What are bonds? What are the requirements for public offering of bonds in Vietnam? – Minh Quan (Da Nang, Vietnam)

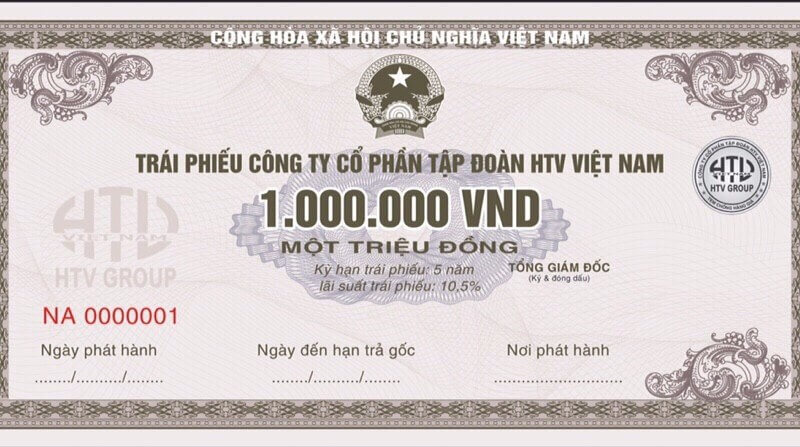

Requirements for public offering of bonds in Vietnam (Internet image)

1. What are bonds?

According to Clause 3, Article 4 of the Law on Securities 2019, bonds are securities that certify their holders’ lawful rights and interests to part of the debt of the issuer.

2. Requirements for public offering of bonds in Vietnam

2.1. Requirements for public offering of bonds in Vietnam

In order to make a public offering of bonds, an enterprise (the issuer) shall satisfy the following requirements:

- The contributed charter capital is at least 30 billion VND on the offering date according to the accounting books;

- The issuer has profit in the preceding year and has no accumulated loss on the offering date; there is no debt that is overdue for more than 01 year;

- There is a plan for issuance, use and repayment of the capital generated by the offering ratified by the General Meeting of Shareholders, Board of Directors, the Board of members or the company president;

- The issuer has a commitment to fulfill its obligations to the investors in terms of conditions for issuance, payment, assurance of the lawful rights and interests of investors and other conditions;

- The offering is consulted by a securities company, unless the issuer is already a securities company;

- All of the requirements specified in Point e Clause 1 of this Article are satisfied;

- The issuer has a credit rating if required by the Government;

- The issuer has an escrow account to receive payments for the offered bonds;

- The issuer has a commitment to have its shares listed on the securities trading system after the end of the offering.

2.2. Requirements for public offering of convertible bonds in Vietnam

Requirements for public offering of convertible bonds include:

- The contributed charter capital is at least 30 billion VND on the offering date according to the accounting books;

- The company has profit over the last 02 years and has no accumulated loss on the offering date;

- There is a plan for issuance and use of capital generated by the offering ratified by the General Meeting of Shareholders;

- At least 15% of its voting shares have been sold to at least 100 non-major shareholders. If the issuer’s charter capital is 1.000 billion VND or above, the ratio shall be 10%.

- Before the offering date, the major shareholders have made a commitment to hold at least 20% of the issuer’s charter capital for at least 01 year from the end of the offering;

- The issuer is not undergoing criminal prosecution and does not have any unspent conviction for economic crimes;

- The offering is consulted by a securities company, unless the issuer is already a securities company;

- The issuer has a commitment to have its shares listed or registered on the securities trading system after the end of the offering;

- The issuer has an escrow account to receive payments for the offered shares.

- The company has profit in the preceding year and has no accumulated loss on the offering date;

- The value of the new shares does not exceed the total value of shares outstanding at their face value, unless there is a commitment to buy all of the shares of the issuer for reselling or to buy all of the unsold shares of the issuer, shares issued to raise more capital from equity, shares issued for swapping, consolidation or acquisition of enterprises;

- If the public offering is meant to raise capital to execute a project of the issuer, at least 70% of the offered shares must be sold to the investors. The issuer shall have a plan to make up for the shortage in case the capital generated by the offering is inadequate.

- The issuer has a commitment to fulfill its obligations to the investors in terms of conditions for issuance, payment, assurance of the lawful rights and interests of investors and other conditions;

(Clause 3, 4, Article 15 of the Law on Securities 2019)

Diem My

- Key word:

- public offering of bonds in Vietnam

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)