Recently, the General Department of Taxation of Vietnam issued Official Dispatch No. 377/TCT-DNNCN regarding the promotion of organizing and implementing the issuance of e-tax accounts in the field of taxation for individuals. In this Official Dispatch, the General Department of Taxation provides specific guidance on the steps to register e-tax accounts online for taxpayers in Vietnam as follows:

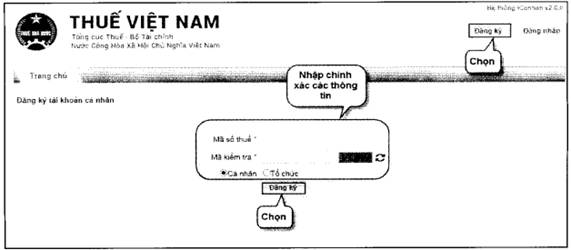

Step 1: Taxpayer accesses the link https://canhan.gdt.gov.vn/, and selects "Register", the screen will display the account registration information as follows:

Account Registration Screen

- Tax Identification Number (TIN): Taxpayer enters the TIN used to register an account.

- Verification Code: Enter the verification code displayed on the screen accurately. If entered incorrectly, the system will issue a warning: "Verification code is incorrect. Please re-enter!"

- Taxpayer checks "Individual" if the entered TIN is for an individual or checks "Organization" if the entered TIN is for an organization in Vietnam.

- Taxpayer clicks "Register".

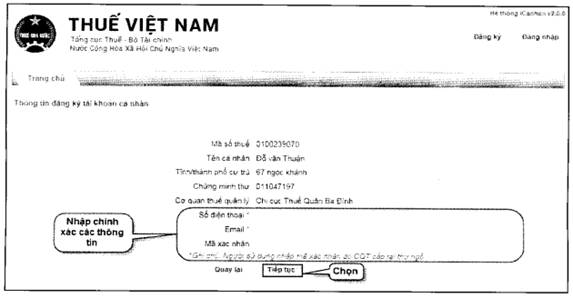

Step 2: Taxpayer enters information Phone Number, Email, Verification Code.

- At the account registration information display screen, the system automatically displays information Tax Identification Number, Individual's Name, Province/City of Residence, Identification Card, Managing Tax Authority and does not allow editing, as follows:

Account Registration Information Screen

Taxpayer in Vietnam must enter all required information:

+ Phone Number: Taxpayer enters a valid phone number and cannot leave it blank.

+ Email: Taxpayer enters a valid email address (e.g., [email protected]), cannot leave it blank.

+ Verification Code: Taxpayer enters the verification code provided by the Tax Authority in the notification letter accurately.

(Note: If the Verification Code has not been issued by the Tax Authority, leave the Verification Code field blank. If the Verification Code has been issued by the Tax Authority, the Taxpayer must enter the Verification Code. If entered incorrectly, the system will display a warning: "Verification code is incorrect. Please re-enter the verification code!"

- After entering all information, the Taxpayer clicks "Continue".

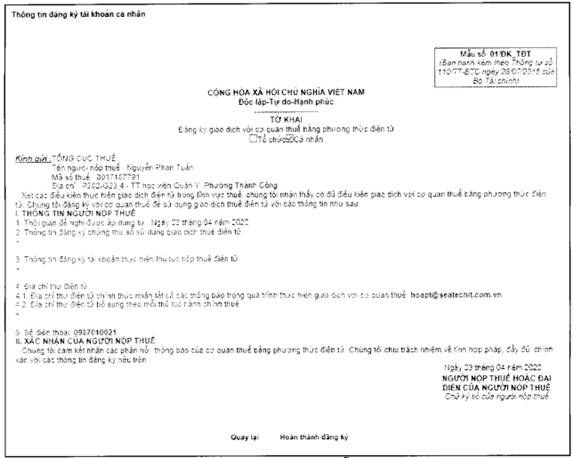

Step 3: The system displays the "Registration Form for Electronic Transactions with Tax Authorities" - Form No. 01/DK_TDT as follows, the Taxpayer checks the information and clicks "Complete Registration".

Account Registration Information Screen according to Form 01/DK-TDT Circular 110

- In case the Taxpayer has a verification code from the Tax Authority in Vietnam: The system notifies the completion of the registration and sends notice Form 01/TB-TDT to the registered email and sends the login password to the registered phone number of the Taxpayer.

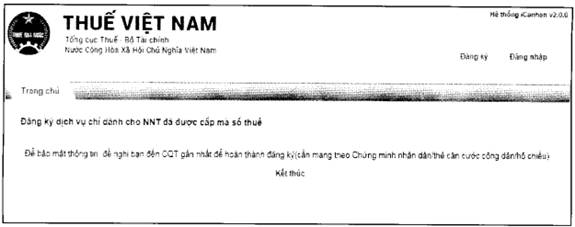

- In case the Taxpayer does not have a verification code from the Tax Authority in Vietnam: The system will notify "To secure information, please visit the nearest Tax Authority to complete the registration (bring your ID card/Citizen ID card/passport)".

+ The Taxpayer goes to the One-Stop section, provides the TIN to the tax officer (TO) and also provides the TO with the phone number and email information (if changed) for the TO to verify the account. The Taxpayer receives a registration form - Form 01/DK-TDT printed by the TO from the application, rechecks the information, and signs the registration form to submit to the TO.

More details can be found in instructions on electronic tax transaction account registration steps through the National Public Service Portal in the Appendix issued with Official Dispatch 377/TCT-DNNCN of Vietnam dated February 05, 2021.

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)