Cases of termination of compulsory civil liability insurance contract of motor vehicle users in Vietnam

What are the cases of termination of compulsory civil liability insurance contract of motor vehicle users in Vietnam? - Thanh Ha (Tien Giang, Vietnam)

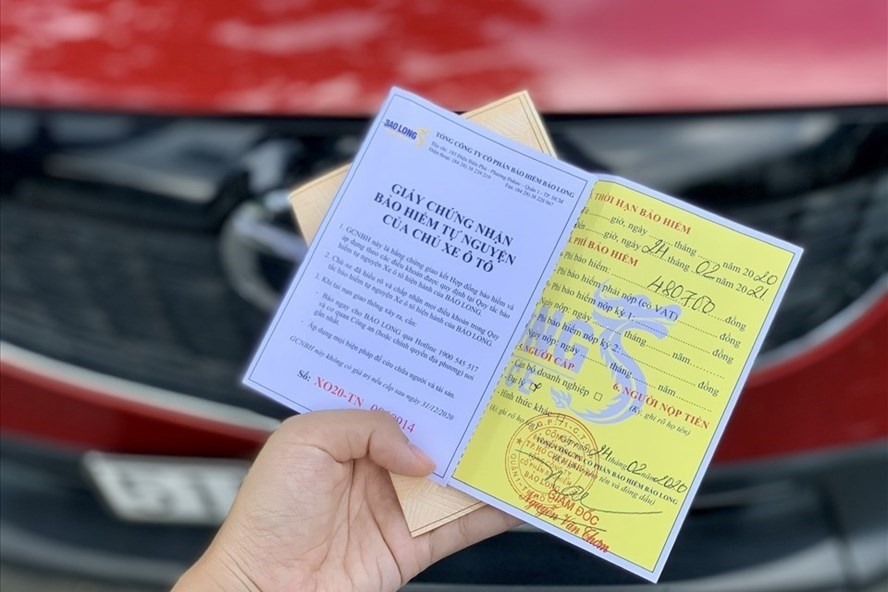

Cases of termination of compulsory civil liability insurance contract of motor vehicle users in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Cases of termination of compulsory civil liability insurance contract of motor vehicle users in Vietnam

Cases of termination of compulsory civil liability insurance contract of motor vehicle users in Vietnam according to Article 10 of Decree 03/2021/ND-CP include:

(1) Insurance contracts shall be terminated in case vehicle registration certificates or vehicle license plates must be revoked according to Ministry of Public Security.

(2) Insurance contracts shall be terminated in case motor vehicle users fail to adequately pay insurance premiums.

(3) Insurance contracts shall be unilaterally suspended in case of changes to factors which serve as the basis for calculating insurance premiums thereby lead to increase and/or decrease of insured risks.

2. Legal consequences of terminating compulsory civil liability insurance contract of motor vehicle users in Vietnam

According to Article 11 of Decree 03/2021/ND-CP, the legal consequences of terminating compulsory civil liability insurance contract of motor vehicle users are as follows:

* In case of termination of insurance contracts specified under Clause 1 Article 10 of Decree 03/2021/ND-CP:

- Insurance buyers and insurance beneficiaries must inform insurance enterprises in writing, attach certificates of insurance to be terminated and certification for revocation of vehicle registration certificates, license plates or decisions of competent agencies on revoking vehicle registration certificates, license plates.

Insurance contracts shall be terminated from the date on which insurance enterprises receive notice on termination of insurance contracts. Date of termination of insurance contracts shall be determined as follows:

= In case insurance buyers and insurance beneficiaries send notice in person or via postal service, termination of insurance contracts shall start from the date on which the termination is noted in records of insurance enterprises.

= In case insurance buyers and insurance beneficiaries send notice via fax or e-mail, termination of insurance contracts shall start from the date on which insurance enterprises receive fax or e-mail.

- Within 5 working days from the date on which notice is received, insurance enterprises must refund insurance premiums to insurance buyers and insurance beneficiaries corresponding to remaining duration of insurance contracts which insurance buyers and insurance beneficiaries have paid insurance premiums after deducting reasonable costs related to insurance contracts.

