tax calculation

-

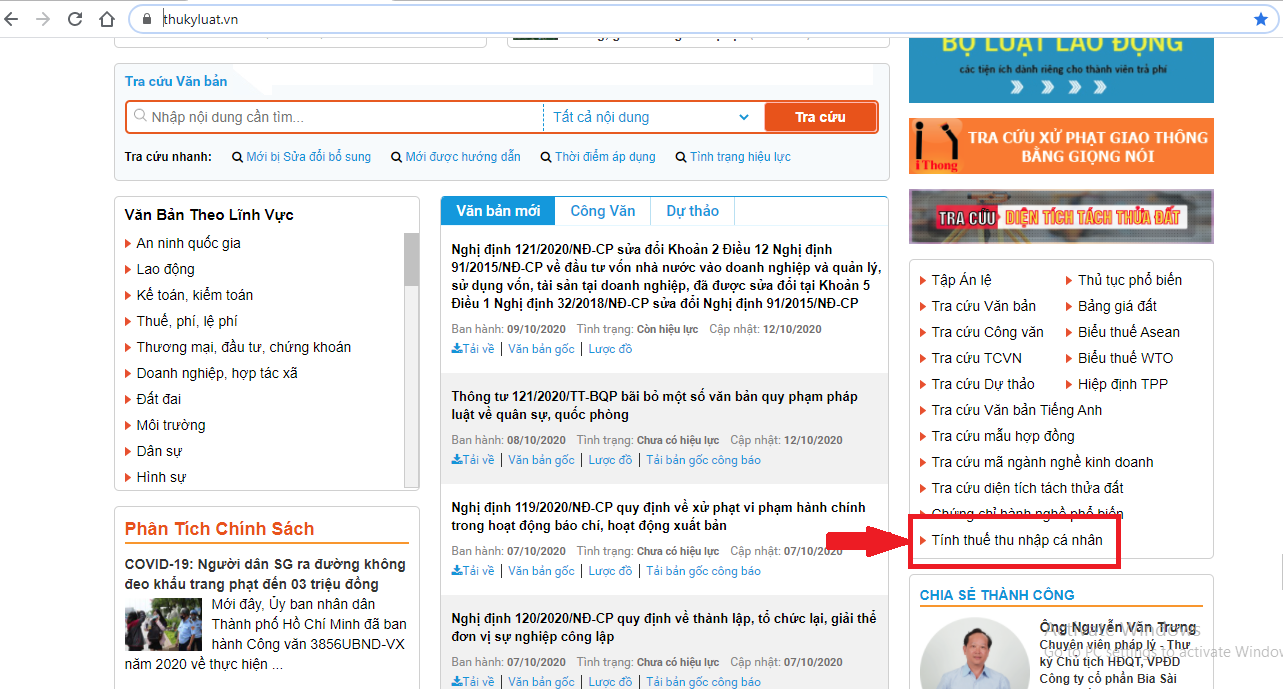

- Guidance on tax calculation in case organizations and individuals declaring and paying tax on behalf of other individuals in Vietnam

- 10:40, 08/11/2023

- What is guidance on tax calculation in case organizations and individuals declaring and paying tax on behalf of other individuals in Vietnam? - Dang Anh (Tien Giang)

-

- Tax calculation in cases where individuals lease out their property or directly sign contracts to work as lottery agents, insurance agents in Vietnam

- 14:09, 09/08/2023

- What are the regulations on tax calculation in cases where individuals lease out their property or directly sign contracts to work as lottery agents, insurance agents in Vietnam? - Quang Huy (Ca Mau)

-

.png)

- Method of tax calculation for the individual who directly signs the insurance agent contract in Vietnam?

- 08:05, 10/05/2022

- I am the current employee working at the insurance agent However, it is recommended that the auditor concludes an insurance agent? What is the tax statement made? Thanks!

Most view

SEARCH ARTICLE