To easily support domestic businesses, Decree No. 39/2018/NĐ-CP of Vietnam’s Government has classified small and medium enterprises by size including microenterprises, small enterprises and medium-sized enterprises based on the following factors:

DOWNLOAD The self-declaration of microenterprise, small enterprise or medium-sized enterprise

1. Operating sectors (Article 7 of Decree No. 39/2018/NĐ-CP of Vietnam’s Government)

Operating sectors of SMEs shall be determined in accordance with regulations and laws on economic sector system and special law. (Decision No. 27/2018/QĐ-TTg)

If a SME operates in multiple fields, its business lines shall be determined in the sector that it earns the highest revenue. If the sector in which the highest revenue is unidentifiable, its business lines shall be determined in the sector that it employs the most workers.

2. Total capital of SMEs (Article 9 of Decree No. 39/2018/NĐ-CP of Vietnam’s Government)

Total capital being determined in the balance sheet on the financial statement of the preceding year which the enterprise submits to the tax authority.

If the enterprise has operated for less than 1 year, total capital shall be determined in its balance sheet at the end of the quarter close to the time that the enterprise applies for support.

3. Total revenue of SMEs (Article 10 of Decree No. 39/2018/NĐ-CP of Vietnam’s Government)

Total annual revenue means total revenue from goods sold and services rendered, being determined in the financial statement of preceding year which the enterprise submits to the tax authority.

If the enterprise has operated for less than 1 year or over 1 year but has not generated revenue, the enterprise is determined whether a SME according to criteria for total capital prescribed in Article 9 of this Decree.

According to Article 6 of Decree No. 39/2018/NĐ-CP of Vietnam’s Government, LawNet would like to summarize criteria for Customers to easily distinguish and determine what size your business belongs to according to the following table:

An enterprise, deemed as a SME, shall self-assess and declare that it qualifies as a microenterprise, small enterprise, or medium-sized enterprise using the form in Appendix issued with Decree No. 39/2018/NĐ-CP and submit it to the SME supporting body. The SME shall take legal responsibility for its declaration.

Download the form on Self-declaration of microenterprise, small enterprise or medium-sized enterprise HERE.

Hai Thanh

- Key word:

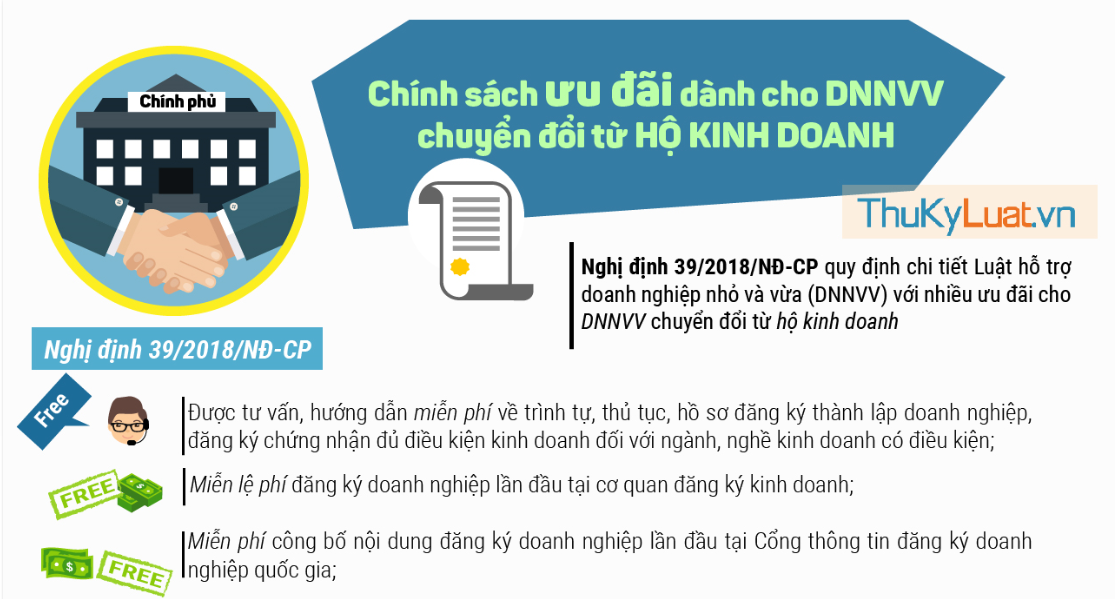

- Decree No. 39/2018/NĐ-CP

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)