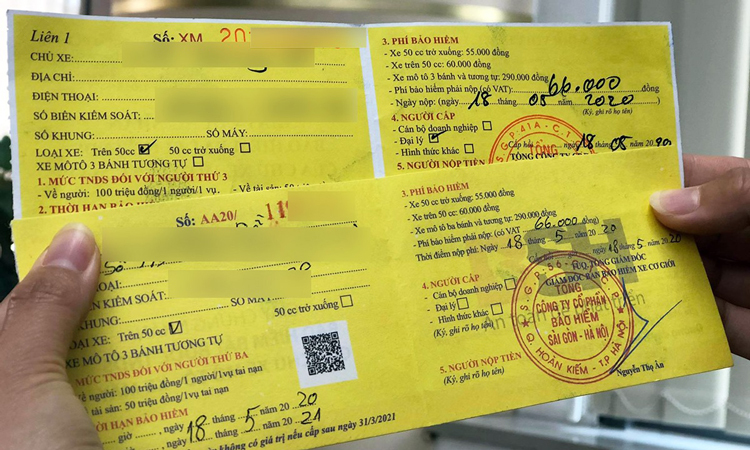

This is a notable content specified in Decree No. 103/2008/NĐ-CP of Vietnam’s Government on compulsory insurance for civil liability of motor vehicle owners.

Specifically, according to Clause 3 Article 3 of Decree No. 103/2008/NĐ-CP of Vietnam’s Government, “motor vehicle means an automobile, tractor, construction vehicle or machine, agricultural or forestry vehicle or machine or a special-type vehicle, which is used for security or defense purpose (including trailers and semi-trailers pulled by automobiles or tractors), two-wheeled motorcycle, three-wheeled motorcycle, motorbike or a similar motor vehicle (including motor vehicles for disabled people) which runs on road”.

Decree No. 103/2008/NĐ-CP specifies principles for insurance participation as follows:

- Motor vehicle owners shall participate in compulsory insurance for their civil liability under this Decree and in accordance with the rules, terms and table of premium rates of compulsory insurance for civil liability of motor vehicle owners set out by the Ministry of Finance.

- A motor vehicle owner may not concurrently enter into two or more policies of compulsory insurance for civil liability for the same motor vehicle.

- Apart from entering into policies of compulsory insurance for civil liability, motor vehicle owners may also reach agreement with insurance enterprises on entry into voluntary insurance policies.

- Insurance enterprises may take the initiative in selling compulsory insurance for civil liability of motor vehicle owners by the following modes:

+ Direct sale to motor vehicle owners;

+ Through insurance agents or brokers:

+ Through bidding;

+ By other modes in accordance with law.

In case of sale of compulsory insurance for civil liability of motor vehicle owners through insurance agents, these insurance agents must satisfy the criteria specified in the Law on Insurance Business of Vietnam, guiding documents and relevant legal provisions.

Insurance enterprises may not use other insurance enterprises agents for sale of insurance for civil liability of motor vehicle owners, unless those enterprises so consent in writing.

Currently, the widespread sale of motorbike insurance is a difficult problem, which is why the Department of Insurance Management and Supervision recently issued Official Dispatch No. 189/QLBH-PNT on selling compulsory insurance for civil liability of motor vehicle owners, which clearly states:

In case of violations by insurance enterprises, depending on the severity, the Department of Insurance Management will consider and sanction administrative violations according to regulations of Decree No. 103/2008/NĐ-CP dated September 16, 2008 of Vietnam’s Government on compulsory insurance for civil liability of motor vehicle owners, Decree No. 98/2013/NĐ-CP dated August 28, 2013 of Vietnam’s Government providing for the sanctioning of administrative violations in domains of insurance business and lottery business and Decree No. 48/2018/NĐ-CP dated March 21, 2018 of Vietnam’s Government on amendments to Decree No. 98/2013/NĐ-CP dated August 28, 2013 of Vietnam’s Government providing for the sanctioning of administrative violations in domains of insurance business and lottery business.

Thus, motor vehicle owners and insurance companies must follow the principles of compulsory civil liability insurance according to the above regulations to avoid being handled for violations.

Le Hai

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)