Compulsory social insurance contribution rates in Vietnam from June 1, 2017

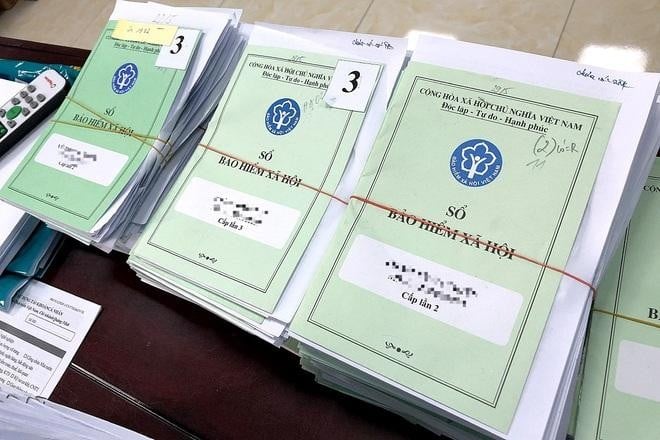

the Government of Vietnam has just signed and promulgated Decree 44/2017/ND-CP regulating the compulsory social insurance (SI) contribution rates to the Occupational Accident and Disease Insurance Fund (hereinafter referred to as the Fund).

Every month, employers contribute to the Social Insurance Fund for employees as specified in Clause 1, Article 2 of the Social Insurance Law, with the following contribution rates:

- 0.5% of the statutory pay rate for non-commisSocial Insuranceoned officers, soldiers in the military; non-commisSocial Insuranceoned officers, soldiers in the police serving for a limited period; military, police, and cipher students receiving living expenses;

- 0.5% of the wage fund used to pay Social Insurance premiums for employees who are other subjects, except for domestic workers.

Thus, compared to the current rates, the new Social Insurance contribution rate has been reduced by half.

Depending on the ability to ensure the Fund's balance, the above-mentioned rate may be adjusted from January 1, 2020.

Decree 44/2017/ND-CP takes effect from June 1, 2017. For employees working under labor contracts of 01 month to less than 03 months, the contribution rate will apply from January 1, 2018.

- Organizational structure of Departments and criteria for establishing subordinate organizations under the departments in Vietnam

- System of legislative documents in Vietnam from April 1, 2025

- Rights and responsibilities of National Assembly Deputies and People's Council Deputies of Vietnam

- Organizational structure of the Department of Customs of Vietnam from March 1, 2025

- Principles for establishing prices for electricity system operation dispatch and electricity market transaction administration in Vietnam

- Prime Minister of Vietnam directs various measures to reduce lending interest rates

-

- Social insurance regime for regular militia and ...

- 17:32, 08/02/2025

-

- Guidelines on the form for Notification No. 01 ...

- 11:00, 04/02/2025

-

- Coefficient of compulsory social insurance price ...

- 15:24, 22/01/2025

-

- Subjects adjusted for salaries and monthly income ...

- 17:59, 20/01/2025

-

- Social insurance price slippage coefficient for ...

- 10:47, 20/01/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents