Official Dispatch 377/TCT-DNNCN regarding the promotion and organization of issuing electronic transaction accounts in the field of taxation for individuals issued by the General Department of Taxation on February 05, 2021.

Enclosed with this Official Dispatch is an Appendix providing detailed guidelines for the steps to register an electronic tax transaction account through the National Public Service Portal, including:

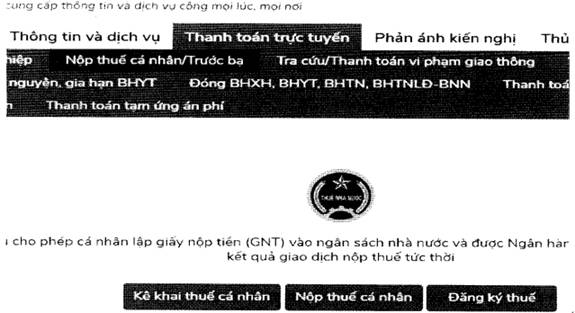

Step 1: The taxpayer (NNT) logs into the National Public Service Portal according to the provided link, then navigates to the function “Online Payment” > “Personal Tax/Beforehand Tax” > “Personal Tax Declaration”.

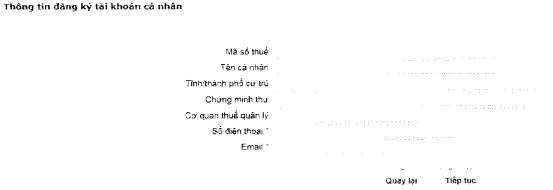

Step 2: The taxpayer (NNT) enters the information under “Personal Account Registration”.

.jpg)

- Tax Identification Number (TIN): Automatically displayed according to TIN from the National Public Service Portal. If the TIN information is not displayed, the taxpayer must manually enter the TIN information.

- Verification Code: Accurately enter the verification code displayed on the screen. If entered incorrectly, the system will display a warning prompting the taxpayer to re-enter.

- The taxpayer selects “Individual” if the entered TIN belongs to an individual or selects “Organization” if the entered TIN belongs to an organization.

- The taxpayer clicks “Register”.

Step 3: The taxpayer checks and enters information on the screen displayed “Personal Account Registration Information”.

- If the taxpayer's ID/CCCD registered with the National Public Service Portal differs from the ID/CCCD according to TIN information: The system displays a warning: “ID/CCCD number does not match between the National Public Service Portal with the tax authority information. Please update your information with the tax authority” and does not allow the taxpayer to register.

- If the taxpayer's ID/CCCD registered with the National Public Service Portal matches the ID/CCCD according to TIN information: The system automatically displays the information Tax Identification Number, Personal Name, Residential Province/City, ID, Managing Tax Authority according to TIN information:

+ At the same time, the system automatically displays the phone number and email according to the information of the National Public Service Portal; if there is no email, the taxpayer is requested to enter the information.

- The taxpayer clicks “Continue”.

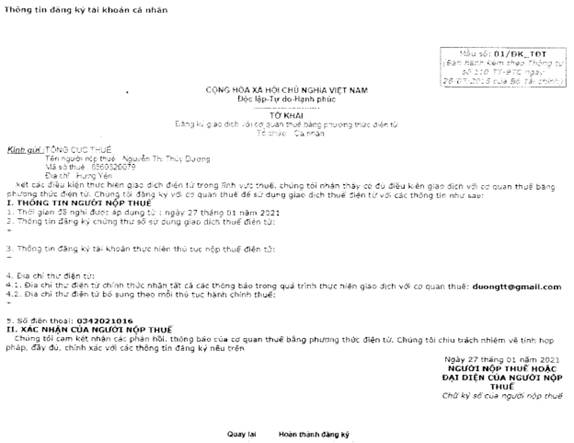

Step 4: The system displays the “Registration form for electronic transactions with the tax authority” - form No. 01/DK_TDT as follows, the taxpayer checks the information and clicks “Complete Registration”.

- The system displays a notification “You have successfully registered an account”. At the same time, the taxpayer receives a message on the phone with TIN information and the account password as follows: “You have successfully registered, account: “TIN”, “Password”: xxx”.

Step 5: The taxpayer logs into the iCanhan system, changes the password, and conducts electronic transactions with the tax authority.

>>> See also: 03 steps to register an online electronic tax transaction account for taxpayers

Article table of contents

Article table of contents