regarding the application for receiving a lump-sum social insurance payout

According to Article 109 of the Law on Social Insurance, the application for a lump-sum social insurance payout includes:

- Social insurance book.

- Application form for a lump-sum social insurance payout completed by the employee.

- For those moving abroad for permanent residence, an additional copy of the confirmation document from the competent authority regarding renunciation of Vietnamese nationality or a certified or notarized translation of one of the following documents is required:

- Passport issued by a foreign country;- Visa granted by a competent foreign authority confirming permission for immigration for residency abroad;- Document confirming the initiation of procedures for acquiring foreign nationality; document confirming or card of permanent residence, or a residence permit with a term of 5 years or more issued by a competent foreign authority.

- For employees suffering from life-threatening diseases, the application must include a medical record extract.

Note: According to Clause 2, Article 2 of Decision 166/QD-BHXH, to be entitled to a lump-sum social insurance payout, the application needs to be submitted to:

- District-level social insurance agency at the place of residence;- Provincial-level social insurance agency (if social insurance is decentralized to resolve lump-sum social insurance payouts) at the place of residence.

At the same time, according to Article 110 of the Law on Social Insurance, within 10 days from the date of receipt of the complete application from eligible individuals, the social insurance agency will resolve and organize the payment of the social insurance benefit to the employee.

Le Vy

- Key word:

- lump-sum social insurance payout

- Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents

.JPG)