Cases of not being compensated by compulsory civil liability insurance of motor vehicle users in Vietnam

What are the cases of not being compensated by insurance enterprises in Vietnam? – Hoang Van (Binh Dinh)

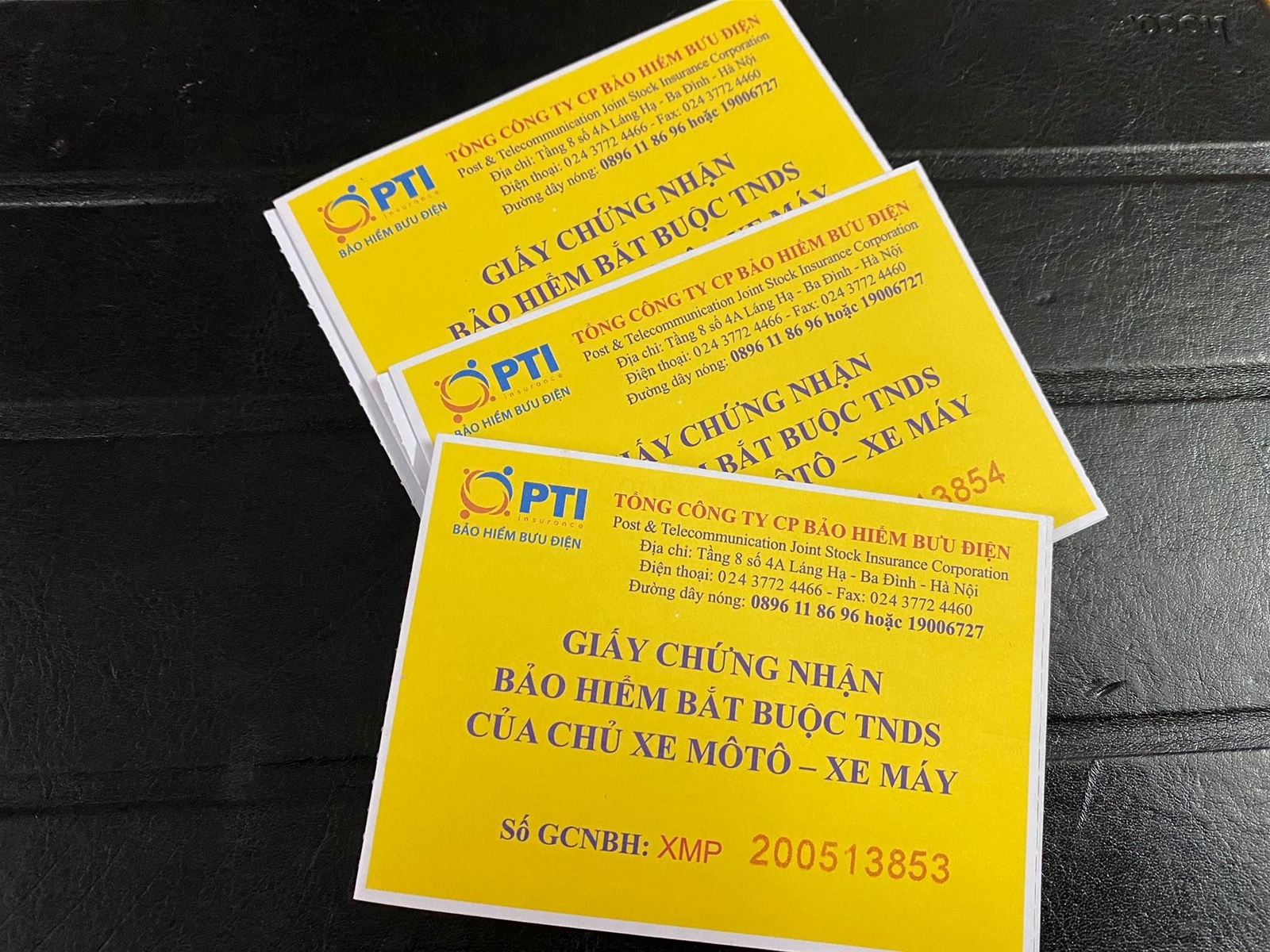

Cases of not being compensated by compulsory civil liability insurance of motor vehicle users in Vietnam (Internet image)

1. Cases of not being compensated by insurance enterprises in Vietnam

Insurance enterprises shall not compensate for following cases:

- Damage done intentionally by motor vehicle users, motor vehicle operators or victims of the accidents.

- Vehicle operators intentionally fleeing the scene after committing accidents without exercising civil responsibilities of motor vehicle users. Vehicle operators intentionally fleeing the scene after committing accidents and exercising civil responsibilities of motor vehicle users shall not be included under insurance exclusion.

- Operators who are not within adequate age range to operate motor vehicles as per road traffic laws; operators who do not carry legitimate, proper driving license (driving license with template number at the back inconsistent with the latest template number in information system for managing driving license) issued by competent authorities at the time of accidents or carry inappropriate driving license when operating motor vehicles which require specific driving license.

In case driving license of operators are revoked or suspended, the operators are considered to be not carrying driving license.

- Damage that causes indirect consequences including: reduced commercial value, damage related to use and utilization of damaged assets.

- Damage to assets caused by operators who have alcohol in breath or blood, or use narcotics or other prohibited stimulants as per the law.

- Damage to assets which are lost or stolen as a result of the accidents.

- Damage to special assets including: gold, silver, precious stones, financial instruments namely money, antiques, precious fine arts, and cadavers.

- War, acts of terrorism, earthquake.

(Article 13 of Decree 03/2021/ND-CP)

2. Rights and obligations of insurance buyers and insurance beneficiaries in Vietnam

2.1. Rights of insurance buyers and insurance beneficiaries in Vietnam

In addition to rights under Law on Insurance Business, insurance buyers and insurance beneficiaries have the rights to:

- Include insurance premiums in business expenditure in case insurance buyers are manufacturing entities;

- Allocate insurance premiums in recurrent operation expenditure of agencies and entities in case insurance buyers are administrative agencies or service providers of the Government.

(Article 17 of Decree 03/2021/ND-CP)

2.2. Obligations of insurance buyers and insurance beneficiaries in Vietnam

In addition to obligations under Law on Insurance Business, insurance buyers and insurance beneficiaries have the obligations to:

- Cooperate with insurance enterprises in inspecting vehicle conditions before issuing certificates of insurance.

- Promptly inform insurance enterprises to adopt appropriate insurance premiums for the remaining duration of insurance contracts in case of changes to factors which serve as the basis for calculating insurance premiums thereby increasing insured risks.

- Always carry valid (physical or electronic) certificates of insurance when participating in traffic and present these documents at request of traffic police and other competent authorities as per the law.

- Comply with regulations on road traffic safety.

- In case of traffic accidents, be responsible for:

+ Immediately informing insurance enterprises to cooperate in resolving, treating, limiting further damage to health, life and property, and protecting accident scenes; immediately informing the nearest police authorities or local governments to cooperate in resolving the accidents as per the law and cooperate with authorities in investigating and verifying causes of accidents.

+ Refraining from moving, dismantling or repairing properties without consensus of insurance enterprises; except for cases in which such activities are necessary to ensure safety, prevent damage to health, life and properties or according to request of competent agencies.

+ Collecting and providing documents required under insurance claim dossiers within responsibilities of insurance buyers and insurance beneficiaries for insurance enterprises according to Article 15 of Decree 03/2021/ND-CP.

+ Enabling insurance enterprises to verify documents by the insurance buyers and insurance beneficiaries.

- Notify victims or heirs or representatives of the victims about claims paid by insurance enterprises for each case of damage to health and life according to Point a Clause 3 Article 14 of this Article and pay claims.

- Inform insurance enterprises in writing according to Point a Clause 1 and Point a Clause 3 Article 11 of Decree 03/2021/ND-CP.

(Article 18 of Decree 03/2021/ND-CP)

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents