social insurance

-

- Mandatory Social Insurance Contribution Rates to the Occupational Accident and Disease Insurance Fund from June 01, 2017 in Vietnam

- 09:52, 11/07/2024

- According to the notification of the Ho Chi Minh City Social Insurance at Official Dispatch 1012/BHXH-QLT dated May 22, 2017, the monthly contribution rate to the Occupational Accident and Disease Insurance Fund from June 1, 2017 for employers in Vietnam is 0.5% on the salary fund used as the basis for social insurance contributions for employees.

-

- Social Insurance in Vietnam provides guidance on contributions according to new statutory pay rate

- 09:23, 11/07/2024

- On June 01, 2017, Vietnam Social Security (VSS) issued Official Dispatch 2159/BHXH-BT providing guidance on the contribution rates to the Occupational Accident and Disease Insurance Fund and the collection of social insurance, health insurance, unemployment insurance, and occupational accident and disease insurance according to the new statutory pay rate.

-

- 04 Changes in Social Insurance Benefits for Employees in Vietnam

- 09:03, 11/07/2024

- the Government of Vietnam issued Decree 72/2018/ND-CP adjusting the statutory pay rate effective from July 01, 2018, which has changed Social Insurance benefits.

-

.jpg)

- From June 1, 2017, there are many changes in the Social Insurance and Health Insurance policy in Vietnam

- 08:47, 11/07/2024

- Below is the content mentioned in the Draft Circular detailing the implementation of certain provisions of the Law on Social Insurance and the Law on Health Insurance within the healthcare sector in Vietnam. It amends, supplements, and abolishes multiple regulations related to the payment of medical examination and treatment costs under health insurance.

-

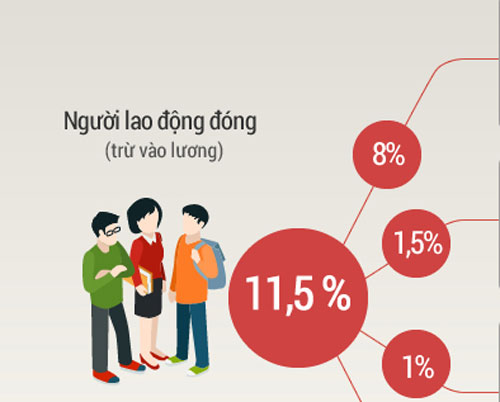

- Contribution Rates of Social Insurance for Employees in Vietnam in 2018

- 08:39, 11/07/2024

- Currently, according to Decision 595/QD-BHXH, there are a total of 03 types of insurance that enterprises must contribute for their employees, including: social insurance (retirement, sickness, maternity), health insurance, and unemployment insurance.

-

- Contributions and non-contributions for social insurance in Vietnam in 2017 and 2018

- 08:29, 11/07/2024

- From January 1, 2018, onwards, there are certain changes regarding Social Insurance (SI), Health Insurance (HI), and Unemployment Insurance (UI) compared to the current provisions. Among these changes are regulations concerning the components accounted for and not accounted for in Social Insurance contributions.

-

- Changes in Social Insurance, Health Insurance, and Unemployment Insurance in Vietnam from 2018

- 08:19, 11/07/2024

- From January 01, 2018 onwards, several issues related to Social Insurance, Health Insurance, and Unemployment Insurance in Vietnam have changes compared to the current regulations. Among these, the monthly salary for Social Insurance contributions includes the salary, salary allowances, and other supplementary amounts as stipulated by labor law.

-

- Compulsory social insurance contribution rates in Vietnam from June 1, 2017

- 08:12, 11/07/2024

- the Government of Vietnam has just signed and promulgated Decree 44/2017/ND-CP regulating the compulsory social insurance (SI) contribution rates to the Occupational Accident and Disease Insurance Fund (hereinafter referred to as the Fund).

-

- Hanoi-Vietnam: Method for calculating pension in 2018

- 07:59, 11/07/2024

- Pension is a significant benefit for those who have paid social insurance premiums for a sufficient period upon retirement, serving as a moral support for the elderly. Under the Law on Social Insurance 2014, from January 1, 2018, the regulations on pension calculation in Vietnam have undergone some changes, particularly with the pension from July 1, 2018, being increased by 6.92%.

Most view

SEARCH ARTICLE