On January 15, 2021, the Government of Vietnam issued the Decree No. 03/2021/NĐ-CP compulsory civil liability insurance of motor vehicle users with many new notable points.

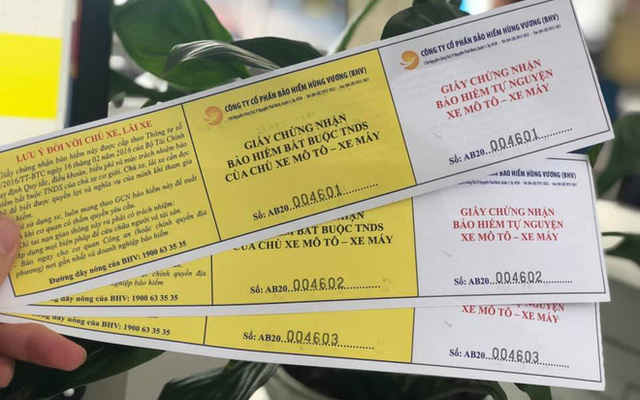

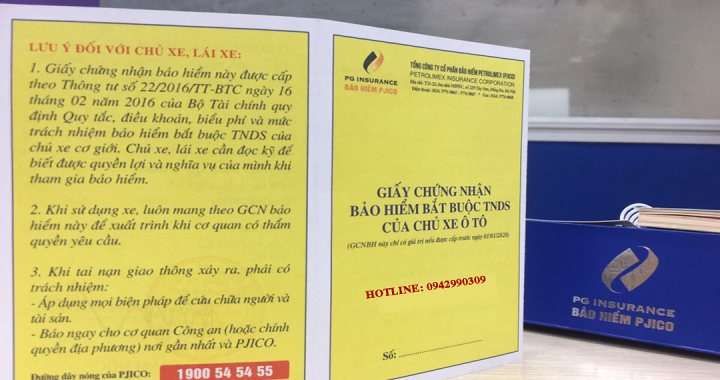

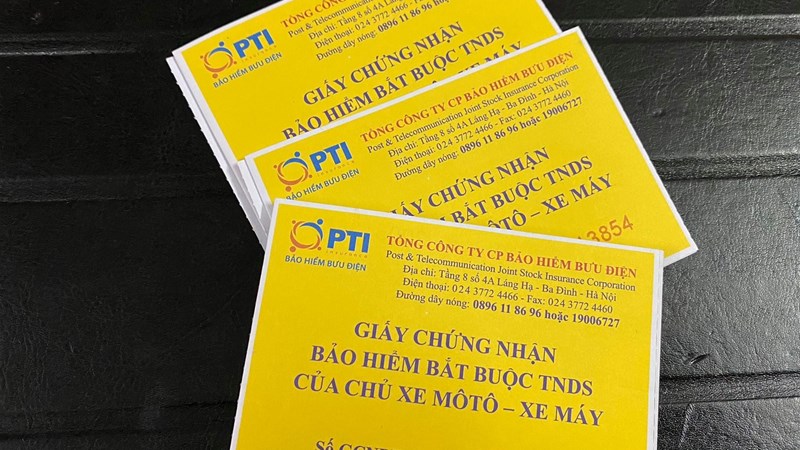

1. Issuance of Electronic certificates of insurance

Certificates of compulsory civil liability insurance of motor vehicle users are proof of concluding compulsory civil liability insurance contracts between motor vehicle users and insurance enterprises. Each motor vehicle shall be issued with 1 certificate of insurance.

Decree No. 03/2021/NĐ-CP stipulates that in case of issuance of electronic certificates of insurance, insurance enterprises must comply with Law on Electronic Transactions and guiding documents; Electronic certificates of insurance must closely comply with applicable regulations and law and Clause 3 Article 6 of the Decree No. 03/2021/NĐ-CP, which include following details:

- Name, address and phone number (if any) of motor vehicle users.

- License plate or chassis number, engine number.

- Type of vehicle, payload, number of seats and use purpose in case of automobiles.

- Name, address and hotline number of insurance enterprises.

- Civil insurance liabilities for third party and passengers.

- Responsibilities of motor vehicle users and operators in case of accidents.

- Insurance duration, insurance premiums and payment deadline of insurance premiums.

- Date of issue of certificates of insurance.

- Number code and barcode registered, managed and used according to the Ministry of Science and Technology of Vietnam to enable storage, transmission and extraction of ID information of insurance enterprises and basic contents of certificates of insurance.

Electronic certificates of insurance is a completely new content specified in the Decree No. 03/2021/NĐ-CP that currently Decree No. 103/2008/ND-CP and Decree No. 214/2013/ND-CP do not mention.

