Personal income tax

-

- Settlement of Personal Income Tax (PIT), Corporate Income Tax (CIT) in 2016 in Vietnam and Issues to Note

- 09:09, 11/07/2024

- Year-end tax finalization in Vietnam is an issue of concern for many organizations and individuals. According to regulations, the deadline for submitting the tax finalization declaration is no later than the 90th day from the end of the calendar year. Thus, the deadline for submitting tax finalization documents is approaching quickly. The following are important notes to be aware of when carrying out tax finalization.

-

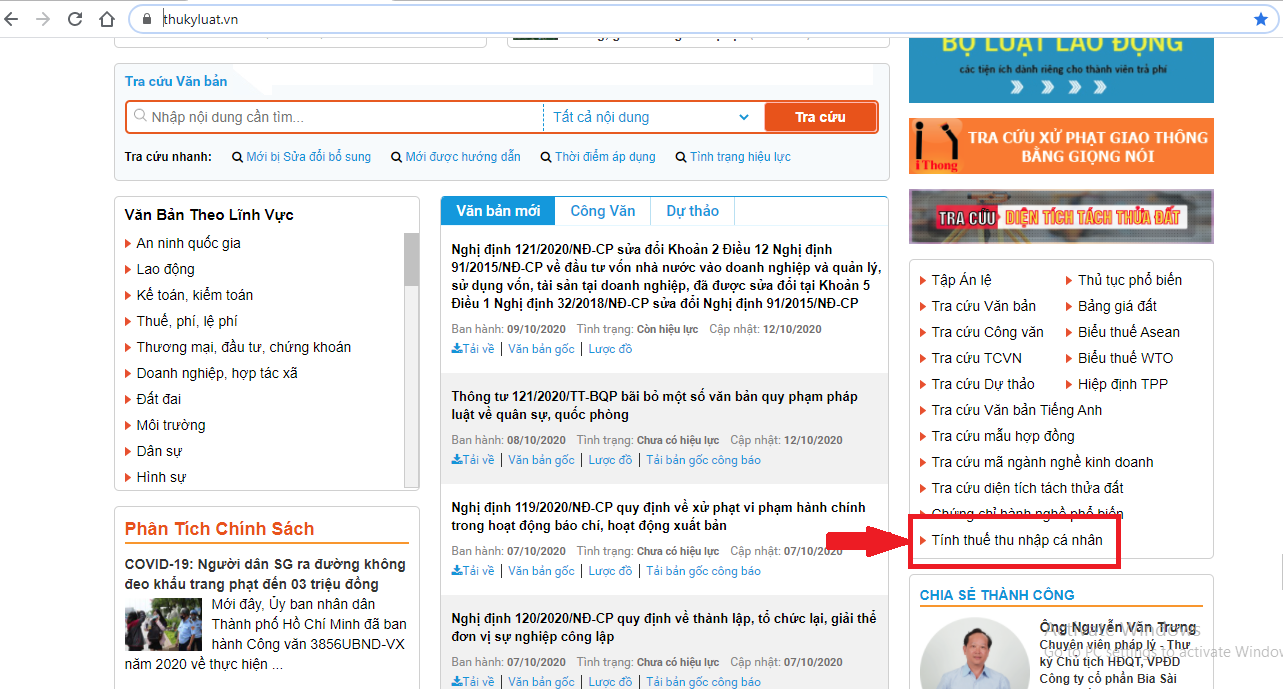

- Documents guiding personal income tax finalization in Vietnam

- 08:56, 11/07/2024

- In order to assist our esteemed members in easily searching and referencing documents related to personal income tax (PIT) finalization, There is a number of legal documents below:

-

- Form for personal income tax finalization return in Vietnam in 2017

- 08:55, 11/07/2024

- Below is the list of Form for personal income tax finalization return in Vietnam in 2017 compiled by Thu Ky Luat.

-

- Guidelines for Submitting the 2017 Annual Tax Finalization Declaration in Vietnam

- 08:20, 11/07/2024

- To address issues arising during the personal income tax (PIT) finalization process, An Giang Provincial Tax Department has issued Official Dispatch 242/CT-TNCN to units responsible for personal income tax finalization, providing guidance on submitting the 2016 personal income tax finalization declaration in Vietnam. Below are some noteworthy points.

-

- List of Forms and Documents for Personal Income Tax (PIT) and Corporate Income Tax (CIT) Finalization Documentation in Vietnam

- 18:18, 10/07/2024

- Below is the summary table of forms and documents serving the tax finalization in 2017 in Vietnam, compiled by Lawnet.

-

- Resolution of Some Situations Pertaining to Personal Income Tax in Vietnam

- 18:17, 10/07/2024

- Below is a compilation of common issues encountered during the personal income tax finalization process, compiled by the Hanoi Department of Taxation.

-

- Personal Income Tax Rates Table for 2018 in Vietnam

- 17:48, 10/07/2024

- Lawnet respectfully introduces to our members the Personal Income Tax Rates Table for the year 2018 in Vietnam, with the applicable tax rates in specific cases as follows:

-

- Simple method to calculate personal income tax in Vietnam that everyone needs to know

- 21:40, 09/07/2024

- Personal Income Tax is one of the essential issues that many people are concerned about. However, not everyone knows how to calculate their personal income tax in Vietnam. Below is a simple method to calculate personal income tax that everyone needs to know.

-

- Vietnam: Personal income tax calculation requires only 2 simple steps

- 21:21, 09/07/2024

- Personal income tax is an issue that everyone is concerned about. From now on, calculating personal income tax accurately has become easier with the following two steps.

Most view

SEARCH ARTICLE