Yesterday at noon, on August 2, the National Wage Council finalized the plan to increase the regional minimum wage for 2017 to submit to the Government of Vietnam with a proposed increase of 7.3%, equivalent to 213,000 VND.

Minimum wage is the lowest wage that the Government of Vietnam requires employers to pay workers for performing a certain job under normal conditions, and this wage must be sufficient to meet the minimum living needs of an ordinary family.

Minimum wage includes the general minimum wage (also known as statutory pay rate) and the regional minimum wage. The statutory pay rate corresponds to the wage level 1, used to calculate salaries according to coefficients for officials and public employees, military force, workers in state agencies, and state enterprises. The regional minimum wage applies to workers in enterprises, cooperatives, and households under labor contracts, with wage differences among different regions divided into four zones as stipulated in the annex attached to Decree No. 122/2015/ND-CP dated November 14, 2015, of the Government.

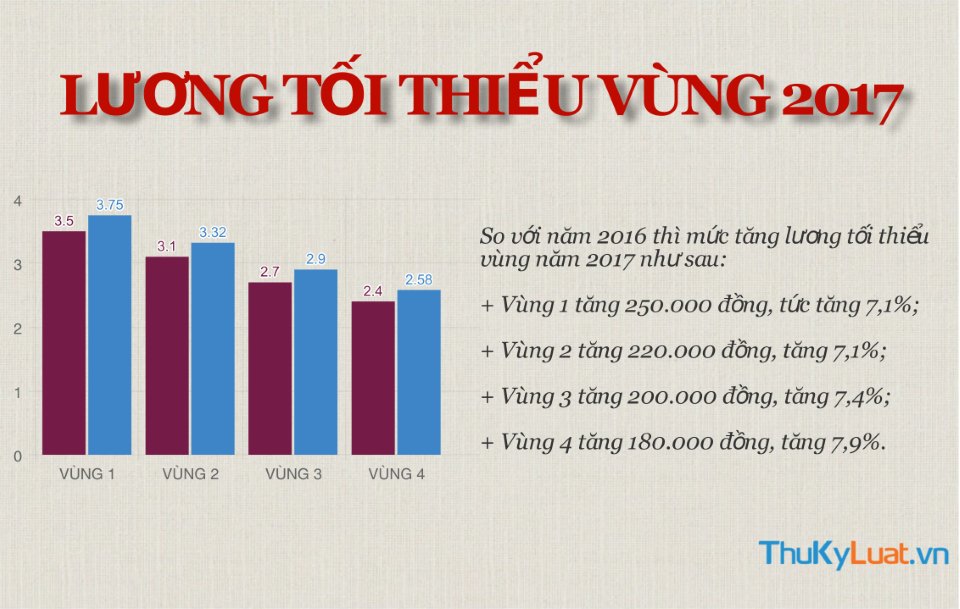

Increase in regional minimum wage by 7.3%

Since 2010, the regional minimum wage has continuously increased, and at the time of each minimum wage increase, businesses face difficulties as each increment in the regional minimum wage imposes significant pressure on their profit margins.

Firstly, an increase in the regional minimum wage will drive up labor costs. This is especially true for the leading sectors in Vietnam, such as textiles, agricultural products, and seafood with a very large workforce, averaging around 2,000 workers per company. Therefore, 250,000 VND/month increase (Region I) will equate to approximately half a billion VND added to the business costs when compared to the previous year.

Additionally, similar to the situation in previous years, rising minimum wages will naturally result in an increase in Social Insurance contributions. Currently, Social Insurance, Health Insurance, and Unemployment Insurance rates are set at 8%, 1.5%, and 1% respectively for employees, while employers contribute at 18%, 3%, 1%, along with an anticipated high increase of 7.1%.

An increase in the regional minimum wage also means increments in union dues (2%), union fees (1%), overtime pay, and night shift pay. Workers earning below the regional minimum wage will be adjusted to meet the standard wage level, causing other workers to receive wage increases as well, which puts further pressure on businesses.

It can be observed that an increase in the regional minimum wage is a positive move for workers, but it also exerts pressure on businesses, directly impacting revenue. For some businesses with marginal revenues, this could lead to bankruptcy. This situation might prompt businesses to evade obligatory insurance and tax payments due to non-profitability, resulting in losses for the state budget and the overall economy. This is a balance that the Government of Vietnam must consider.

In the context of openness and integration, if the regional minimum wage continues to rise significantly, coupled with high salary-based contributions, it will reduce business profitability and decrease direct tax revenue from corporate income tax. While foreign-invested enterprises benefit from preferential policies, Vietnamese enterprises, due to reduced profitability, insufficient capital for production investment, and enhanced quality, might be forced to increase product prices to balance with the invested capital. Consequently, this affects the competitiveness of domestic enterprises, causing them to be overshadowed.

This is also the primary reason why representatives of textile enterprises, in the recent session, voiced opinions against the immediate increase of the regional minimum wage.

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)