What are the regulations on the form of access and use of e-invoice information on web portal in Vietnam? - Trung Nghia (Tien Giang, Vietnam)

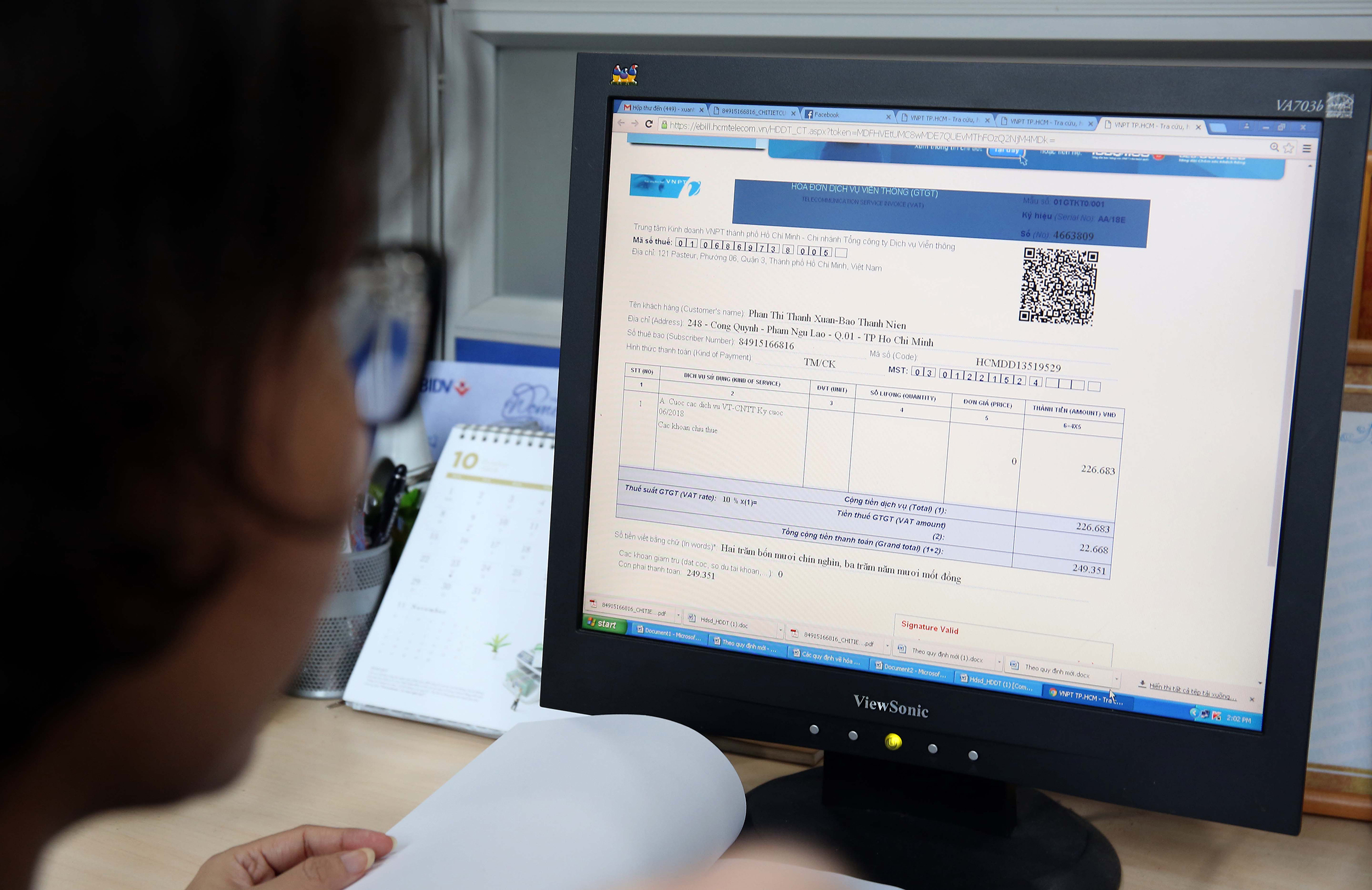

Form of access and use of e-invoice information on web portal in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Rules for searching, provision and use of e-invoice information in Vietnam

Article 44 of Decree 123/2020/ND-CP stipulates the rules for searching, provision and use of e-invoice information as follows:

- E-invoice information shall be searched for, provided and used for completing tax procedures, making payments via banks and other administrative procedures; verifying the legitimacy of goods sold on the market.

- E-invoice information must be only searched for and provided by authorized persons in an adequate and timely manner.

- The provided e-invoice information must be used for its intended purposes, serving professional operations within the functions and tasks of the information user, and in a manner that complies with regulations of the Law on protection of state secrets.

2. E-invoice information providers and users in Vietnam

E-invoice information providers and users according to Article 46 of Decree 123/2020/ND-CP are as follows:

- The General Department of Taxation shall provide e-invoice information at the request of central authorities and organizations performing state management tasks. Provincial Departments of Taxation, and Sub-departments of Taxation shall provide e-invoice information at the request of regulatory authorities and organizations performing state management tasks of the same level.

- E-invoice information users include:

+ Enterprises, business entities, household or individual businesses that are providers of goods or services; buyers of goods or services;

+ Regulatory authorities that use e-invoice information for competing administrative procedures as prescribed by law; verifying the legitimacy of goods sold on the market;

+ Credit institutions that use e-invoice information for their completion of procedures for tax and payments via banks;

+ E-invoice service providers.

+ Organizations that use electronic record information for deducting PIT.

3. Form of access and use of e-invoice information on web portal in Vietnam

Form of access and use of e-invoice information on web portal according to Article 47 of Decree 123/2020/ND-CP are as follows:

- Information users, including enterprises, business entities, household or individual businesses that are sellers of goods/services, and buyers of goods/services, shall access the web portal of the General Department of Taxation for searching e-invoice information according to contents of e-invoices.

- Information users, including regulatory authorities, credit institutions, e-invoice service providers that have signed the information exchange regulation or contracts, shall register for and be granted the right to access, connect and use e-invoice information from the General Department of Taxation as follows:

+ Apply a valid digital signature as prescribed by law;

+ Perform line coding;

+ Ensure information security as prescribed by law;

+ Meet technical requirements laid down by the General Department of Taxation, including: Information items, data format, connection method and information exchange frequency.

Information users prescribed in Clause 2 of Article 47 of Decree 123/2020/ND-CP shall assign their units or persons in charge of registering the use of e-invoice information (hereinafter referred to as “responsible applicant”) and send written notification thereof to the General Department of Taxation.

Quoc Dat

- Key word:

- web portal in Vietnam

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)