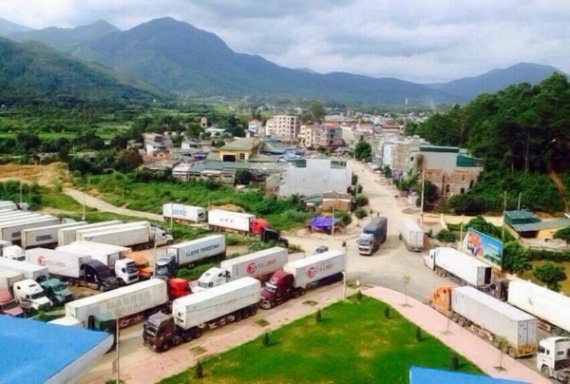

Vietnam’s new guidelines on customs procedures applied to import and export goods

On November 15, 2019, the Ministry of Finance of Vietnam issued Circular No. 80/2019/TT-BTC on customs procedures, tax administration, fees and charges with respect to export and import goods according to Decree No. 14/2018/ND-CP.

According to Article 6 of Circular No. 80/2019/TT-BTC of the Ministry of Finance of Vietnam, customs procedures, tax administration, fees and charges applied to import and export goods of traders are guided as follows:

- Customs procedures to be adopted with respect to import and export goods of traders traveling across borders shall comply with Decree No. 08/2015/ND-CP dated January 21, 2015 receiving amendments thereto in Decree No. 59/2018/ND-CP dated April 20, 2018 of Vietnam’s Government and Circular No. 38/2015/TT-BTC dated March 25, 2015 receiving amendments thereto in Circular No. 39/2018/TT-BTC dated April 20, 2018 of Minister of Finance; traders must fully satisfy obligations relating duties, fees and charges as per the law.

- Import and export goods of traders traveling across border checkpoints must comply with regulations and law on commodity types, quarantine inspection, and inspection of food safety and quality.

- Goods imported via secondary border checkpoints or border gates shall comply with regulations under Clause 2 Article 3 of Circular No. 01/2018/TT-BCT.

- Traders specified in Article 5 of Decree No. 14/2018/ND-CP dated January 23, 2018 of Government while trading and exchanging goods across borders must be issued with TIN before adopting customs procedures.

View more details at Circular No. 80/2019/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2020, which replaces Circular No. 217/2015/TT-BTC.

- Key word:

- Circular No. 80/2019/TT-BTC

- Organizational structure of Departments and criteria for establishing subordinate organizations under the departments in Vietnam

- System of legislative documents in Vietnam from April 1, 2025

- Rights and responsibilities of National Assembly Deputies and People's Council Deputies of Vietnam

- Organizational structure of the Department of Customs of Vietnam from March 1, 2025

- Principles for establishing prices for electricity system operation dispatch and electricity market transaction administration in Vietnam

- Prime Minister of Vietnam directs various measures to reduce lending interest rates

-

- What are the responsibilities of Vietnam’s customs ...

- 09:53, 19/11/2019

-

- Vietnam: Customs inspection with respect to import ...

- 09:42, 18/11/2019

-

- Vietnam: Guidelines for customs procedures applied ...

- 09:26, 18/11/2019

-

- Vietnam: New customs procedures applied to import ...

- 09:09, 18/11/2019

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents