I am the current employee working at the insurance agent However, it is recommended that the auditor concludes an insurance agent? What is the tax statement made? Thanks!

What is the way to calculate tax for the individual who directly signs the insurance agent contract?

Pursuant to Clause 2 Article 9 of Circular No. 40/2021/TT-BTC, the method for tax calculation applied to individuals who directly sign lottery, insurance, or multi-level marketing agents shall be prescribed as follows:

"Article 9. Tax calculation methods in some special cases

...

2. A person who directly signs a lottery agent, insurance agent, or multi-level marketing agent contract (hereinafter referred to as "lottery agent"), insurance agent, or multi-level marketing agent (hereinafter referred to as "multi-level marketing agent") with a lottery company, insurer, or multi-level marketing company in the form of selling agents.

b) The lottery agent, insurance agent, or multi-level marketing agent shall not directly declare tax, except for the case in Point d of this Clause.

c) Lottery companies, insurers, and multi-level marketing companies must deduct and declare PIT if the company determines that the commission paid to the individual in the calendar year exceeds VND 100 million. If the lessor earns a revenue of VND 100 million/year or lower from multiple places in the same year, the lessor may authorize the issuers to deduct tax from the commission paid by the lottery company, insurer, or multi-level marketing agent to declare tax monthly or quarterly.

d) If the income-paying organization does not deduct tax because it does not reach the deduction level and the individual does not authorize the income-paying organization to deduct tax, and the individual must declare and pay tax annually at the end of the year."

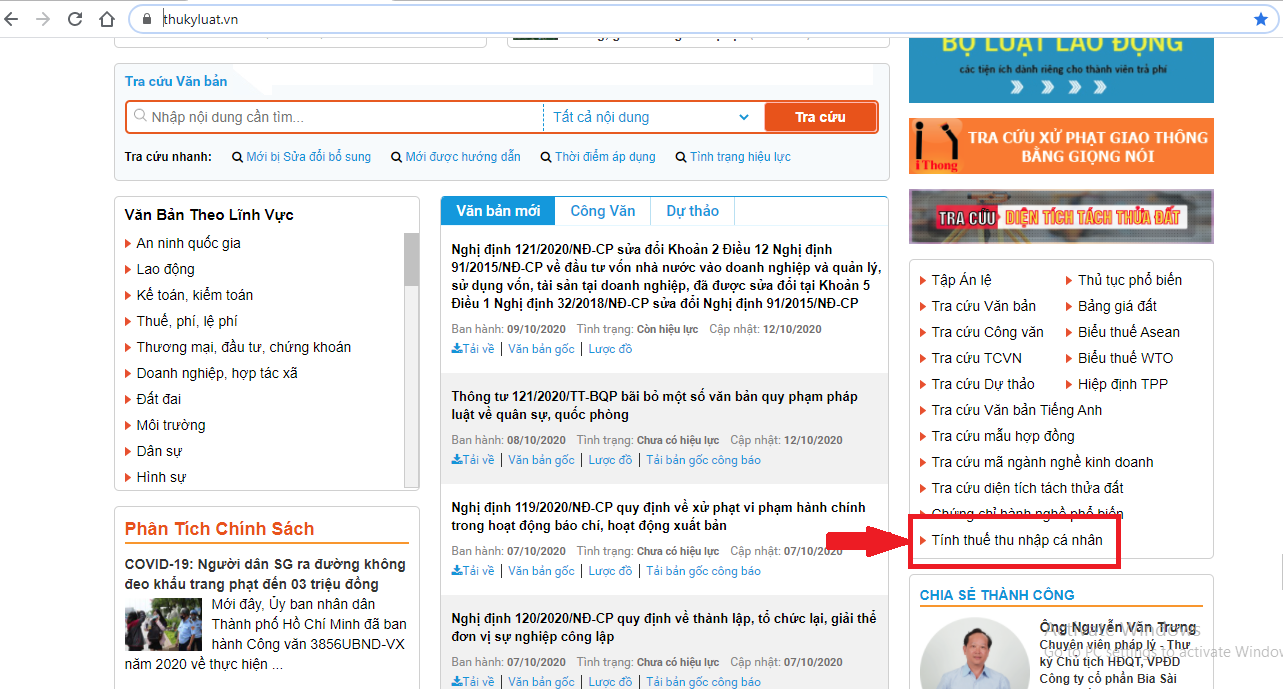

(1).png)

Method of tax calculation for the individual who directly signs the insurance agent contract in Vietnam?

What is the tax declaration dossier submitted by the individual that directly signs the insurance agent contract?

In Article 15 of the Circular No. 40/2021/TT-BTC, it is required to stipulate tax administration applied to individuals who directly sign contracts to act as lottery agents, insurance agents, multi-level marketing agents and other businesses.

"Article 15. Tax administration of persons who directly sign contracts to act as lottery agents, insurance agents, multi-level marketing agents, and other business activities

1. Tax declaration dossier:

a) Declarations of monthly or quarterly tax shall be submitted by the withholding organization to the person who directly signs the contract to act as a lottery agent, insurance agent, or multi-level marketing agent as prescribed in Point 9.1 Appendix I of the Government's Decree No. 126/2020/ND-CP dated October 19, 2020.

- The PIT declaration (for lottery, insurance, and multi-level marketing companies that pay commissions to the agent that directly sells goods at prices; insurers that pay life insurance and other optional insurances) using form 01/XSBHĐC enclosed herewith; and

...

b) Annual tax declaration documents submitted by lottery agents, insurance agents, multi-level marketing agents, and other businesspeople specified in Point 8.6 Appendix I - List of tax declarations issued together with Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government 01/TKN-CNKD enclosed herewith"

Khanh Linh

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)