Vietnam: A passbook must detail the interest rate for savings deposits

This is a content specified in Circular No. 48/2018/TT-NHNN of the State Bank of Vietnam on savings deposits, issued on December 31, 2018.

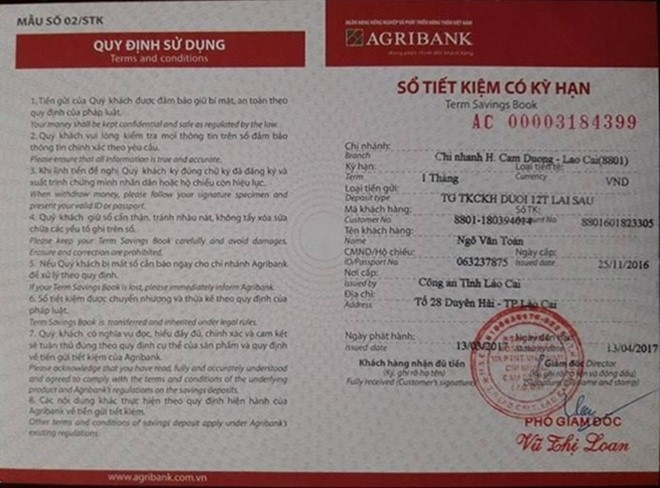

According to Circular No. 48/2018/TT-NHNN of the State Bank of Vietnam, passbook or bankbook (hereinafter referred to as passbook) must detail the interest rate and interest payment method. Moreover, a passbook must have at least the following:

- Credit institution’s name and seal; full name and signature of the bank teller and the legal representative of the credit institution;

- Full name, number and date of issue of identity proof of the depositor or all depositors (in case of a joint savings deposit) and information of the depositor’s legal representative if the savings deposit is made by the legal representative;

- Number of passport; amount; currency; deposit date; maturity date (applied to term savings deposit); deposit term;

- Methods offered to depositors to access their savings deposits;

- Actions to be taken in a case where a passbook is crumpled, torn or lost.

\View more details at Circular No. 48/2018/TT-NHNN of the State Bank of Vietnam, effective from July 05, 2019.

- Key word:

- Circular No. 48/2018/TT-NHNN

- Organizational structure of Departments and criteria for establishing subordinate organizations under the departments in Vietnam

- System of legislative documents in Vietnam from April 1, 2025

- Rights and responsibilities of National Assembly Deputies and People's Council Deputies of Vietnam

- Organizational structure of the Department of Customs of Vietnam from March 1, 2025

- Principles for establishing prices for electricity system operation dispatch and electricity market transaction administration in Vietnam

- Prime Minister of Vietnam directs various measures to reduce lending interest rates

-

- Vietnamese residents may make savings deposits ...

- 09:30, 18/01/2019

-

- Types of savings deposits according to Vietnam ...

- 19:26, 17/01/2019

-

- Vietnam: Details required on the passbook

- 14:33, 17/01/2019

-

- Vietnam: Savings deposits may be taken and paid ...

- 12:20, 17/01/2019

-

- Vietnam’s new regulations on currencies upon savings ...

- 12:01, 17/01/2019

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents