Guidelines for Preparing 2016 Personal Income Tax Finalization Documents in Vietnam

Procedures for implementation and submission of personal income tax finalization documents are subjects that garner significant interest. Recently, the District 1 Department of Taxation in Ho Chi Minh City issued Official Dispatch 2133/CCT-TTHT providing guidelines on the 2016 PIT finalization applicable to resident individuals with income from wages and salaries.

Individuals working at income-paying units required to finalize personal income tax (PIT) for the year 2016 should declare according to the guidelines posted on the website: http://tphcm.gdt.gov.vn of the Ho Chi Minh City Tax Department or in the free flyers available at the Tax Sub-department of District 1.

If individuals are unclear, they should contact the tax authority for guidance according to the following time and place:

- Time: From January 1, 2017, to March 31, 2017 (during business hours);

- Place: Taxpayer support and propaganda unit, No. 100 Tran Quang Khai, Tan Dinh Ward, District 1.

The Tax Sub-department encourages taxpayers to finalize early to avoid overloading.

| 1. Subjects required to finalize | - Individuals with additional tax payable - Individuals with overpaid tax requesting a refund or tax offset. |

|

| 2. Declaration dossier | - Tax finalization declaration form No. 02/QTT-TNCN, Appendix form No. 02-1BK-QTT-TNCN if registration for dependent family member reduction exists (Circular 92/2015/TT-BTC). - Documents proving tax already withheld, temporary tax paid during the year, or tax paid abroad (if any) - photocopies. Individuals are responsible for the accuracy of the information in these photocopies. - Invoices and documents proving contributions to charity funds, humanitarian funds, or study promotion funds (if any) - photocopies. - In cases where individuals receive income from International organizations, Embassies, Consulates, and receive income from abroad, documentation proving the amount paid by the entity or organization abroad must be provided. |

|

| 3. Place to submit the dossier | Tax authority (Tax Department or Tax Sub-department) directly managing the income-paying organization | - Individuals who have calculated family allowance for themselves at the income-paying organization or individual should submit the tax finalization dossier at the tax authority directly managing that income-paying organization or individual. - In cases where individuals have changed workplaces and the final income-paying organization calculates family allowance for themselves, they should submit the tax finalization dossier at the tax authority managing the final income-paying organization or individual. |

| Tax Department | - Individuals receiving income from International organizations, Embassies, Consulates. - Individuals with income from organizations or individuals paying from abroad. |

|

| Tax Sub-department where the individual resides | - In cases where individuals have not calculated family allowance for themselves at any income-paying organization or individual. - In cases where individuals do not have a labor contract or sign a labor contract for less than 3 months, or sign a service provision contract with income from one or multiple sources that have deducted 10%. - Individuals who receive salary, wage income from one or multiple places during the year but at the time of tax finalization, do not work at any income-paying organization or individual. - Individuals changing workplaces at the final income-paying organization who do not calculate family allowance for themselves. (In cases where individuals reside in multiple places, they can choose one place to finalize taxes). |

|

| DEADLINE FOR SUBMISSION | March 31, 2017 | |

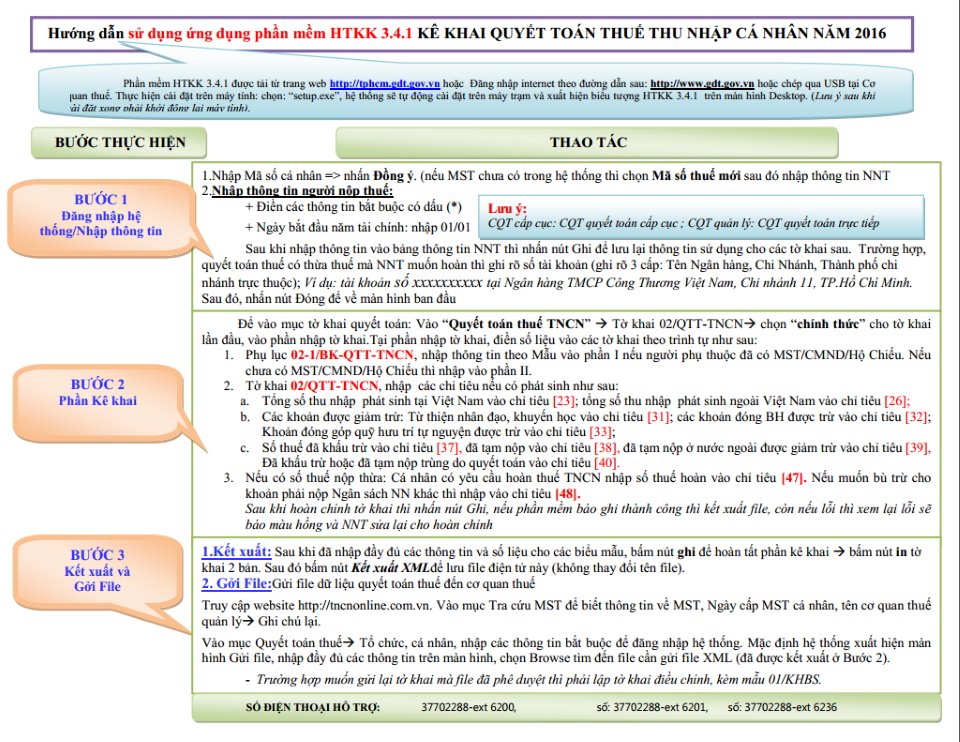

Guidelines for using HTKK 3.4.1 software to declare 2016 PIT finalization

See details HERE

- Key word:

- Personal income tax

- Vietnam

- Ho Chi Minh city

- Vietnam: People with serious illnesses shall be considered for personal income tax exemption and reduction

- Individual Income Tax Finalization for Foreigners

- Penalty for Late Personal Income Tax Settlement

- Tax Exemption for Financial Support for Medical Care of Severe Illnesses

- Update on Guidance Documents for 2016 Personal Income Tax Finalization

- Guidance on Finalization of Corporate Income Tax (CIT) and Personal Income Tax (PIT) for the Year 2016

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents