Precedent No. 11/2017/AL is derived from Cassation Decision No. 01/2017/KDTM-GDT dated March 1, 2017, regarding the commercial case "Dispute over a credit contract" issued according to Decision No. 299/QD-CA in 2017 on the publication of Precedent in Vietnam.

Precedent No. 11/2017/AL on recognizing the mortgage contract of land use rights while there are properties on the land not owned by the mortgagor

Adopted by the Council of Judges of the Supreme People’s Court of Vietnam on December 14, 2017, and published according to Decision No. 299/QD-CA dated December 28, 2017 by the Chief Justice of the Supreme People’s Court of Vietnam.

Source of Precedent:

Cassation Decision No. 01/2017/KDTM-GDT dated March 1, 2017, by the Council of Judges of the Supreme People's Court of Vietnam for the business and commercial dispute case "Dispute over credit contract" in Hanoi City between the plaintiff, Commercial Joint Stock Bank A (represented by Mr. Pham Huu P, authorized representative Mrs. Mai Thu H), and the defendant, Limited Liability Company B (represented by Mr. Tran Luu H1); persons with related rights and obligations including Mr. Tran Duyen H, Mrs. Luu Thi Minh N, Mr. Tran Luu H1, Mrs. Pham Thi V, Mr. Tran Luu H2, Mrs. Ta Thu H, Mr. Nguyen Tuan T, Mrs. Tran Thanh H, Mr. Tran Minh H, Mrs. Do Thi H.

Location of the Precedent Content:

Paragraph 4, section “Court's Opinion.”

Summary of the Precedent:

- Scenario 1:

One party mortgages the land use rights and attached assets owned by them to secure the fulfillment of civil obligations, but there are also assets on the land owned by others; the form and content of the contract comply with legal regulations.

- Legal Solution 1:

In this situation, the Court must determine that the mortgage contract is legally valid.

- Scenario 2:

The mortgagor and the mortgagee agree that the mortgagee has the right to sell the secured asset, which is the land use rights where there is a house not owned by the land user.

- Legal Solution 2:

In this situation, when resolving the case, the Court must give the house owner on the land priority to acquire the land use rights if they have the demand.

Legal provisions related to the Precedent:

Article 342 of the Civil Code 2005 (corresponding to Article 318 of the Civil Code 2015); Article 715, Article 721 of the Civil Code 2005; Section 4 Clause 19 Article 1 of Decree No. 11/2012/ND-CP dated February 22, 2012 by the Government of Vietnam amending and supplementing several articles of Decree No. 163/2006/ND-CP dated December 29, 2006 by the Government of Vietnam on secured transactions (codified in clause 2 Article 325 of the Civil Code 2015).

Keywords of the Precedent:

“Mortgage of land use rights”; “There are properties of others on the land”; “Recognizing the mortgage contract of land use rights”; “Agreement on handling mortgaged assets”; “Priority to receive transfer”.

CASE DETAILS:

In the complaint dated October 06, 2011, and the testimonies at the Court, the plaintiff, Joint Stock Commercial Bank A, stated:

On June 16, 2008, Joint Stock Commercial Bank A (hereinafter referred to as the Bank) and Limited Liability Company B (hereinafter referred to as Company B) signed Credit Contract No. 1702-LAV-200800142. The Bank lent Company B VND 10,000,000,000 and/or its equivalent in foreign currency. The purpose of the credit was to supplement working capital to support the business activities according to the registered business of Company B.

Executing the contract, the Bank disbursed a total of VND 3,066,191,933 to Company B under the combined Credit Contracts cum Debt Retrieval. As of October 05, 2011, Company B owed principal and interest for 03 Loans totaling VND 4,368,570,503 (including a principal of VND 2,943,600,000 and interest of VND 1,424,970,503).

The collateral for the above loan is the house and land [parcel No. 43, map sheet No. 51-1-33 (1996)] at No. 432, Group 28, Ward E, District G, Hanoi City, belonging to Mr. Tran Duyen H and Mrs. Luu Thi Minh N (according to Certificate of House Ownership and Homestead Land Use Rights No. 10107490390 issued by Hanoi City People's Committee on December 07, 2000), mortgaged by Mr. Tran Duyen H and Mrs. Luu Thi Minh N according to the Mortgage Contract on June 11, 2008. This mortgage contract was notarized by Notary Office No. 6 of Hanoi City on June 11, 2008, and registered with the Hanoi City Department of Natural Resources and Environment on June 11, 2008.

On October 30, 2009, the Bank and Company B continued to sign Credit Contract No. 1702-LAV-200900583. The Bank lent Company B 180,000 USD. The loan purpose was to pay for the transportation of the export shipment; the loan term was 09 months; the interest rate was 5.1% per year; the overdue interest rate was 150%.

Executing the contract, the Bank disbursed the full loan amount of 180,000 USD to Company B. Company B repaid the Bank a principal of 100,750 USD and interest of 1,334.50 USD. As of October 05, 2011, Company B owed a principal of 79,205 USD and interest of 16,879.69 USD. The total principal and interest was 96,120.69 USD.

The collateral for the loan in Credit Contract No. 1702-LAV-2009058 includes:

- A batch of 19 new 100% finished JMP brand trucks with a load capacity of 1.75 tons valued at VND 2,778,750,000 (assembled by Company B under the warehouse goods method, the Bank holds the Quality Inspection Certificate) mortgaged by Company B under Mortgage Contract No. 219/2009/EIBHBT-CC on October 29, 2009. This mortgage contract was registered for secured transaction at the Department of Transactions Registration of Hanoi City on November 02, 2009;

- A 03-month term deposit account valued at VND 1,620,000,000 issued by the Bank. As Company B partially repaid the loan, the Bank released the secured deposit account amounting to VND 1,620,000,000 in Company B’s savings account corresponding to the repaid debt.

At the first-instance trial, the Bank’s representative confirmed: for the 180,000 USD loan, Company B had repaid the principal; only the interest of 5,392.81 USD remained; the collateral was 19 vehicles, of which 18 had been sold, leaving only one; requested the Court to handle the remaining vehicle to recover the remaining loan debt.

The Bank requests the Court to order:

- Company B to pay the principal and interest in VND of Credit Contract No. 1702-LAV-200800142 amounting to VND 4,368,570,503;- Company B to pay 5,392.81 USD of interest in USD of Credit Contract No. 1702-LAV-200900583.

In case Company B fails to pay or pays insufficiently, the Bank requests the Court to auction the collateral:

- House ownership and homestead land use rights at No. 432, Group 28, Ward E, District G, Hanoi City, owned and used by Mr. Tran Duyen H and Mrs. Luu Thi Minh N;- 01 JMP brand new 100% finished truck with a load capacity of 1.75 tons assembled by Company B under Mortgage Contract No. 219/2009/EIBHBT-CC on October 29, 2009.

Defendant’s representative, Mr. Tran Luu H1 – General Director of Company B, stated: He acknowledged the principal, interest debt, and collateral as stated by the Bank but requested the Bank to allow gradual repayment.

Stakeholders, Mr. Tran Duyen H and Mrs. Luu Thi Minh N, stated that they acknowledged signing the mortgage contract for house and land No. 432 to secure a maximum loan of VND 3,000,000,000 for Company B. The mortgage contract was notarized and registered for secured transaction. Mr. Tran Duyen H and Mrs. Luu Thi Minh N’s family have helped Company B repay nearly VND 600,000,000 for the loan secured by their house and land. They requested the Bank to extend Company B’s debt so that the company has time to recover production and arrange repayment to the Bank; and requested the Court not to summon their sons, daughters, and in-laws to the Court.

Mr. Tran Luu H2, on behalf of Mr. Tran Duyen H and Mrs. Luu Thi Minh N’s children living in the house and land at No. 432, stated:

At the end of 2010, he learned that his parents had mortgaged the family house and land to secure Company B's loan. After Mr. Tran Duyen H and Mrs. Luu Thi Minh N were issued the House Ownership Certificate and Homestead Land Use Certificate in 2000, Mr. Tran Luu H2 and Mr. Tran Minh H spent money to build an additional 3.5-story house on the land, with 16 family members currently residing at house and land No. 432. When signing the mortgage contract, the Bank did not seek the opinions of him and those living at the house and land. Therefore, he requested the Court not recognize the mortgage contract and reconsider the VND 550,000,000 that he and his siblings contributed to repaying Company B’s loan secured by the house and land at No. 432, but the Bank unilaterally counted toward the foreign currency loan secured by the 19 trucks.

In the First Instance Judgment No. 59/2013/KDTM-ST on September 24, 2013, Hanoi City People's Court decided:

- Accept the plaintiff's lawsuit by Joint Stock Commercial Bank A against Limited Liability Company B.

- Force Limited Liability Company B to repay Joint Stock Commercial Bank A the remaining debt of Credit Contract No. 1702-LAV-200800142, comprising: principal of VND 2,813,600,000; in-term interest of VND 2,080,977,381; overdue interest as of September 23, 2013, of VND 1,036,575,586; late payment interest as of September 23, 2013, of VND 123,254,156; totaling: VND 6,054,407,123.

- Force Limited Liability Company B to repay Joint Stock Commercial Bank A the remaining debt of Credit Contract No. 1702-LAV-200800583, including overdue interest of 5,392.81 USD.

In case Limited Liability Company B fails to repay or repays insufficiently the remaining debt of Credit Contract No. 1702-LAV-200800142, Joint Stock Commercial Bank A has the right to request Hanoi City Civil Judgment Enforcement Department to handle the secured property according to the law: house ownership and land use rights at Parcel No. 43, map sheet No. 5I-1-33 (1996) as per Certificate of House Ownership and Homestead Land Use Rights No. 10107490390 issued by Hanoi City People's Committee on December 07, 2000, for Mr. Tran Duyen H and Mrs. Luu Thi Minh N’s property at No. 432, Group 28, Ward E, District G, Hanoi City to recover the debt...

In case Limited Liability Company B fails to repay or repays insufficiently the debt of Credit Contract No. 1702-LAV-200800583, Joint Stock Commercial Bank A has the right to request Hanoi City Civil Judgment Enforcement Department to handle the secured property as 01 JMP brand truck with a load capacity of 1.75 tons assembled by Limited Liability Company B under Mortgage Contract No. 219/2009/EIBHBT-CC on October 29, 2009, to recover the debt.

Additionally, the First Instance Court also decided on the court fees and the appeal rights of the parties according to the law.

After the first-instance trial, the defendants and interested parties appealed the first-instance judgment.

In the Appellate Judgment No. 111/2014/KDTM-PT on July 07, 2014, the Appellate Court of the Supreme People's Court of Vietnam in Hanoi decided:

Uphold the decision of the First Instance Judgment No. 59/2012/KDTM-ST on September 24, 2013, of the Hanoi People’s Court regarding the Credit Contract, the loan amounts, and the amounts Limited Liability Company B must pay to Joint Stock Commercial Bank A; annul the part of the decision of the First Instance Judgment No. 59/2013/KDTM-ST on September 24, 2013, of the Hanoi People's Court regarding the mortgage contract and the security of third parties, specifically:

...Annul the decision on the mortgage contract of land use rights and assets attached to the land of the third party (house and land at No. 432, Group 28, Ward E, District G, Hanoi City) signed on June 11, 2008, at Notary Office No. 6 of Hanoi and registered with the Hanoi City Department of Natural Resources and Environment on June 11, 2008...

Refer the case file back to the Hanoi People's Court for verification, evidence collection, and retrial, determining the legal assets owned by Mr. Tran Duyen H and Mrs. Luu Thi Minh N as collateral for Limited Liability Company B’s loan from Joint Stock Commercial Bank A under Credit Contract No. 1702-LAV-200800142 on June 16, 2008.

Additionally, the Appellate Court also ruled on court fees.

After the appellate trial, the Bank and Hanoi People's Court submitted requests for cassation to review the appellate judgment.

In the Cassation Appeal No. 14/2016/KDTM-KN on April 12, 2016, the Chief Justice of the Supreme People's Court of Vietnam appealed Appellate Commerce Business Judgment No. 111/2014/KDTM-PT on July 07, 2014, of the Appellate Court of the Supreme People's Court of Vietnam at Hanoi. It recommends the Judicial Council of the Supreme People's Court of Vietnam annul the Appellate Commerce Business Judgment No. 111/2014/KDTM-PT on July 07, 2014, of the Appellate Court of the Supreme People's Court of Vietnam at Hanoi and the First Instance Commerce Business Judgment No. 59/2013/KDTM-ST on September 24, 2013, of the Hanoi People's Court; return the case file to the Hanoi People's Court for retrial according to the law.

At the cassation hearing, the representative of the Supreme People's Procuracy agreed with the appeal of the Chief Justice of the Supreme People's Court of Vietnam; recommending the Judicial Council of the Supreme People's Court of Vietnam to annul the appellate judgment and return the case file to the Hanoi High People’s Court for a new appellate trial.

THE COURT'S FINDINGS:

[1] The case file shows that to secure the loan under Credit Agreement No. 1702-LAV-200800142 dated June 16, 2008 at the Bank of Company B, where Mr. Tran Luu H1, son of Mr. Tran Duyen H and Mrs. Luu Thi Minh N, serves as Director, on June 11, 2008, Mr. Tran Duyen H and Mrs. Luu Thi Minh N mortgaged the house and land at No. 432, Group 28, Ward E, District G, Hanoi City, which are owned and used by Mr. Tran Duyen H and Mrs. Luu Thi Minh N according to the Land Use Right and Attached Asset Mortgage Agreement dated June 11, 2008. This mortgage agreement was notarized and registered for secured transaction in accordance with legal provisions.

[2] According to the Certificate of Ownership of Residential Housing and Homestead Land Use Right dated December 7, 2000, the house and land at No. 432, Group 28, Ward E, District G, Hanoi City (hereinafter referred to as “House and Land No. 432”), includes: homestead land area of 147.7 m², residential house area of 85 m², house structure: concrete and brick; number of floors: 02+01. During the appraisal of the mortgaged assets, the Bank was aware that on the 147.7 m² land plot, in addition to the registered 2-story house, there was also an unregistered 3.5-story house. However, the Bank only appraised the land use rights and the registered 2-story house with a total value of 3,186,700,000 VND, without gathering sufficient information and documents to clarify the ownership and origin of the 3.5-story house, which was a deficiency and did not ensure the rights of the parties involved.

[3] During the case resolution process, on June 6, 2012, the People’s Court of Hanoi City conducted an on-site inspection and appraisal, determining that House and Land No. 432 comprises two blocks (block one: land occupancy area 37.5 m², length 5.9 m, width 6.35 m; block two: a three-story concrete house with a balcony, area 61.3 m²) and currently accommodates 16 people with permanent, long-term residence. Before the first-instance trial, on September 21, 2013, Mr. Tran Luu H2 (son of Mr. Tran Duyen H and Mrs. Luu Thi Minh N) submitted a petition to the People’s Court of Hanoi City stating that after being granted the Certificate of Ownership of Residential Housing and Homestead Land Use Right in 2000, due to housing difficulties, the family of Mr. Tran Duyen H and Mrs. Luu Thi Minh N agreed for Mr. Tran Luu H2 and other children of Mr. Tran Duyen H and Mrs. Luu Thi Minh N to invest in building an additional 3.5-story house next to the old 2-story house on the mentioned parcel in 2002. Thus, the People’s Court of Hanoi City had factual knowledge that at the time of the mortgage, the parcel had two houses (the old 2-story house and the 3.5-story house) which did not match the Certificate of Ownership of Residential Housing and Homestead Land Use Right in 2000 and the Land Use Right and Attached Asset Mortgage Agreement dated June 11, 2008. While resolving the case, although the People’s Court of Hanoi City considered the claims of Mr. Tran Luu H2 and the children of Mr. Tran Duyen H and Mrs. Luu Thi Minh N concerning the 3.5-story house, the court did not clearly decide whether to foreclose on the 3.5-story house, which was incorrect, failing to ensure the rights and legitimate interests of the parties involved.

