salaries

-

- Information on the proposal to increase salaries and pensions for officials, public employees in Vietnam in 2025

- 11:57, 18/01/2025

- Proposal to increase salaries and pensions for officials, public employees in case the socio-economic situation in 2025 in Vietnam for more favorable and balanced resources.

-

- Amendments to various circulars on salary scales, salaries, and wage allowances for employees in Vietnam

- 17:38, 25/11/2024

- On November 14, 2024, the Minister of Labor, War Invalids and Social Affairs of Vietnam issued Circular 12/2024/TT-BLDTBXH amending and supplementing 10 Circulars guiding the implementation of labor management, salaries, remuneration, and bonuses for the Vietnam Deposit Insurance, Vietnam Asset Management Company of credit institutions, Vietnam Television, Local Development Investment Fund, State Capital Investment Corporation, Credit Guarantee Fund for Small and Medium Enterprises, Small and Medium Enterprise Development Fund, National Technology Innovation Fund, Cooperative Development Support Fund, and guidance on labor management, salaries, remuneration, and bonuses for the single-member limited liability company of Vietnam Debt Trading.

-

- 10 Regulations to Know About Labor, Salaries, and Social Insurance in Vietnam

- 22:09, 11/07/2024

- The regulations on employment, salaries, and social insurance policies may not be unfamiliar to employees, as these are issues we are always concerned about. Below, Lawnet would like to highlight some basic legal provisions that employees in Vietnam need to know about this field.

-

- Salaries and Bonuses for Hung Kings' Commemoration Day in Vietnam

- 09:11, 11/07/2024

- According to legal regulations, employees working on holidays in Vietnam are entitled to a salary of at least 300%, excluding the paid holiday salary for employees who receive daily wages. If a holiday coincides with a weekly day off, employees are entitled to compensatory leave on the following day.

-

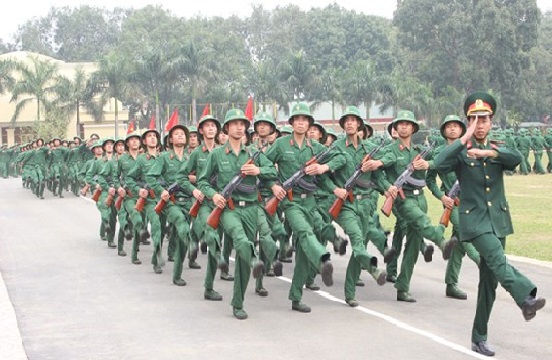

- Salaries and Allowances of National Defense Workers and Public Employees in 2018 in Vietnam

- 09:06, 11/07/2024

- Salary and allowances, benefits of workers, public employees in Vietnam are stipulated in Decree 19/2017/ND-CP prescribing salary policies for national defense workers and seniority allowance policies for national defense public employees.

-

- List of Salaries and Allowances Subject to and Exempt from Social Insurance Contributions in Vietnam

- 19:05, 10/07/2024

- The components of salary and allowances subject to social insurance contributions depend on whether the employee's salary is determined by State policies or by the unit's policies in Vietnam. To accurately identify which components of salary and allowances are subject to social insurance contributions and which are not, please refer to the table below.

-

- All Documents on Salaries and Allowances for Officials in Vietnam in 2018

- 18:11, 10/07/2024

- Since 2018, regulations on salaries and allowances for officials and public employees in Vietnam have undergone many changes. To help you easily grasp these changes, Lawnet would like to share all legal documents on salaries and allowances for Vietnamese officials and public employees and the people's armed forces that are in effect as of the present time. You can follow the list of documents through the summary table below.

-

- In 2020, Salaries of Judges, Procurators, and Court Clerks in Vietnam are Expected to Increase Significantly

- 00:36, 10/07/2024

- To date, the salary of Judges, Procurators, and Court Clerks in Vietnam is still determined according to the provisions of Resolution 730/2004/NQ-UBTVQH11 on the approval of the position salary table, the position allowance table for State leadership officials; the professional salary table, and professional allowance table for the Court sector and the Procuracy sector.

-

- In 2020, Teachers' Salaries and Allowances in Vietnam Will Increase the Most Ever

- 00:35, 10/07/2024

- Resolution on the state budget estimate for 2020 is expected to be passed at the 8th session of the 14th National Assembly of Vietnam. According to the proposal in this Resolution, the statutory pay rate for 2020 applicable to officials and public employees in Vietnam will be increased to 1.6 million VND starting from July 1, 2020.

Most view

SEARCH ARTICLE