If the car owner is late in notifying the insurance company about the accident, will his/her benefits be affected in Vietnam? This is a question LAWNET has received a lot recently from customers and members.

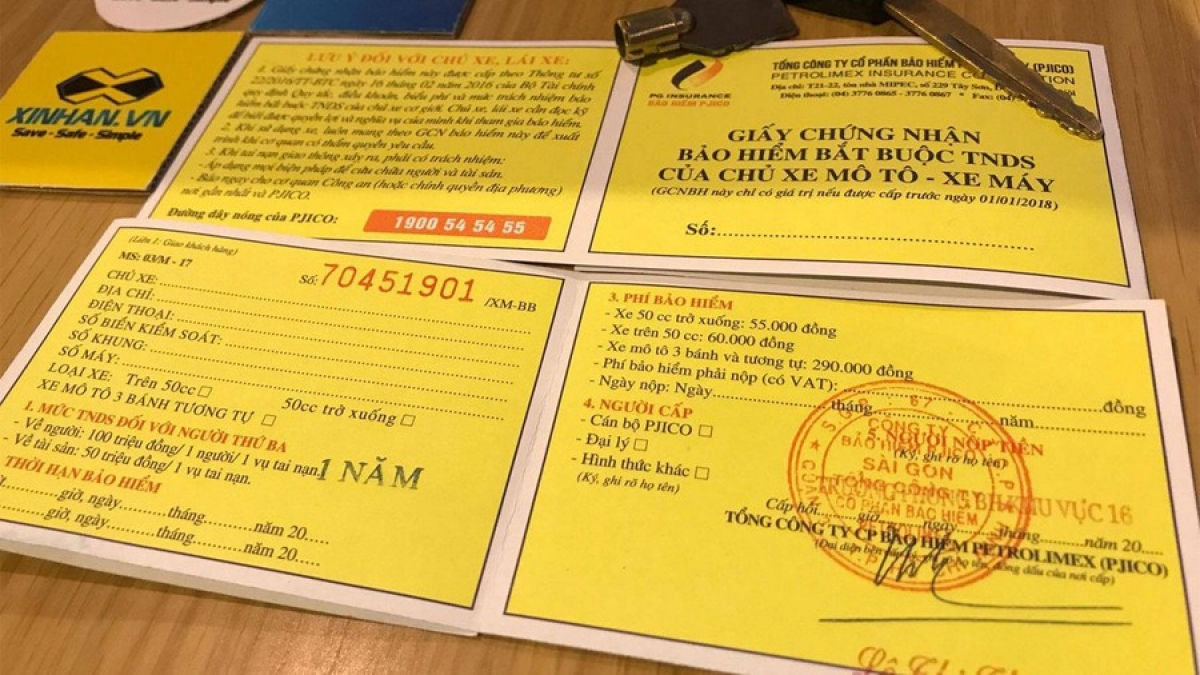

Vietnam: Insurers' right to reduce compensation if the car owner reports accident late(Artwork).

Regarding this issue, LAWNET would like to answer as follows:

Up to now, the car owner's delay in reporting the accident to the insurance company has not affected any benefits. However, from March 1, 2021, this will be a big problem for car owners if they are slow to notify the insurance company when the car causes an accident to a third party or its passengers, according to the provisions of Vietnam's Decree 03/2021/ND-CP on compulsory insurance for the civil liability of motor vehicle owners, effective from March 1, 2021.

1. New regulations on insurance claims

If accidents within insurance liabilities occur, insurance enterprises must reimburse insurance beneficiaries for the payment that has been made or will be made to the accident victims by the insurance beneficiaries.

Specific compensation for health and lives is determined for each type of injury and casualty under Schedule for health and life compensation under Annex I attached to Vietnam's Decree 03/2021/ND-CP or according to agreement (if any) between insurance beneficiaries and victims or victims’ heirs (in case the victims have deceased) or victims’ representatives (in case the victims lack legal capacity according to judicial decisions or are under 16 years of age) but must not exceed the amount specified under Annex I.

In case of accidents which are entirely caused by third party as determined by competent authorities, health and life insurance for the third party shall equal 50% of the amount specified under Annex I attached to Vietnam's Decree 03/2021/ND-CP or agreement (if any) between insurance beneficiaries or victims’ heirs (in case victims have deceased) or victims’ representatives (in case victims lack legal capacity according to judicial decisions or are under 16 years of age) but must not exceed 50% of the amount specified under Annex I attached to Vietnam's Decree 03/2021/ND-CP.

Insurance enterprises are not obliged to pay for the excess insurance liabilities according to Ministry of Finance except for cases in which motor vehicle users participate in voluntary insurance contracts.

2. Rights of insurance enterprises when paying insurance

According to the provisions of Clause 2, Article 19 of Vietnam' Decree No. 03/2021/ND-CP, insurance enterprises have the right to:

Reduce up to 5% of property damage claims in case insurance buyers or insurance beneficiaries fail to notify insurance enterprises about accidents according to Clause 2 Article 16 of this Decree or fail to notify in case of changes to factors which serve as the basis for calculating insurance premiums thereby increasing insured risks after insured events have occurred.

According to Clause 2, Article 16 of Vietnam's Decree 03/2021/ND-CP stipulates the time limit for vehicle owners to notify accidents, specifically as follows:

Within 5 working days from the date on which accidents occur (except for force majeure), insurance buyers or insurance beneficiaries must send notice of accidents in writing or electronically to insurance enterprises.

Thus, if the car owner fails to notify the insurer about the accident or is late in notifying (more than 5 working days from the date of the accident), the insurer has the right to deduct up to 5% of the damage compensation amount. This is a new right of insurance enterprises from March 1, 2021, according to the provisions of Decree 03/2021/ND-CP. At the same time, the car owner only needs to notify the insurance company by sending it in writing or via electronic form; there is no need to submit documents proving the damage as currently prescribed (After 5 days from the date of the accident, it is still possible to add supporting documents later). This new regulation helps to ensure the right of third parties to receive timely compensation as well as ensure accuracy in determining the compensation level, thereby avoiding errors when prolonging the insurance payment.

Hai Thanh

- Key word:

- Decree 03/2021/ND-CP of Vietnam

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)