Decision 15/2020/QD-TTg stipulating the implementation of policies to support people facing difficulties due to the Covid-19 pandemic has just been signed and issued by the Prime Minister of the Government of Vietnam on April 24, 2020.

![]()

Illustrative photo

This Decision specifies the conditions, dossiers, procedures, and formalities for household businesses to receive support money according to Resolution 42/NQ-CP as follows:

Support Conditions:

- Revenue managed by the tax authority for household businesses in 2020 is less than VND 100 million, determined as of January 15, 2020, in accordance with tax management laws.

- Temporarily suspending business from April 1, 2020, according to the Decision of the Chairman of the Provincial People's Committee implementing Directive 15/CT-TTg dated March 27, 2020, of the Prime Minister of the Government of Vietnam.

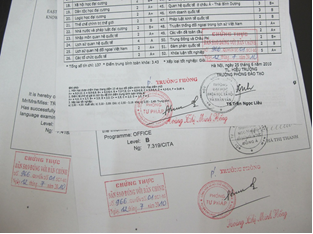

Application Dossier: According to the Appendix attached to this Decision, send it to the Commune People's Committee. Details of the Support Request Form are as follows:

.png)

Photo of a part of the Support Request Form for household businesses

Support Request Form (For household businesses with tax-reported revenue under VND 100 million/year)

Support Request Form (For household businesses with tax-reported revenue under VND 100 million/year)

Procedures and Formalities:

- Within 05 days, the Commune People's Committee confirms the business suspension of the household businesses; publicly posts the information; aggregates and reports to the Tax Sub-Department.

- Within 02 working days, the Tax Sub-Department, in cooperation with related agencies, appraises and submits aggregated reports to the District People's Committee.

- Within 03 days, the District People's Committee reviews, consolidates, and submits to the Chairman of the Provincial People's Committee.

- Within 02 working days, the Chairman of the Provincial People's Committee issues a decision approving the list and support funds; simultaneously directs the implementation of the support. In case of non-support, the Chairman of the Provincial People's Committee provides a written notification stating the reason.

See more details in: Decision 15/2020/QD-TTg which takes effect from April 24, 2020.

Nguyen Trinh

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)