Highlight of Documents from January 29 - February 03, 2018 in Vietnam

Below are some new, notable documents in Vietnam that have been updated by Lawnet in the past week (from January 29, 2018 - February 03, 2018):

1. Adjustment of Monthly Salary for Social Insurance Contribution in 2018 in Vietnam

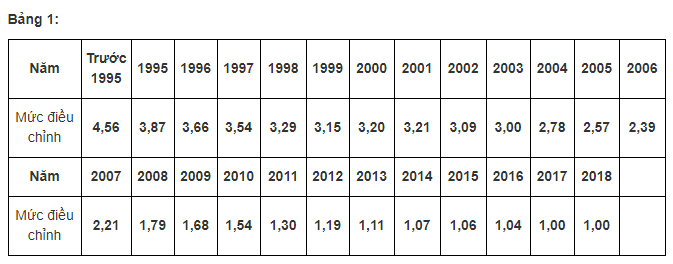

The Ministry of Labor, War Invalids and Social Affairs issued Circular 32/2017/TT-BLDTBXH stipulating the adjustment of monthly salary and income for social insurance contributions.

- From January 1, 2018, the monthly salary for social insurance contributions will be adjusted according to the following formula:

Adjusted monthly salary for social insurance contributions of each year = Total monthly salary for social insurance contributions of each year x Adjustment rate of social insurance contributed salary of the corresponding year.

- Subjects subject to adjustment:

+ Employees who started participating in social insurance from January 1, 2016, receive a one-time social insurance payment or die, and their relatives receive a one-time death benefit from January 1, 2018 to December 31, 2018.

+ Employees who contribute to social insurance based on the salary policies decided by the employer, receive pensions, lump sum allowance upon retirement, one-time social insurance, or die, and their relatives receive a one-time death benefit from January 1, 2018 to December 31, 2018.

Details on the adjustment rates for salaries of various years can be found in Circular 32/2017/TT-BLDTBXH, effective from February 15, 2018.

2. Lump Sum Payment of 2 Months' Pensions and Social Insurance Allowances in February 2018 in Vietnam

On January 16, 2018, Vietnam Social Security issued Official Dispatch 176/BHXH-TCKT guiding the payment of pensions, social insurance, and unemployment insurance allowances for February and March 2018 as follows:

- Vietnam Social Security allocates funding for paying pensions, social insurance, and unemployment insurance allowances for February and March 2018 to local social insurance agencies during the same payment period for February 2018;

- Local social insurance agencies develop plans to pay pensions, social insurance, and unemployment insurance allowances for February and March 2018 and notify the post office agencies of the payment plan;

- Post office agencies are responsible for informing beneficiaries of the payment schedule.

3. Ministry of Health Guides the Validity Period of Health Insurance Cards in Vietnam

On January 31, 2018, the Ministry of Health issued Official Dispatch 742/BYT-BH resolving issues regarding the validity period of health insurance cards as follows:

- For children under 6 years old born after September 30:

+ Children under 6 years old will have health insurance cards valid until they reach 72 months of age;

+ Children who reach 72 months of age but have not yet entered school will have health insurance cards valid until September 30 of that year.

- Individuals with health insurance cards undergoing medical treatment at healthcare facilities when their health insurance cards expire:

+ The health insurance fund still covers medical expenses within the scope of benefits and entitlements as per policies until discharge or the end of outpatient treatment (Clause 2, Article 11 of Decree 105/2014/ND-CP);

+ The Ministry of Health requests Vietnam Social Security to promptly issue directives and guidelines to local social insurance agencies for implementation.

4. 0% Interest Rate Incentive Loans for Specially Controlled Credit Institutions

According to the guidance in Circular 01/2018/TT-NHNN, credit institutions under special control will be granted special loans by the State Bank of Vietnam with preferential interest rates as low as 0% under the following circumstances:

- Support recovery for commercial banks, cooperative banks, finance companies, and microfinance organizations according to approved recovery plans;

- Support recovery for commercial banks according to approved mandatory transfer plans;

- Commercial banks that were compulsorily purchased before the effective date of the Law on Credit Institutions Amendment 2017 (January 15, 2018);

- Commercial banks that were compulsorily purchased before the effective date of the Law on Credit Institutions Amendment 2017 and have been subsequently transferred according to approved transfer plans.

Circular 01/2018/TT-NHNN takes effect from January 29, 2018.

5. Elimination of Public Employees Who Fail to Complete Tasks for Two Consecutive Years in Vietnam

This directive is from the Government of Vietnam in Resolution 08/NQ-CP regarding the Action Program implementing Resolution 19-NQ/TW on continuing to innovate the organizational system and management, improving the quality and efficiency of public service providers.

Specifically, in the management of staff and improvement of human resources, the Government of Vietnam outlines several noteworthy tasks and solutions such as:

- Piloting the recruitment and hiring of executive directors at public service providers;

- Implementing policies of fixed-term contracts for newly recruited public employees;

- Eliminating public employees who fail to complete tasks for two consecutive years;

- Resolving the excess number of public employees and workers exceeding the allocated staff quota (excluding financially autonomous units);

- Classifying public employees from 2018 based on job positions and reorganizing the structure of public employees by professional positions, ensuring a minimum rate of 65%.

Resolution 08/NQ-CP was issued on January 24, 2018.

- Organizational structure of Departments and criteria for establishing subordinate organizations under the departments in Vietnam

- System of legislative documents in Vietnam from April 1, 2025

- Rights and responsibilities of National Assembly Deputies and People's Council Deputies of Vietnam

- Organizational structure of the Department of Customs of Vietnam from March 1, 2025

- Principles for establishing prices for electricity system operation dispatch and electricity market transaction administration in Vietnam

- Prime Minister of Vietnam directs various measures to reduce lending interest rates

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents