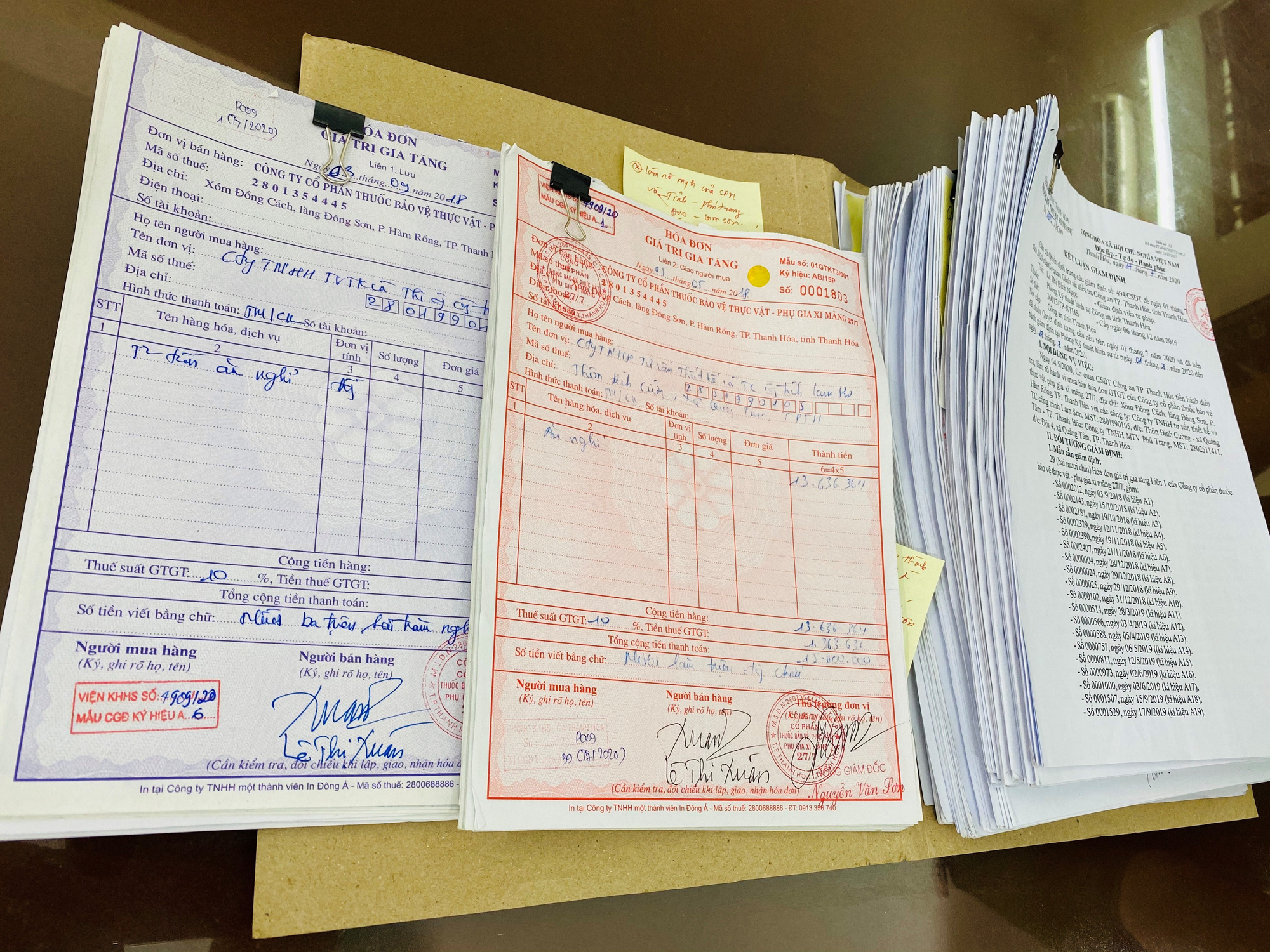

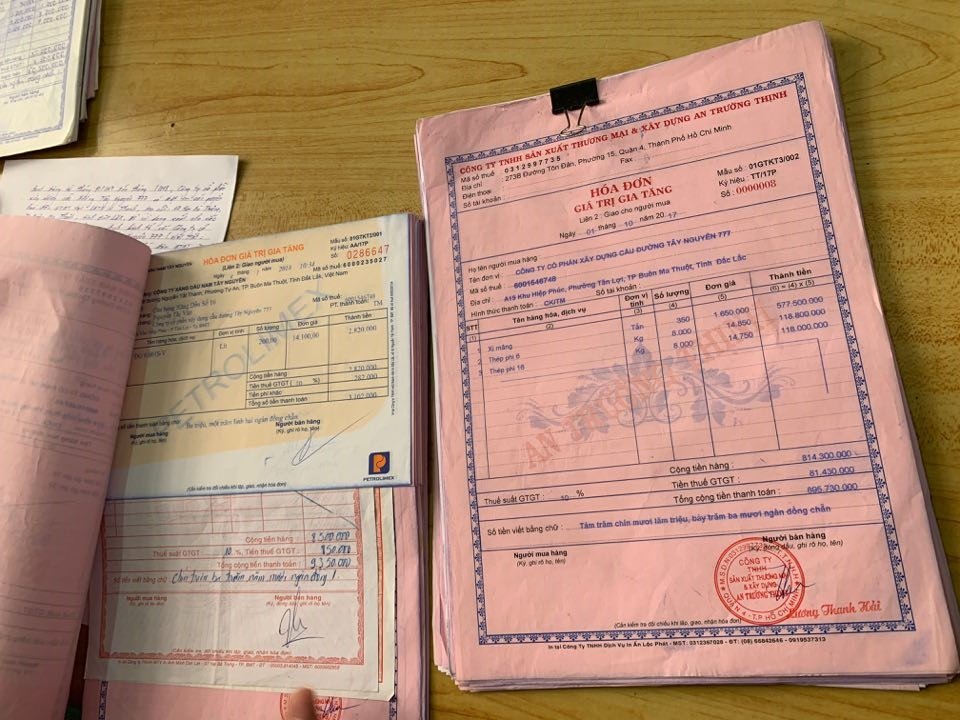

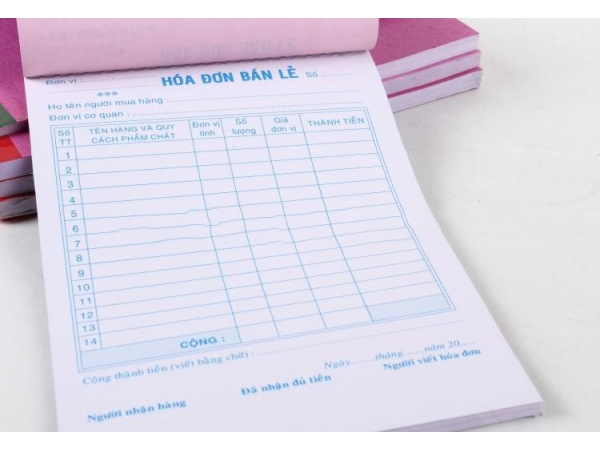

invoices

-

- Do foreign invoices have to be translated into Vietnamese?

- 15:35, 16/10/2023

- Do foreign invoices have to be translated into Vietnamese? Will you be fined for failure to translate accounting records in foreign language to Vietnamese? - Thanh Thuong (Nghe An)

-

- Vietnam: Summary of 19 violations against regulations on externally printed invoices printing of externally ordered invoices and release of invoices

- 09:30, 24/10/2020

- Recently, the Government of Vietnam has issued the Decree No. 125/2020/NĐ-CP regulating administrative penalties for tax or invoice-related violations.

-

- Summary of penalties for invoice-related violations applied in Vietnam from December 05, 2020

- 08:50, 24/10/2020

- Recently, the Government of Vietnam has issued the Decree No. 125/2020/NĐ-CP regulating administrative penalties for tax or invoice-related violations. This Decree has specified provisions on common invoice-related violations, applied in Vietnam from December 05, 2020.

-

- Vietnam: New fines for causing the loss, burning, cancellation, destruction or elimination of invoices will apply from December 05, 2020

- 15:30, 21/10/2020

- This is a notable content of Decree No. 125/2020/NĐ-CP prescribing administrative penalties for tax or invoice-related violations issued by the Government of Vietnam on October 19, 2020. According to this Decree, new fines for causing the loss, burning, cancellation, destruction or elimination of invoices will apply from December 05, 2020.

-

- Vietnam: New procedure for sale and issue of separate invoice at Sub-departments of Taxation

- 14:10, 26/04/2018

- Recently, the General Department of Taxation of Vietnam issued Decision No. 829/QD-TCT promulgating procedure for sale and issue of separate invoices.

Most view

SEARCH ARTICLE