Motorcycle insurance is one of the documents that motorcycle owners must have when participating in traffic. When participating in motorcycle insurance, motor vehicle owners should pay attention to the following 04 contents.

1. 02 types of motorcycle insurance

According to Article 4 of the Circular No. 22/2016/TT-BTC of the Ministry of Finance of Vietnam, motor vehicle owners traveling on road within the territory of Vietnam shall buy compulsory insurance. Concurrently, a motor vehicle owner must not enter into more than one compulsory civil liability insurance contract for the same motor vehicle.

Besides compulsory insurance contract, motor vehicle owners may enter into voluntary insurance contracts.

Thus, according to the above provision, there are 02 types of motorcycle insurance, which are compulsory insurance and voluntary insurance. Besides compulsory insurance contract, motor vehicle owners may enter into voluntary insurance contracts. Insurers are allowed to provide the compulsory insurances for motor vehicles owners through the following methods:

- Directly;

- Via insurance agents or insurance brokers;

- Other forms or shapes in accordance with provisions of laws.

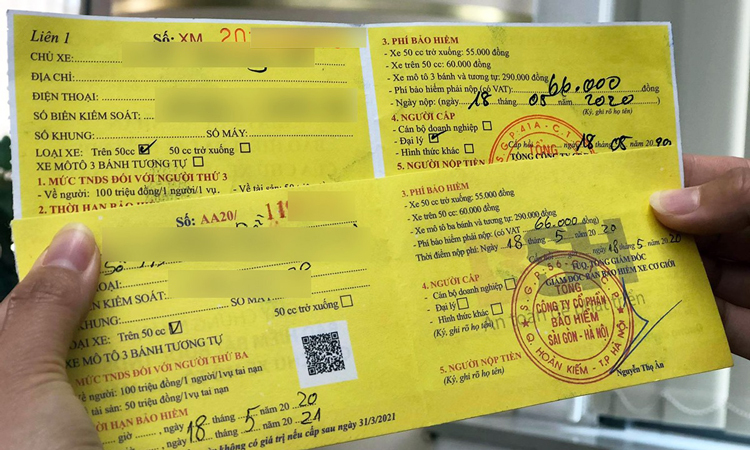

2. Premiums

According to Article 8 of the Circular No. 22/2016/TT-BTC of the Ministry of Finance of Vietnam, premiums are as follows:

- Motorbike not exceeding 50cc: VND 55,000.

- Motorbike exceeding 50cc: VND 65,000.

- With regard to motor vehicles that are permitted to have under-one-year compulsory insurances, premiums are specifically calculated as follow:

Note: In case of the duration of maximum 30 days, the premium shall equal the annual premium by type of motor vehicle divided by 12.

Besides, it should be noted that the expiration of the Certificate of Compulsory Insurance shall be 01 year (according to Article 7 of the Circular No. 22/2016/TT-BTC). However, in some cases, the expiration of Certificate of Compulsory Insurance may be less than 01 year.

3. Limits of liability and indemnity in the event of an accident

Specifically, according to Article 9 of the Circular No. 22/2016/TT-BTC of the Ministry of Finance of Vietnam, the limit of liability means the maximum amount of money that the insurer pay for deaths, bodily injuries or property damage to the third party and passengers for each undesirable occurrence by motor vehicles covered by compulsory insurance. To be specific:

- A death as a result of motor vehicle accidents shall be indemnified at the rate of 100 million dong per person per occurrence.

- Property damage by two-wheelers, tricycle, motorbikes and the like (including vehicles for the disabled) shall be indemnified at the rate of 50 million dong per occurrence.

- Property damage by cars, tractor, construction vehicles, and vehicles for agricultural or forestry uses and other types of military vehicles for the use of national security and defense (including trailers and semi-trailers pulled by motor cars or tractors) shall be indemnified at the rate of 100 million dong per occurrence.

Thus, according to the above provisions, the maximum amount of money that the insurer pays to the third party in each accident are 100 million dong per person per occurrence for human damage and 50 million dong per occurrence for property damage. Indemnities for each type of injuries area specified in the schedule of indemnities for injuries presented in the Annex 06 hereof or may be negotiable (if any) by vehicle owners and damaged people or the legal representative of victims (if the victim died) but shall not exceed the prescribed indemnities.

4. Occurrences not covered by compulsory insurances

According to Article 12 of the Circular No. 22/2016/TT-BTC of the Ministry of Finance of Vietnam, insurers shall not be liable for any damage incurred in the 07 following cases:

- The vehicle owner, driver or victim intentionally causes damage to his/herself.

- The driver or vehicle owner deliberately runs away from his/her civil liability after the traffic accident.

- The driver does not obtain a driving license or obtain the inappropriate driving license. Where the driver whose driving license is temporarily or permanently withdrawn shall be considered as driving without a driving license.

- Traffic accidents results in indirect consequences: decreases in commercial value, or losses associated with the use of damaged property.

- Property is stolen or robbed in the traffic accident.

- Wars, terrorism attacks or earthquakes occur.

- Loss or damage of special property includes: gold, silver, and gemstones, valuable papers such as money, antiques, valuable paintings or pictures, dead bodies or corpses.

Ty Na

- Key word:

- Circular No. 22/2016/TT-BTC

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)