Law on Severance tax 2009

-

- Vietnam: Cases of severance tax exemption and reduction

- 11:20, 12/12/2017

- The Law on Severance tax 2009 of Vietnam was promulgated on November 25, 2009 and officially effective from July 01, 2010, of which one of the fundamental contents is the regulation on cases of severance tax exemption and reduction.

-

- Vietnam: Severance tax-liable objects and entities eligible for severance tax exemption

- 10:09, 12/12/2016

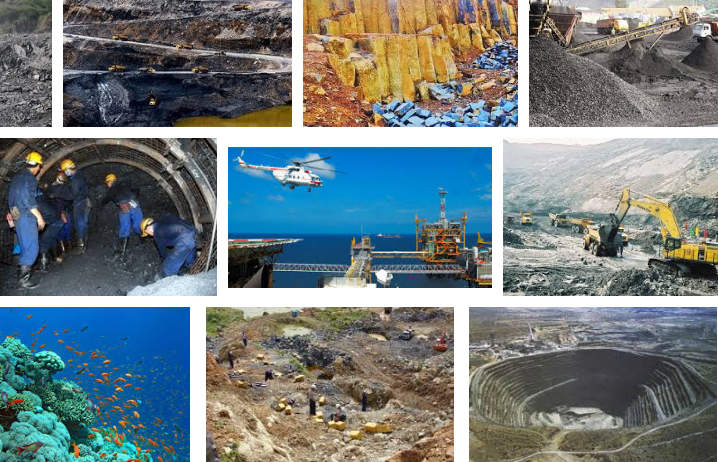

- Severance tax-liable objects are natural resources within the land, islands, internal waters, territorial sea, contiguous zones, exclusive economic zone, and continental shelves under the sovereignty and jurisdiction of Vietnam.

-

- Severance tax-liable objects according to Vietnam’s current regulations

- 11:35, 07/07/2016

- On November 25, 2009, the National Assembly of Vietnam approved the Law on Severance tax 2009, which provides for severance tax-liable objects, severance tax payers, severance tax bases, and severance tax declaration, payment, exemption and reduction.

-

- Law on Severance tax 2009 of Vietnam: Regulations on taxpayers

- 11:48, 01/01/2016

- According to Vietnam’s regulations, severance tax payers include organizations and individuals that exploit severance tax-liable natural resources.

Most view

Conditions and criteria for separating land area into independent projects in Ben Tre according to Decision 08

Conditions and criteria for separating land area into independent projects in Ben Tre according to Decision 08Conditions and criteria for separating a land area into an independent project in Ben Tre are stipulated in Decision 08/2025/QD-UBND.

- Process of detection and inspection of inaccurate or non-operational electrical measuring devices in Vietnam from February 1, 2025

- Working regime of the Government of Vietnam and each member of the Government of Vietnam from March 1, 2025

- Four principles for determining the scope of basic investigation on renewable energy resources in Vietnam

- Duties and powers of the Government of Vietnam according to the Law on Organization of the Government of Vietnam 2025

SEARCH ARTICLE