What are the eligibility criteria to be satisfied by e-invoice service providers to enter into contracts for provision of authenticated e-invoice services, e-invoice data receipt, transmission and storage services, and other relevant services in Vietnam?

Criteria for organizations providing authenticated and unauthenticated e-invoice solutions for sellers and buyers in Vietnam

(1) Entity:

- It is an IT organization established under the law of Vietnam;

- Information about e-invoice services is published on its website;

(2) Personnel: There are at least 5 employees possessing bachelor’s degree in IT;

(3) Technology: There are IT infrastructure and equipment, and software system meeting the following requirements:

- They are adequate to provide solutions for creating, handling and storing data on authenticated and unauthenticated e-invoices for sellers and buyers as prescribed by the Law on e-invoices and relevant laws;

- There are solutions for receiving and transmitting e-invoice data from and to service users; solutions for transmitting and receiving e-invoice data to and from tax authorities through the e-invoice data receipt, transmission and storage service provider. Information about data receipt and transmission must be fully recorded to serve verification purposes;

- There are solutions for backup, recovery and protection of confidentiality of e-invoice data;

- There are records of successful technical testing on solutions for transmission and receipt of e-invoice data with the e-invoice data receipt, transmission and storage service provider.

Pursuant to: Clause 1, Article 10 of Circular 78/2021/TT-BTC

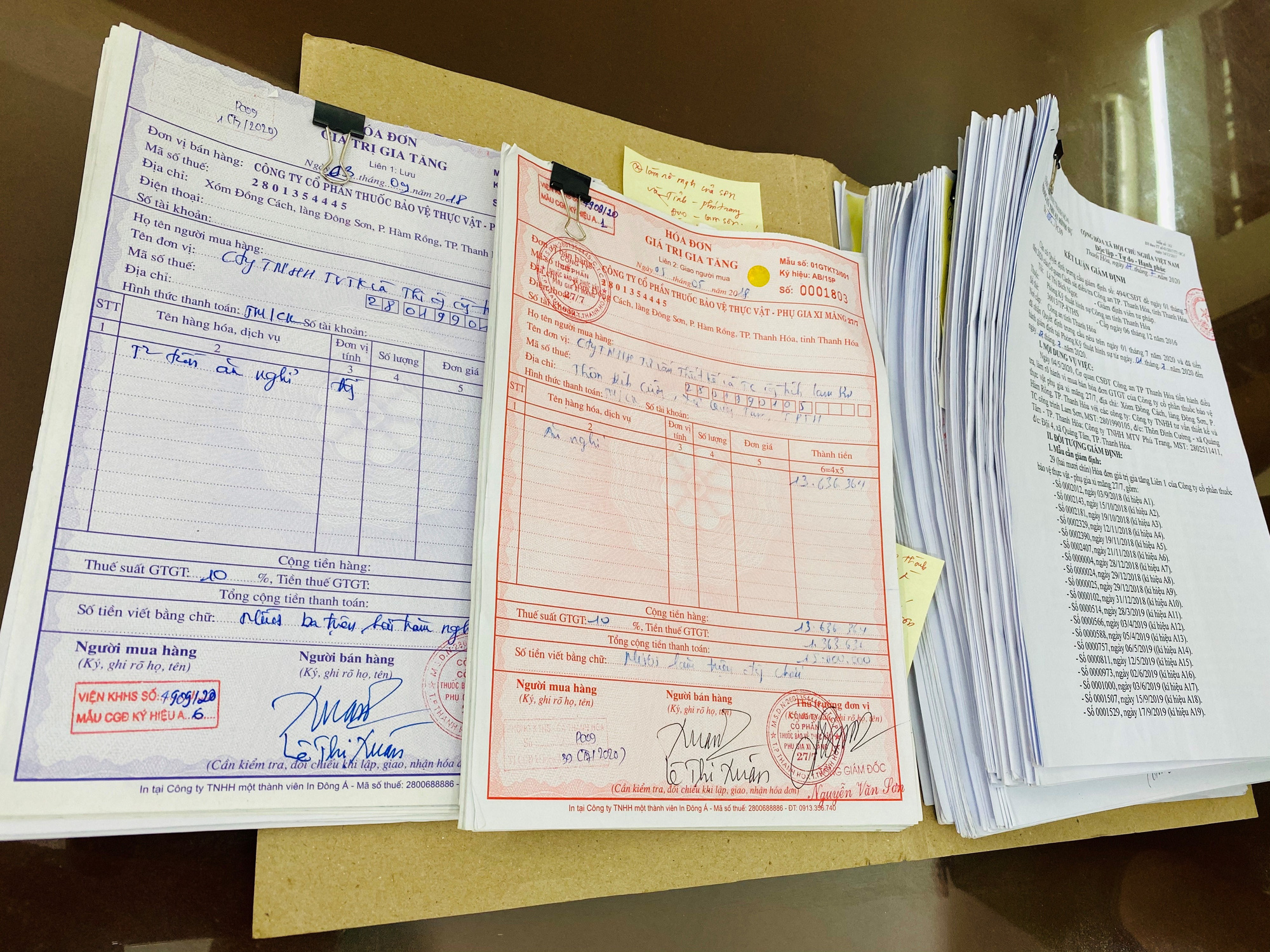

Eligibility criteria to be satisfied by e-invoice service providers in Vietnam (Internet image)

Criteria for e-invoice data receipt, transmission and storage service provider in Vietnam

(i) Entity:

- It is an IT organization established under the law of Vietnam, and has been operating in the IT field for at least 05 years;

- Information about e-invoice services is published on its website;

(ii) Finance: t has paid a deposit at a bank lawfully operating in Vietnam or has obtained a guarantee of not less than VND 5 billion from a bank lawfully operating in Vietnam to manage risks and make compensation for any damage that may occur during the service provision;

(iii) Personnel: There are at least 20 employees possessing bachelor’s degree in IT;

(iv) Technology: There are IT infrastructure and equipment, and software system meeting the following requirements:

- They are adequate to provide solutions for creating, handling and storing data on authenticated e-invoices in accordance with the Law on e-invoices and relevant laws;

- There are solutions for connecting, receiving, transmitting and storing e-invoice data with organizations providing authenticated and unauthenticated e-invoice services for sellers and buyers; solutions for connecting, receiving, transmitting and storing e-invoice data with tax authorities. Information about data receipt and transmission must be fully recorded to serve verification purposes;

- The technical infrastructure system used for providing e-invoice services is operated on both the main data center and backup center. The backup center is located at least 20 km away from the main data center and is ready for use when the main data center encounters problem;

- The system must be capable of detecting, giving warning and preventing illegal access and cyberattacks to ensure the confidentiality and integrity of data exchanged between parties;

- The system for backing up and recovering data must be available;

- It is connected to the General Department of Taxation through a separate channel or MPLS VPN of Layer 3 or equivalent, which consists of 1 main channel and 2 backup channels. Each channel has a minimum bandwidth of 20 Mbps; use an encrypted Web Service or Message Queue (MQ) for connection; use SOAP/TCP to compile, transmit and receive data.

Pursuant to: Clause 2, Article 10 of Circular 78/2021/TT-BTC

Mai Thanh Loi

- Key word:

- e-invoice

- in Vietnam

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)