[4] According to Section 4, Clause 19, Article 1 of Decree No. 11/2012/ND-CP dated February 22, 2012, of the Government of Vietnam, amending and supplementing several provisions of Decree No. 163/2006/ND-CP dated December 29, 2006, of the Government of Vietnam on secured transactions: “In case only land use rights are mortgaged without the mortgaging of assets attached to the land and the land user is not concurrently the owner of the assets attached to the land, then when disposing of the land use rights, the owner of the assets attached to the land is entitled to continue using the land as per the agreement between the land user and the owner of the assets attached to the land, except as otherwise agreed. The rights and obligations between the mortgagor and the owner of the assets attached to the land are transferred to the buyer, the person receiving the transfer of the land use rights.” In this case, when entering into the mortgage contract for the land use rights and attached assets, both the mortgagor (Mr. Tran Duyen H and Mrs. Luu Thi Minh N) and the mortgagee (the Bank) clearly knew that besides the registered 2-story house, there was also an unregistered 3.5-story house on the parcel of Mr. Tran Duyen H and Mrs. Luu Thi Minh N, but they only agreed to mortgage the assets including the land use rights and the registered 2-story house attached to the land. If the land has multiple assets attached to it with some owned by the land user and others by different owners, and the land user only mortgages the land use rights and the assets they own attached to the land, and the mortgage contract complies with legal form and content, then the mortgage contract has legal effect. Therefore, the appellate court's ruling to partially invalidate the Land Use Right and Attached Asset Mortgage Agreement dated June 11, 2008, (the part concerning the 3.5-story house); annul the first-instance court's decision regarding the mortgage contract and remand the case to the People’s Court of Hanoi City for further evidence collection to ascertain the legitimate assets owned by Mr. Tran Duyen H and Mrs. Luu Thi Minh N and reassess was improper. Instead, with available documents and evidence in the case file, the appellate court should have considered and decided on the handling of the secured assets as the land use rights and the house legitimately owned by Mr. Tran Duyen H and Mrs. Luu Thi Minh N in accordance with the law. In rehearing the case, the appellate court should request the parties to provide documents and evidence proving the origin of the 3.5-story house for resolving the case that ensures the legal rights and interests of those who invested in building the house and are residing there. Moreover, the appellate court should seek opinions, and motivate, and encourage the parties to agree on handling the secured assets. Suppose the mortgagor and the mortgagee agree that the mortgagee can sell the secured assets as the land use rights on which stands a house owned by others not the land user. In that case, the house owner should be given priority if they intend to purchase (receive the transfer).

[5] Additionally, the first-instance court, based on the agreement between the parties in Clause 5.4, Article 5 of the Credit Agreement on late payment interest on unpaid interest "Late payment penalty is over 10 days from the due date, the penalty rate is 2% on unpaid interest; over 30 days from the due date, the penalty rate is 5% on unpaid interest", to accept the Bank's claim requiring Company B to pay a late payment penalty of 123,254,156 VND was not conformable with the law, and should not be accepted as it constitutes compound interest. The appellate court not detecting this error and retaining this decision of the first-instance judgment was also incorrect.

For the above reasons,

DECISION:

Under Clause 2, Article 337, Clause 3, Article 343, Article 345 of the Civil Procedure Code 2015; Resolution No. 103/2015/QH13 dated November 25, 2015, on the implementation of the Civil Procedure Code;

-

Accept the Cassation Appeal No. 14/2016/KDTM-KN dated April 12, 2016, of the Chief Justice of the Supreme People’s Court of Vietnam.

-

Annul the Business and Commercial Appellate Judgment No. 111/2014/KDTM-PT dated July 7, 2014, of the Appellate Court of the Supreme People’s Court of Vietnam in Hanoi regarding the business and commercial case disputing the credit agreement between the plaintiff, Joint Stock Commercial Bank A, and the defendant, Limited Liability Company B, and 10 persons with rights and obligations involved.

-

Remand the case file to the High People’s Court in Hanoi for re-trial according to appellate procedures conformable with the law.

PRECEDEN CONTENT

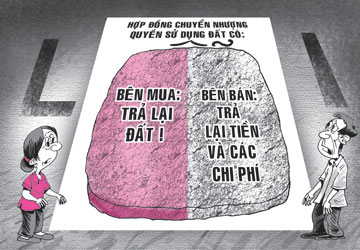

“ [4] In cases where land has multiple assets attached, including some owned by the land user and some by others, and the land user mortgages only the land use rights and assets attached to the land they own, and the mortgage contract complies with legal form and content, the mortgage contract has a legal effect...

... If the mortgagor and mortgagee agree that the mortgagee can sell the secured assets as land use rights with a house owned by others on it not being the land user, the house owner should be given priority if they intend to purchase (receive transfer).”

Article table of contents

Article table of contents

.jpg)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)