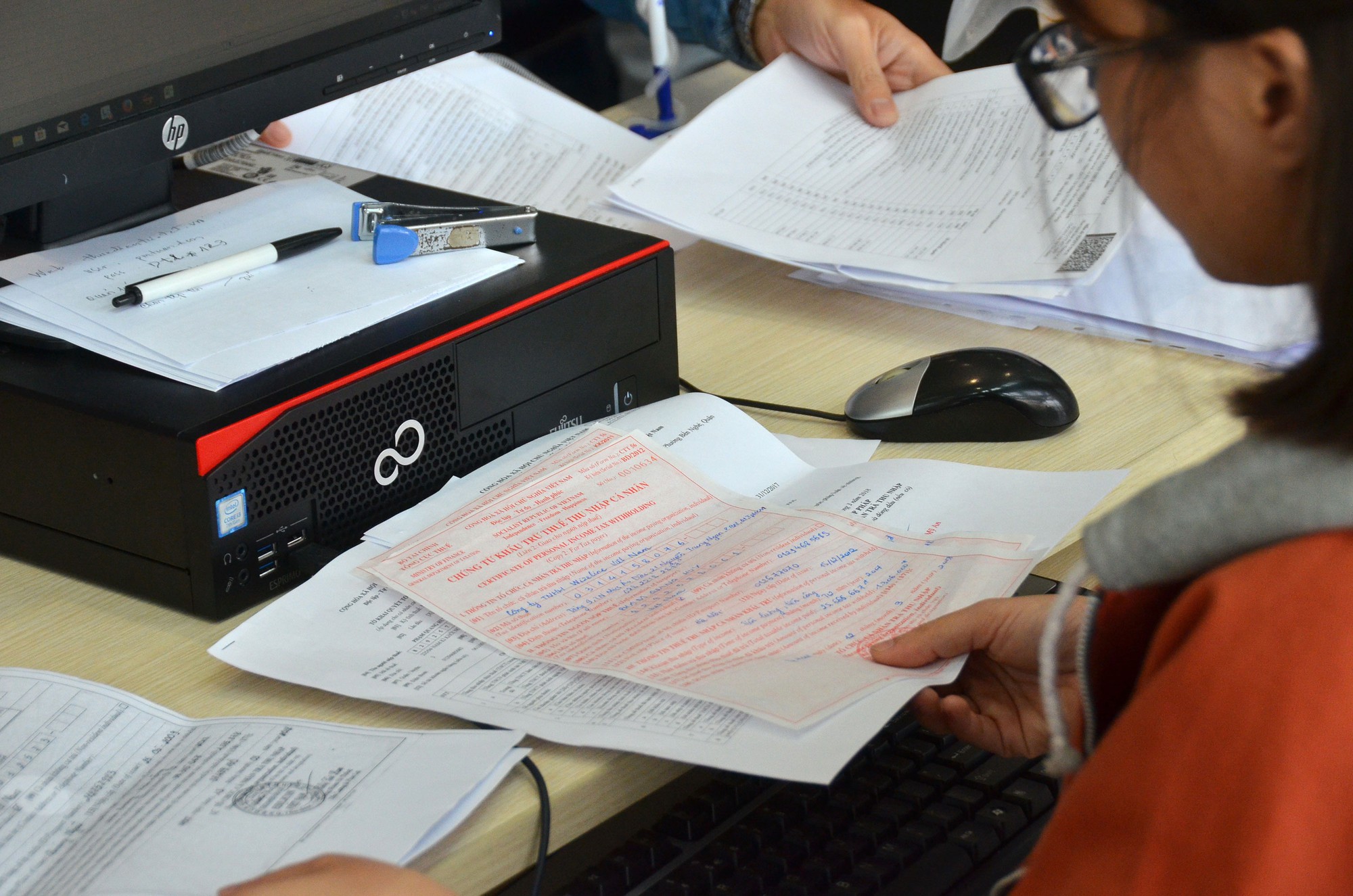

How are penalties for forging or providing false information in accounting records according to current Vietnam’s regulations? Shall the violating entity be sentenced to imprisonment? These are questions that Mr. Nguyen Ngoc Linh in Ho Chi Minh City sent to LAWNET for advice on June 01, 2020.

LAWNET would like to answer Mr. Linh’s questions as follows:

According to current regulations of Decree No. 41/2018/NĐ-CP of Vietnam’s Government, forging or providing false information in accounting records shall be imposed a fine ranging from VND 20.000.000 to VND 30.000.000. Specifically, according to Clause 3 Article 8 of Decree No. 41/2018/NĐ-CP of Vietnam’s Government, penalties for violations against regulations on accounting records are as follows:

Article 8. Penalties for violations against regulations on accounting records

…

3. A fine ranging from VND 20.000.000 to VND 30.000.000 shall be imposed for one of the following violations:

a) Forging or providing false information in accounting records but not serious enough for criminal prosecution;

b) Forging or providing false information in accounting records by means of collusion or coercion but not serious enough for criminal prosecution;

c) Inconsistency in the contents of copies of accounting records for the same transaction;

d) Failure to make accounting records for every economic/financial transaction;

dd) Make multiple accounting records for an economic/financial transaction;

e) Spending without sufficient signatures on the expense records as specified in the law on accounting.

In addition to fines, the violating entity shall be forced to destroy forged or falsified records in case of forging or providing false information in accounting records.

Particularly, more seriously, forging or providing false information in accounting records can also be prosecuted for criminal liability for commission of fraud in performance of duties according to the Criminal Code 2015 amended in 2017 of Vietnam, specifically as follows:

Article 359. Commission of fraud in performance of duties

1. Any person who, for personal gain or other self-seeking purposes, abuses his/her position or power to commit any of the following acts shall face a penalty of 01 - 05 years' imprisonment:

a) Falsifying a document;

b) Fabricating a document or issuing a fabricated document;

c) Forging an office holder's signature.

2. This offense committed in any of the following circumstances carries a penalty of 03 - 10 years' imprisonment:

a) The offense is committed by an organized group;

b) The offender is the person in charge of making or issuing documents;

c) The offense involves 02 - 05 fabricated documents.

3. This offense committed in any of the following circumstances carries a penalty of 07 - 15 years' imprisonment:

a) The offense involves 05 - 10 fabricated documents;

b) The offense is meant to serve the commission of a less serious crime or serious crime.

4. This offense committed in any of the following circumstances carries a penalty of 12 - 20 years' imprisonment:

a) The offense involves ≥ 11 fabricated documents;

b) The offense is meant to serve the commission of very serious crime or extremely serious crime.

5. The offender might also be liable to a fine of VND 10,000,000 - VND 100,000,000 or prohibited from holding certain positions or doing certain jobs for 01 - 05 years.

Nguyen Trinh

- Key word:

- Decree No. 41/2018/NĐ-CP

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)