Insurance enterprises shall not refund insurance premiums in case insured events have occurred and compensation liabilities have derived before insurance contracts are terminated.

- In case insurance buyers and insurance beneficiaries fail to inform termination of insurance contracts but insurance enterprises have adequate evidence for eligibility of motor vehicles for termination of insurance contracts according to Clause 1 Article 10 of Decree 03/2021/ND-CP, insurance enterprises must inform insurance buyers and insurance beneficiaries in writing and provide evidence for eligibility of motor vehicles for termination of insurance contracts.

If insurance buyers and insurance beneficiaries fail to adopt procedures for terminating insurance specified under Point a Clause 1 of Article 11 of Decree 03/2021/ND-CP after 15 days from the date on which notice is received, insurance contracts are automatically terminated.

Insurance enterprises shall refund insurance premiums as specified under Point b Clause 1 of Article 11 of Decree 03/2021/ND-CP.

In case insured events take place within 15 days from the date on which insurance enterprises notify insurance buyers and insurance beneficiaries about termination of insurance contracts, insurance enterprises must be responsible for compensating for insurance beneficiaries.

* In case of termination of insurance contracts specified under Clause 2 Article 10 of Decree 03/2021/ND-CP:

-) Insurance contracts shall be terminated on the day following the day on which insurance buyers and insurance beneficiaries pay insurance premiums.

Within 5 working days from the date on which insurance contracts terminate, insurance enterprises must inform insurance buyers and insurance beneficiaries in writing about terminating insurance contracts and refunding the excess insurance premiums (if any) to insurance buyers and insurance beneficiaries or requesting insurance buyers and insurance beneficiaries to pay insurance premiums up to the point of terminating insurance contracts.

- Insurance enterprises shall not refund insurance premiums in case insured events have occurred and compensation liabilities have derived before insurance contracts are terminated.

- Insurance enterprises are not obliged to compensating insurance beneficiaries in case of insured events. Insurance contracts shall be terminated from the date on which insurance buyers or insurance beneficiaries receive notice on termination of insurance contracts. Date of termination of insurance contracts shall be determined as follows:

= In case insurance buyers and insurance beneficiaries send notice in person or via postal service, termination of insurance contracts shall start from the date on which insurance buyers or insurance beneficiaries provide confirmatory signature for receiving the notice.

= In case insurance buyers and insurance beneficiaries send notice via fax or e-mail, termination of insurance contracts shall start from the date on which insurance enterprises receive fax or e-mail.

- Insurance contracts shall continue to be valid from the date on which motor vehicle users adequately pay insurance premiums and receive written consensus of insurance enterprises.

* In case of unilateral termination of insurance contracts specified under Clause 3 Article 10 of Decree 03/2021/ND-CP:

- If insurance enterprises reject reduction to insurance premiums in case of unilaterally suspending insurance contracts due to changes to factors which serve as the basis for calculating insurance premiums which lead to decrease of insured risks:

Insurance buyers must issue written notice within 5 working days from the date on which insurance enterprises refuse to reduce insurance premiums. Insurance contracts shall be terminated from the date on which insurance enterprises receive notice on termination of insurance contracts. Legal consequences of terminating insurance contracts shall conform to Point b Clause 1 of Article 11 of Decree 03/2021/ND-CP.

- If insurance buyers reject increase to insurance premiums in case of unilaterally suspending insurance contracts due to changes to factors which serve as the basis for calculating insurance premiums which lead to increase of insured risks:

Insurance enterprises must issue written notice within 5 working days from the date on which insurance buyers reject increase to insurance premiums. Insurance contracts shall be terminated from the date on which insurance buyers receive notice on termination of insurance contracts.

Within 5 working days from the date on which insurance contracts are terminated, insurance enterprises must refund insurance premiums to insurance buyers and insurance beneficiaries corresponding to remaining duration of insurance contracts which insurance buyers and insurance beneficiaries have paid insurance premiums after deducting reasonable costs related to insurance contracts.

Insurance enterprises shall not refund insurance premiums in case insured events have occurred and compensation liabilities have derived.

- Key word:

- motor vehicle users in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents