This is a notable content of Decree No. 41/2018/NĐ-CP of Vietnam’s Government on penalties for administrative violations in the fields of accounting and independent audit, effective from May 01, 2018.

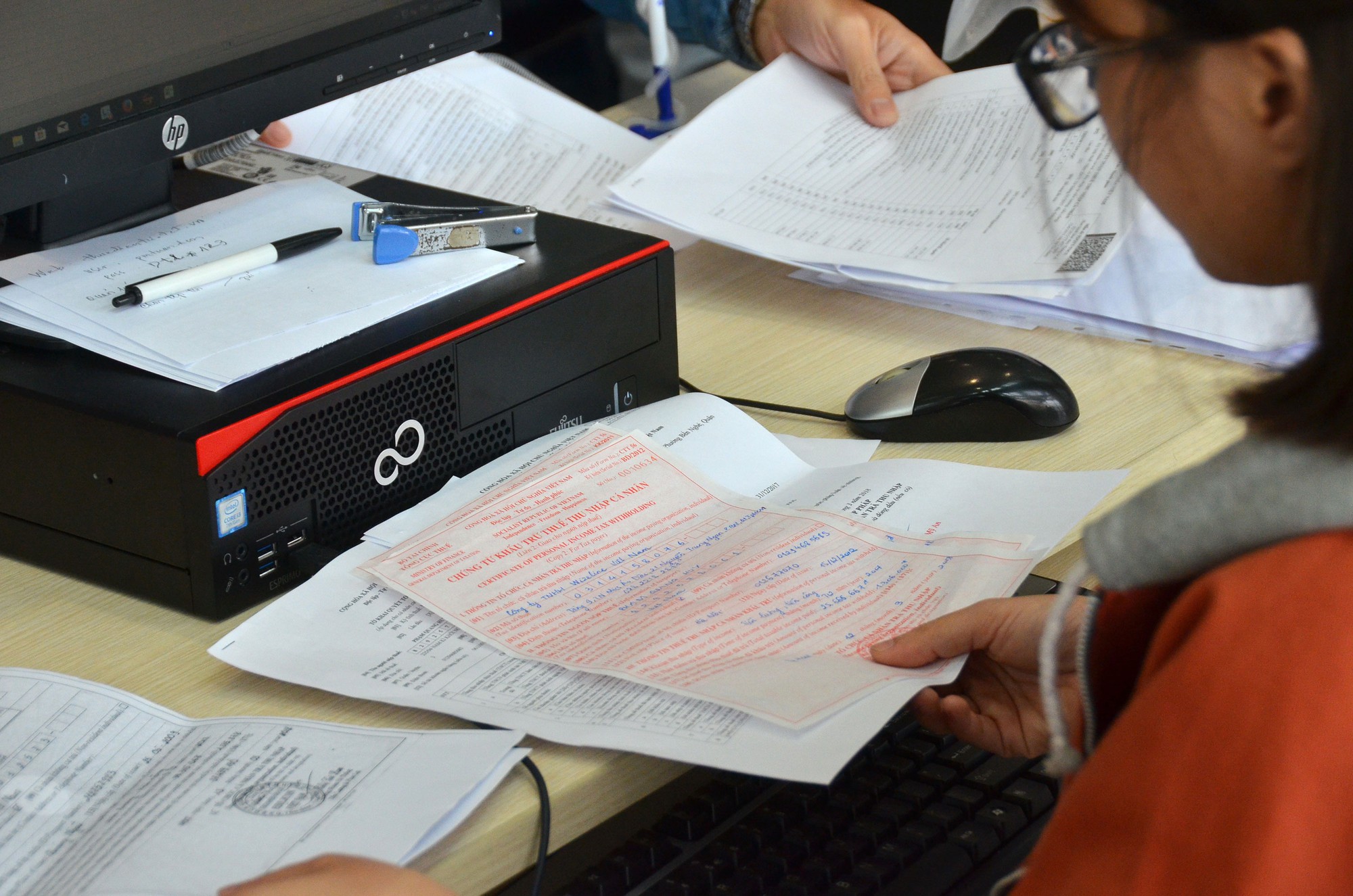

Specifically, according to Point c Clause 1 Article 8 of Decree No. 41/2018/NĐ-CP of Vietnam’s Government, red or faded signatures on accounting records shall be imposed a fine ranging from VND 3.000.000 to VND 5.000.000.

This fine also applies to the following violations:

- Accounting record forms having insufficient mandatory content;

- Tampering with accounting records;

- Using signature stamps on accounting records;

- Expense records do not have signatures on all copies.

Article 8. Penalties for violations against regulations on accounting records

1. A fine ranging from VND 3.000.000 to VND 5.000.000 shall be imposed for one of the following violations:

a) Accounting record forms having insufficient mandatory content;

b) Tampering with accounting records;

c) Red or faded signatures on accounting records;

d) Using signature stamps on accounting records;

dd) Expense records do not have signatures on all copies.

Moreover, according to Decree No. 41/2018/NĐ-CP of Vietnam’s Government, a fine ranging from VND 5.000.000 to VND 10.000.000 shall be imposed for one of the following violations:

- The accounting record having insufficient copies as specified in the regulations;

- Signing accounting records which have insufficient contents;

- Signing accounting records ultra vires;

- Inconsistent signatures or signatures not matching those in the signature registry;

- Accounting records having insufficient signatures as specified in those records;

- Failure to translate accounting records in foreign language to Vietnamese;

- Loss or damage of accounting documents and records while in use.

In particular, a fine ranging from VND 20.000.000 to VND 30.000.000 shall be imposed for one of the following violations:

- Forging or providing false information in accounting records but not serious enough for criminal prosecution;

- Forging or providing false information in accounting records by means of collusion or coercion but not serious enough for criminal prosecution;

- Inconsistency in the contents of copies of accounting records for the same transaction;

- Failure to make accounting records for every economic/financial transaction;

- Make multiple accounting records for an economic/financial transaction;

- Spending without sufficient signatures on the expense records as specified in the law on accounting.

In addition to fines, remedial measures shall also apply to certain violations as follows:

- Make sure the forms of accounting record forms having insufficient mandatory content have sufficient mandatory content;

- Destroy forged or falsified records in case of forging or providing false information in accounting records;

- Make records for economic/financial transactions without them in the cases of failure to make accounting records for every economic/financial transaction;

- Destroy the economic/financial transaction’s multiple records in case of spending without sufficient signatures on the expense records as specified in the law on accounting.

Nguyen Trinh

- Key word:

- Decree No. 41/2018/NĐ-CP

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)