2. Up to 15% premium increase

Insurance premiums refer to payment made by motor vehicle users to insurance enterprises when purchasing compulsory civil liability insurance of motor vehicle users. Pursuant to Clause 3 Article 7 of the Decree No. 03/2021/NĐ-CP on insurance premiums and payment thereof:

3. Based on accident records of each motor vehicle and insurance enterprises’ risk tolerance capacity, insurance enterprises shall consider and increase insurance premiums. Insurance premiums can be increased by up to 15% of insurance premiums prescribed by Ministry of Finance.

The Ministry of Finance of Vietnam shall prescribe insurance premiums on the basis of statistical figures to ensure payment capacity of insurance enterprises corresponding to insurance requirements, insurance liabilities and level of risks by type of motor vehicles and use purposes.

Insurance liability is prescribed as following:

- Insurance liability refers to the maximum payment potentially made by insurance enterprises for damage to health, lives and assets of third party and passengers done by motor vehicles in accidents within scope of compensation.

- Based on practical costs for medical examination, treatment and care services and asset damages, Ministry of Finance shall prescribe liabilities of compulsory civil liability insurance of motor vehicle users.

3. The maximum insurance duration for mopeds is 3 years

Pursuant to Article 9 of the Decree No. 03/2021/NĐ-CP, insurance duration is specified on certificates of insurance, to be specific:

- For motorcycles, motorized tricycles, mopeds (including electric mopeds) and similar vehicles according to Law on Road Traffic, the minimum insurance duration is 1 year and the maximum insurance duration is 3 years.

- For remaining motor vehicles, the minimum insurance duration is 1 year and the maximum insurance duration shall conform to a valid period of periodic technical safety and environmental protection inspection which has more than 1 year of valid period.

- For following cases, insurance duration shall be less than 1 year: Foreign motor vehicles which temporarily import for re-export participate in traffic within Socialist Republic of Vietnam territory for less than 1 year; service life of motor vehicles is less than 1 year as per the law; temporarily registered motor vehicles according to regulations of Ministry of Public Security of Vietnam.

Insurance effect shall start and end according to the duration specified on certificates of insurance.

Note: In case shift in ownership of motor vehicles takes place within the duration specified on certificates of insurance, all insurance benefits related to civil responsibilities of the former motor vehicle users shall remain valid for the new motor vehicle users.

4. 8 cases of insurance exclusion

Pursuant to Article 13 of the Decree No. 03/2021/NĐ-CP, insurance enterprises shall not compensate for following cases:

(1) Damage done intentionally by motor vehicle users, motor vehicle operators or victims of the accidents.

(2) Vehicle operators intentionally fleeing the scene after committing accidents without exercising civil responsibilities of motor vehicle users. Vehicle operators intentionally fleeing the scene after committing accidents and exercising civil responsibilities of motor vehicle users shall not be included under insurance exclusion.

(3) Operators who are not within adequate age range to operate motor vehicles as per road traffic laws; operators who do not carry legitimate, proper driving license (driving license with template number at the back inconsistent with the latest template number in information system for managing driving license) issued by competent authorities at the time of accidents or carry inappropriate driving license when operating motor vehicles which require specific driving license. In case driving license of operators are revoked or suspended, the operators are considered to be not carrying driving license.

(4) Damage that causes indirect consequences including: reduced commercial value, damage related to use and utilization of damaged assets.

(5) Damage to assets caused by operators who have alcohol in breath or blood, or use narcotics or other prohibited stimulants as per the law.

(6) Damage to assets which are lost or stolen as a result of the accidents.

(7) Damage to special assets including: gold, silver, precious stones, financial instruments namely money, antiques, precious fine arts, and cadavers.

(8) War, acts of terrorism, earthquake.

Thus, from March 01, 2021, there are more cases that motorcycles and mopeds shall not receive compensation from insurance enterprises.

5. Quy định rõ việc tạm ứng bồi thường cho người mua bảo hiểm

Currently, according to Decree No. 103/2008/NĐ-CP, when necessary, insurance enterprises shall promptly advance necessary and reasonable expenses within the scope of insurance liability to remedy accident consequences.

However, from March 01, 2021, the advance payment for insurance buyers is regulated in more detail. According to the Decree No. 03/2021/NĐ-CP, within 3 working days after being notified by insurance buyers or insurance beneficiaries about accidents, insurance enterprises must pay advance compensation for damage to health and lives, to be specific:

**In case accidents have been identified to be within scope of compensation:

- 70% of insurance claims as per the law/person/case in case of fatalities.

- 50% of insurance claims as per the law/person/case in case of bodily injuries receiving emergency medical treatment.

**In case accidents have not been identified to be within scope of compensation:

- 30% of insurance liabilities as per the law/person/case in case of fatalities.

- 10% of insurance liabilities as per the law/person/case in case of bodily injuries receiving emergency medical treatment.

Above are 05 notable regulations on compulsory insurance for civil liability of motor vehicle owners that will officially take effect from March 1, 2021.

Thuy Tram

- Key word:

- Decree No. 03/2021/NĐ-CP

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)