Severance allowance is the amount of money an employer pays to an employee after termination as a form of support for the employee who has contributed to the company over a period of time. Below is the latest methods for calculation for severance allowance in Vietnam in the year 2020.

Newest calculation methods for severance allowance in Vietnam in 2020 (Illustrative Image)

Severance Allowance Calculation Method in Vietnam

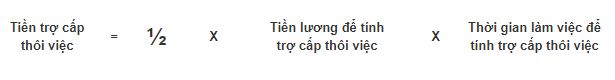

The formula for severance allowance calculation:

In which:

Regarding salary used as the basis for calculating severance allowance:

According to Clause 3, Article 48 of the Labor Code 2012, Article 8 of Circular 47/2015/TT-BLDTBXH, the salary used as the basis for calculating severance allowance is the average salary according to the labor contract of the 06 consecutive months before the employee leaves, specifically:

- The salary level, based on the time-based salary of the job or position according to the wage scale established by the employer in accordance with labor laws and agreed upon by both parties. For employees receiving product-based or project-based wages, the time-based salary used to determine product prices or project wages should be recorded.

- Salary allowances to offset factors about labor conditions, job complexity, living conditions, the degree of labor attraction that are not fully accounted for in the negotiated salary in the labor contract.

- Additional payments that can be specifically quantified along with the negotiated salary in the labor contract and are paid regularly in each wage period.

Regarding time used to calculate severance allowance:

According to Article 48 of the Labor Code 2012, Clause 3, Article 14 of Decree 05/2015/ND-CP, as amended by Clause 5, Article 1 of Decree 148/2018/ND-CP, the working period used to calculate severance allowance and unemployment allowance is the total actual working time of the employee for the employer minus the time the employee participated in unemployment insurance as prescribed by law and the period for which the employer has already paid severance or job-loss allowances (if any). Specifically:

- The actual working time of the employee for the employer includes: time the employee actually worked for the employer according to the labor contract; time spent by the employee being sent for training by the employer; time for enjoying sick leave, maternity leave as prescribed by social insurance law; time off work for treatment and rehabilitation of working capacity due to occupational accidents or diseases where the employer pays salary according to occupational safety and hygiene laws; weekly rest periods, paid leave; time off work to carry out union activities as stipulated by union law; time off work to fulfill civic duties as prescribed by law where the employer pays salary; time off work not due to the employee’s fault; time of being temporarily suspended from work.

- Time the employee participated in unemployment insurance includes: the time the employer contributed to unemployment insurance, the time counted as having contributed to unemployment insurance according to unemployment insurance law, the period during which the employer paid a sum equivalent to the unemployment insurance premiums along with the employee’s wage as prescribed by labor and unemployment insurance law in Vietnam.

- The working period of the employee used to calculate severance allowance is counted by years (full 12 months); in case of odd months, from full 01 month to less than 06 months is counted as 1/2 year; from full 06 months up is counted as 1 year.

Example: Ms. Le Thanh Mai has been continuously working under three labor contracts at Company B:

- Labor contract 01 with a duration of 12 months: From January 1, 2007 – December 31, 2007;

- Labor contract 02 with a duration of 36 months: From January 1, 2008 – December 31, 2010;

- Labor contract 03 with indefinite duration: From January 1, 2011 – December 31, 2018.

Afterward, Ms. Mai unilaterally terminated the labor contract unlawfully. Ms. Mai was contributed by the employer to unemployment insurance continuously from January 1, 2012 – December 31, 2018 (07 years). The average salary before Ms. Mai terminated labor contract 03 was 5,500,000 VND/month.

Thus, the severance allowance for Ms. Mai is calculated as follows:

- Since labor contract 03 (indefinite duration) Ms. Mai unlawfully unilaterally terminated, the time Ms. Mai worked under labor contract 03 (08 years) is not included in the calculation of severance allowance. The working time for the calculation of severance allowance for the previous two contracts is: 01 year + 03 years = 04 years (from January 1, 2007 – December 31, 2010)

- Salary for severance allowance calculation is: 5,500,000 VND

- Thus, the severance allowance Ms. Mai will receive is: 04 years x 5,500,000 VND/month x 1/2 = 11,000,000 VND.

Additionally, the employee in Vietnam should note the specific conditions for receiving severance allowance as follows:

According to Clause 1, Article 48 of the Labor Code 2012, when the labor contract is terminated under one of the following circumstances, the employer is responsible for paying severance allowance to the employee:

- Expiration of the labor contract, except for the case specified in Clause 6, Article 192 of this Code;

- Completion of the work under the labor contract;

- Both parties agree to terminate the labor contract;

- The employee is sentenced to imprisonment, sentenced to the death penalty, or is prohibited from doing the work stated in the labor contract according to the legally effective sentence or decision of the court;

- The employee dies, is declared by the court as lacking legal capacity, missing, or dead;

- The employer, if an individual, dies, is declared by the court as lacking legal capacity, missing, or dead; the employer not being an individual terminates operation;

- The employee lawfully unilaterally terminates the labor contract;

- The employer lawfully unilaterally terminates the labor contract; the employer lays off the employee due to changes in structure, technology, economic reasons, or merges, consolidates, splits, or separates the enterprise, cooperative.

Note: We invite valued customers to also see 04 cases of job termination without severance allowance in Vietnam from January 1, 2021.

Le Vy

- Key word:

- Severance Allowance

- Vietnam

Article table of contents

Article table of contents

.JPG)

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)