Guidance on application of accounting regimes to extra-small enterprises in Vietnam

Recently, the Ministry of Finance of Vietnam issued Circular No. 132/2018/TT-BTC providing guidance on accounting regimes of extra-small enterprises.

Accounting regimes applicable to extra-small enterprises in Vietnam are specified as follows:

- Extra-small enterprises paying their CIT calculated according to the method of calculation of CIT based on assessable income shall apply the accounting regime specified in Chapter II in Circular No. 132/2018/TT-BTC of the Ministry of Finance of Vietnam.

- Extra-small enterprises paying CIT calculated according to the method of calculation of CIT based on the CIT-to-sales ratio (%) shall apply the accounting regime specified in Chapter III herein or may opt to apply the accounting regime specified in Chapter II in Circular No. 132/2018/TT-BTC.

- Extra-small enterprises may opt to apply the accounting regime to medium and small enterprises which is enshrined in Circular No. 133/2016/TT-BTC of the Ministry of Finance of Vietnam.

- Extra-small enterprises shall have the burden of applying the uniform accounting regime in a financial year. Change of the applied accounting regime may only be made in the beginning of the following financial year.

View more details at Circular No. 132/2018/TT-BTC of the Ministry of Finance of Vietnam, effective from February 15, 2019.

- Key word:

- Circular No. 132/2018/TT-BTC

- Organizational structure of Departments and criteria for establishing subordinate organizations under the departments in Vietnam

- System of legislative documents in Vietnam from April 1, 2025

- Rights and responsibilities of National Assembly Deputies and People's Council Deputies of Vietnam

- Organizational structure of the Department of Customs of Vietnam from March 1, 2025

- Principles for establishing prices for electricity system operation dispatch and electricity market transaction administration in Vietnam

- Prime Minister of Vietnam directs various measures to reduce lending interest rates

-

- Detailed list of accounting documents of extra ...

- 18:14, 11/01/2019

-

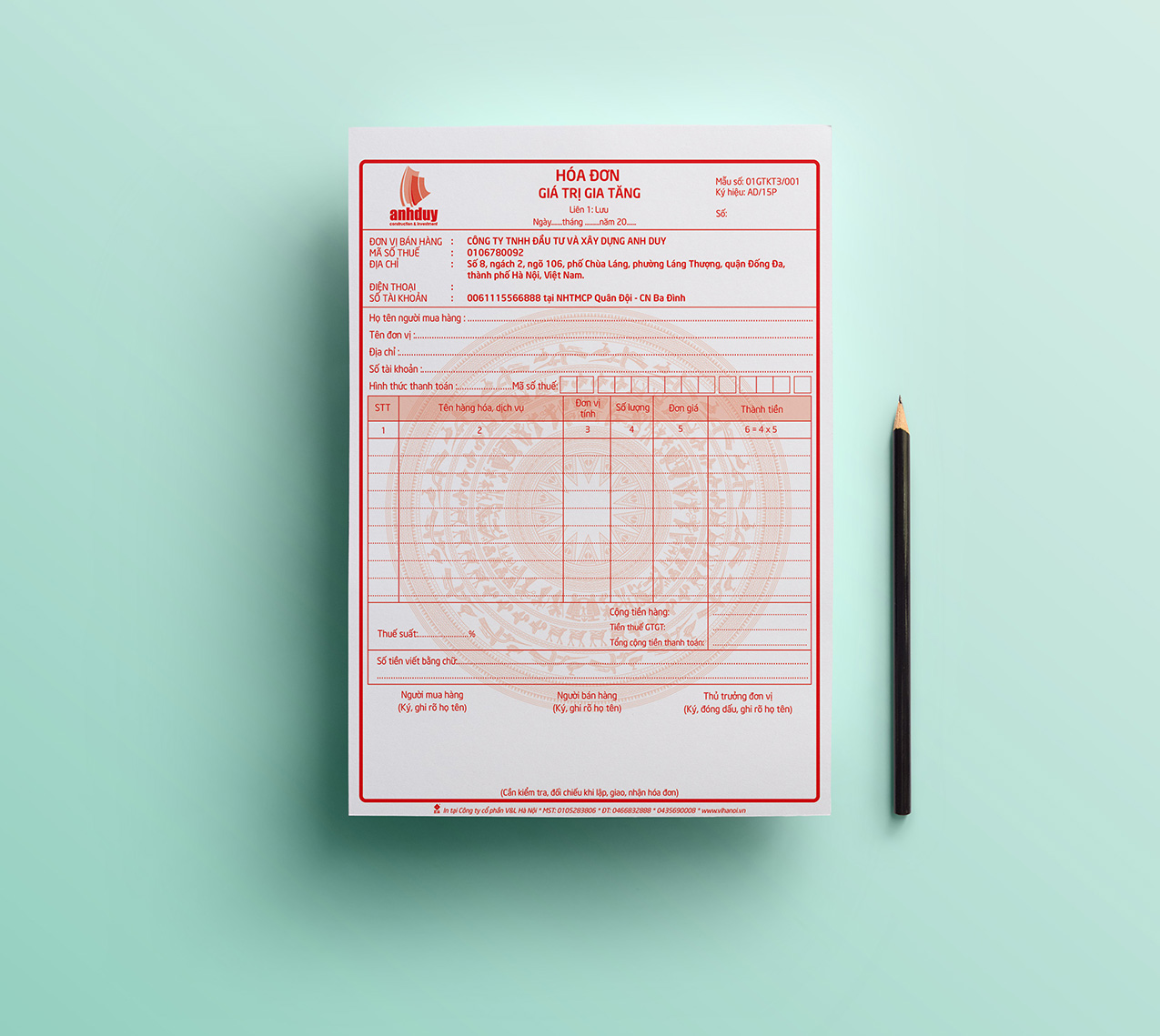

- Vietnam's new regulations on sales invoices of ...

- 12:50, 11/01/2019

-

- Extra-small enterprises may design forms of accounting ...

- 11:39, 11/01/2019

-

- Summary of forms of accounting books of extra ...

- 15:22, 10/01/2019

-

- Extra-small enterprises in Vietnam are not required ...

- 14:37, 10/01/2019

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents