What are the Instructions on declaration and payment of registration fee in Vietnam? What are the regulations on the procedures for deferment of registration fees in Vietnam? - Minh Anh (Tien Giang)

Instructions on declaration and payment of registration fee in Vietnam

According to the provisions of Article 11 of Decree 10/2022/ND-CP, organizations and individuals shall conduct declarations and payments of registration fees in accordance with regulations of the law on tax administration when applying to competent state agencies for the right to own and use properties.

Digital database of payment of registration fees via the Vietnam State Treasury, commercial banks, or providers of intermediary payment services digitally signed by the General Department of Tax and uploaded to the National Public Service Portal, has the same value as paper receipts for traffic enforcer agencies, agencies of natural resources and environment, and other competent state agencies connected to the National Public Service Portal to access and utilize for purposes of resolving financial procedures related to registration of ownership and use rights.

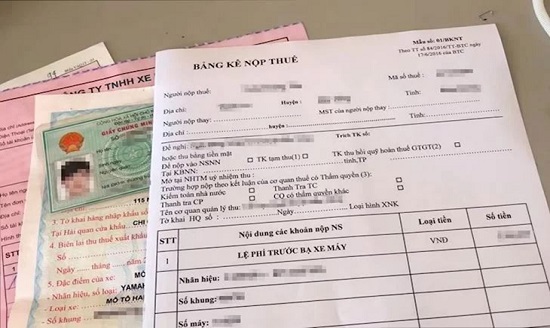

What are the Instructions on declaration and payment of registration fee in Vietnam? (Internet image)

Regulations on deferment of registration fees

Pursuant to the provisions of Clauses 1 and 2, Article 9 of Decree 10/2022/ND-CP, the fee for registration of houses and land of households and individuals eligible for deferment of land use fee shall be deferred according to regulations of the land law on the collection of land use fee.

Households and individuals shall pay the registration fee in arrears according to the houses and land price prescribed by People’s Committees of provinces or centrally affiliated cities upon the declaration of such fee.

When a household or individual granted the deferment of registration fee above transfers, converts or gifts the ownership of housing and the land use right to another entity (except the gifting of houses and land as prescribed in Clause 10 Article 10 of Decree 10/2022/ND-CP), the registration fee deferred must be paid in full prior to the transfer, conversion or gifting of the property.

Procedures for deferment of registration fees in Vietnam

Procedures for deferment of registration fees in accordance with Clause 3, Article 9 of Decree 10/2022/ND-CP, are as follows:

- Households and individuals eligible for deferment of houses, land registration fee, as stated above, shall file the written declaration of registration fee in accordance with regulations of the law on tax administration.

- Agencies competent to issue certificates of land use right and ownership of housing and property on land (referred to as authorized issuers of title deeds) shall consider such documents to verify the declarant's eligibility for deferment of houses, land registration fee, as stated in above, and mark the phrase "Nợ lệ phí trước bạ" ("Registration fee has not been paid") to the certificate of land use right and ownership of housing and property on land before the issuance of such certificate to the proprietor or user of the house, land.

- Upon the receipt of an application for transfer, conversion or gifting of housing ownership and land use right from a household or individual marked indebted for registration fee, authorized issuers of title deeds shall forward the application with a “notification for verification of land-related financial obligation" to tax agencies which shall then calculate and send notifications of the registration fee in arrears to such household or individual for settlement prior to the procedure for transfer, conversion or gifting.

Mai Thanh Loi

- Key word:

- registration fee

- in Vietnam

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)