What are the regulations on the basis for calculation of maternity benefits upon childbirth in Vietnam in 2023? - Bao Anh (Tien Giang, Vietnam)

According to the Law on Social Insurance 2014, female employees who give birth to a child are entitled to the maternity benefits when meeting the conditions for paying social insurance premiums for a full 06 months or more during the 12 months before giving birth.

In the event that a female employee who has paid social insurance premiums for the full 12 months or more must take a leave of absence to take care of her pregnancy as prescribed by a competent medical examination and treatment establishment, she only needs to satisfy the conditions for paying social insurance premiums for the full 3 months or more during the 12 months before giving birth to be entitled to the maternity leave as prescribed.

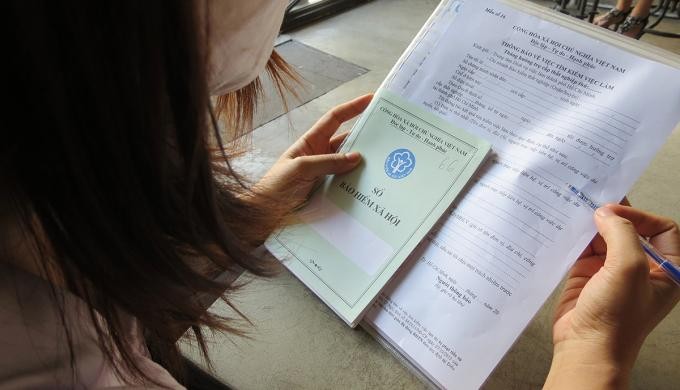

Basis for calculation of maternity benefits upon childbirth in Vietnam 2023 (Internet image)

Basis for calculation of maternity benefits upon childbirth in Vietnam

Maternity benefits for female employees upon childbirth will be calculated according to the following formula:

Benefit level = T x Mbqtl

In there:

(i) T is the leave period for childbirth (in months):

According to the provisions of Clause 1, Article 34 of the Law on Social Insurance 2014, female employees are entitled to a 6-month leave before and after childbirth under the maternity benefits.

For a female employee who gives birth to twins or more infants, she is entitled to an additional leave of 1 month for each infant from the second.

For example:

- If female employees give birth to 1 child, then T = 6 months

- If female employees have twins, then T = 7 months

- Female laborers have 3 stroke T - 8 months

(ii) Mbqtl is average monthly salary paid for social insurance as a basis for entitlement to meternity leave:

According to the provisions of Article 12 of Circular 59/2015/TT-BLDTBXH, the average monthly salary paid for social insurance as a basis for entitlement to meternity leave is the average monthly salary paid for social insurance of the last 06 months before leave taking. If the time of social insurance payment is not consecutive, it shall be accrued.

Where the female employees work until the time of birth giving and the month of birth giving or child adoption is included in the period of 12 months prior to birth giving or child adoption, the Average monthly salary paid for social insurance of the last 06 months before taking leave, including the month of birth giving or child adoption.

Ex: Ms gives a birth on 16/3/2016 and has a period of time of social assurance payment as follows:

- From 10/2015 to 01/2016 (4 months): paying the social insurance on salary of 5,000,000 dong/ month;

- From 02/2016 to 3/2016 (2 months): paying the social insurance on salary of 6,500,000 dong/ month;

The average monthly salary paid for social insurance of the last 06 months before Ms C takes leave is calculated as follows:

Average monthly salary paid for social insurance of the last 06 months prior to leaving taking = [(6,000,000 x 4) + (7,500,000 x 2)] / 6 = 6,500,000 VND

Therefore, the average monthly salary paid for social insurance of the last 06 months prior to leaving taking as a basis for calculation of Ms C's is 5,500,000/month

As a result, the maternity allowance of expenditure A is calculated at 6,500,000 VND/month x 6 months = 39,000,000 VND.

Lump-sum allowance upon childbirth in Vietnam

In addition, according to the provisions of Article 38 of the Law on Social Insurance 2014, female employees giving birth or employees adopting an under-6-month child are entitled to a lump-sum allowance equaling 2 times the statutory pay rate for each child in the month of childbirth or child adoption.

In case the mother gives birth to a child but only the father is covered by social insurance, the father is entitled to a lump-sum allowance equaling 2 times the statutory pay rate for each child in the month of childbirth.

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)