tax

-

- Compilation of Forms Used in Administrative Sanctions on Taxes, Invoices from December 05, 2020 in Vietnam

- 19:43, 09/07/2024

- On October 19, 2020, the Government of Vietnam issued Decree 125/2020/ND-CP providing regulations on administrative penalties for tax and invoice violations.

-

- Some important provisions in Law on Tax Administration 2019 in Vietnam

- 18:39, 09/07/2024

- July 01, 2020, Law on Tax Administration 2019 officially took effect, stipulating the management of various types of taxes and other revenues belonging to the state budget in Vietnam. The Law on Tax Administration 2019 includes several important provisions that need attention.

-

- Update: All tax official dispatches issued in October 2020 in Vietnam

- 18:33, 09/07/2024

- Taxes, fees, and charges are among the critical issues for businesses across various sectors in Vietnam. Below is a compilation of all tax official dispatches issued in October 2020.

-

- Application form for Extension of deadline for payment of Tax and Land Rent in Vietnam for 2023

- 16:57, 09/07/2024

- To eligible for a tax payment extension, what is the application and procedures for Extension of deadline for payment of Tax and Land Rent in Vietnam for 2023? – Mai Anh (Thai Binh)

-

- 3 Steps to register e-tax accounts online for taxpayers in Vietnam

- 16:43, 09/07/2024

- Recently, the General Department of Taxation of Vietnam issued Official Dispatch No. 377/TCT-DNNCN regarding the promotion of organizing and implementing the issuance of e-tax accounts in the field of taxation for individuals. In this Official Dispatch, the General Department of Taxation provides specific guidance on the steps to register e-tax accounts online for taxpayers in Vietnam as follows:

-

- Guidance on registering e-tax accounts via the Public Service Portal in Vietnam

- 16:42, 09/07/2024

- Official Dispatch 377/TCT-DNNCN regarding the promotion and organization of issuing e-tax accounts in the field of taxation for individuals issued by the General Department of Taxation on February 05, 2021.

-

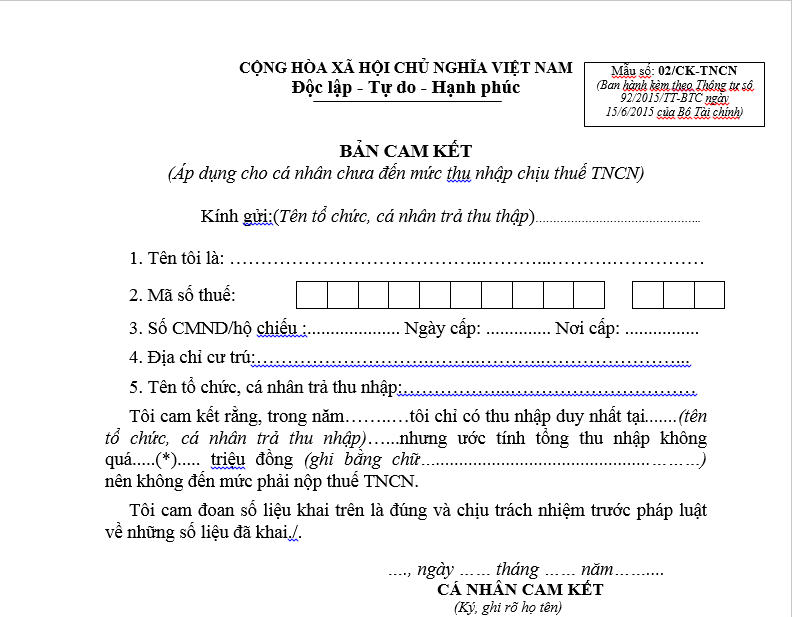

- Vietnam: Commitment Form 02/CK-TNCN for Personal Income Tax Exemption

- 16:23, 09/07/2024

- Form 02/CK-TNCN Commitment form applicable to individuals not yet liable for taxable income in Vietnam promulgated together with Circular 92/2015/TT-BTC.

-

- Immediate tax refunds for tax refund applications meeting the requirements and regulations of the law in Vietnam

- 16:20, 09/07/2024

- In recent times, for enterprises with value-added tax (VAT) refund applications that comply with the law, the tax authorities in Vietnam have processed the refunds for these enterprises in accordance with regulations.

-

- To speed up the roadmap for Tax policy reform under Tax System Reform Strategy to 2030 in Vietnam

- 09:07, 29/06/2024

- "To speed up the roadmap for Tax policy reform under Tax System Reform Strategy to 2030 in Vietnam" is mentioned in Resolution 98/NQ-CP dated June 26, 2024.

Most view

SEARCH ARTICLE