Vietnam: Officially issued Decree No. 41/2020/NĐ-CP on tax and land rent deferral

Recently, the Government of Vietnam has officially issued Decree No. 41/2020/NĐ-CP on tax and land rent deferral.

Entities mentioned in Article 2 of Decree No. 41/2020/NĐ-CP of Vietnam’s Government shall be entitled to deferral of added value tax (VAT), corporate income tax (CIT), personal income tax (PIT) and land rent, specifically as follows:

- VAT incurred by the enterprises and organizations mentioned in Article 2 of this Decree during March, April, May, June of 2020 (for taxpayers declaring tax monthly), first and second quarter of 2020 (for taxpayers declaring tax quarterly) may be deferred for 05 months from the deadlines for VAT payment;

- CIT declared in the 2019’s annual statement and CIT declared in the first and second quarters of 2020 by these entities will be deferred for 05 months form the deadline for CIT payment;

- Deadline for annual payment of rents that are due in the beginning of 2020 for direct lease of land by the State to the taxpayers mentioned above under decisions or contracts of competent authorities will be deferred for 05 months starting from May 31, 2010.

View more details at Decree No. 41/2020/NĐ-CP of Vietnam’s Government, effective from April 08, 2020.

- Key word:

- Decree No. 41/2020/NĐ-CP

- Organizational structure of Departments and criteria for establishing subordinate organizations under the departments in Vietnam

- System of legislative documents in Vietnam from April 1, 2025

- Rights and responsibilities of National Assembly Deputies and People's Council Deputies of Vietnam

- Organizational structure of the Department of Customs of Vietnam from March 1, 2025

- Principles for establishing prices for electricity system operation dispatch and electricity market transaction administration in Vietnam

- Prime Minister of Vietnam directs various measures to reduce lending interest rates

-

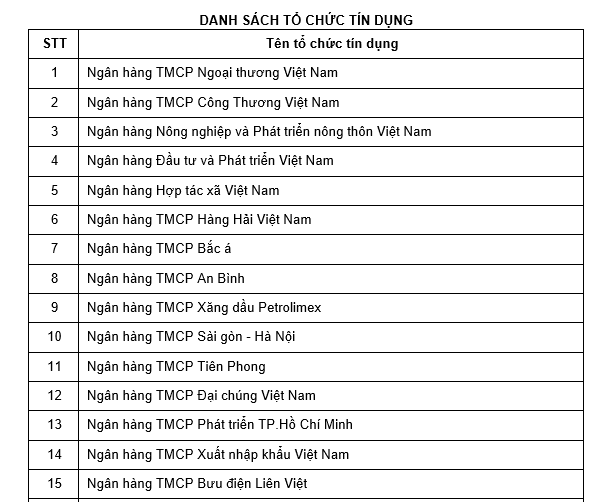

- Vietnam: Publishing the List of credit institutions ...

- 09:42, 04/05/2020

-

- Vietnam: VAT, CIT, PIT and land rent deferred ...

- 08:29, 25/04/2020

-

- Vietnam: Guidance on VAT tax deferral from April ...

- 17:15, 12/04/2020

-

- What types of taxes are small enterprises and ...

- 16:56, 12/04/2020

-

- Guidance on tax and land rent deferral applied ...

- 11:30, 09/04/2020

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents