Decree No. 41/2018/NĐ-CP

-

- Vietnam: How are fines for enterprises for making improper financial statements?

- 18:02, 04/09/2020

- According to Vietnam’s regulations, enterprises are responsible for making periodical financial statements. The implementation period is not to exceed 90 days from the end of the fiscal year. In case enterprises do not comply with regulations, they will be penalized as follows:

-

- Vietnam: Penalties for forging or providing false information in accounting records

- 14:35, 10/06/2020

- How are penalties for forging or providing false information in accounting records according to current Vietnam’s regulations? Shall the violating entity be sentenced to imprisonment? These are questions that Mr. Nguyen Ngoc Linh in Ho Chi Minh City sent to LAWNET for advice on June 01, 2020.

-

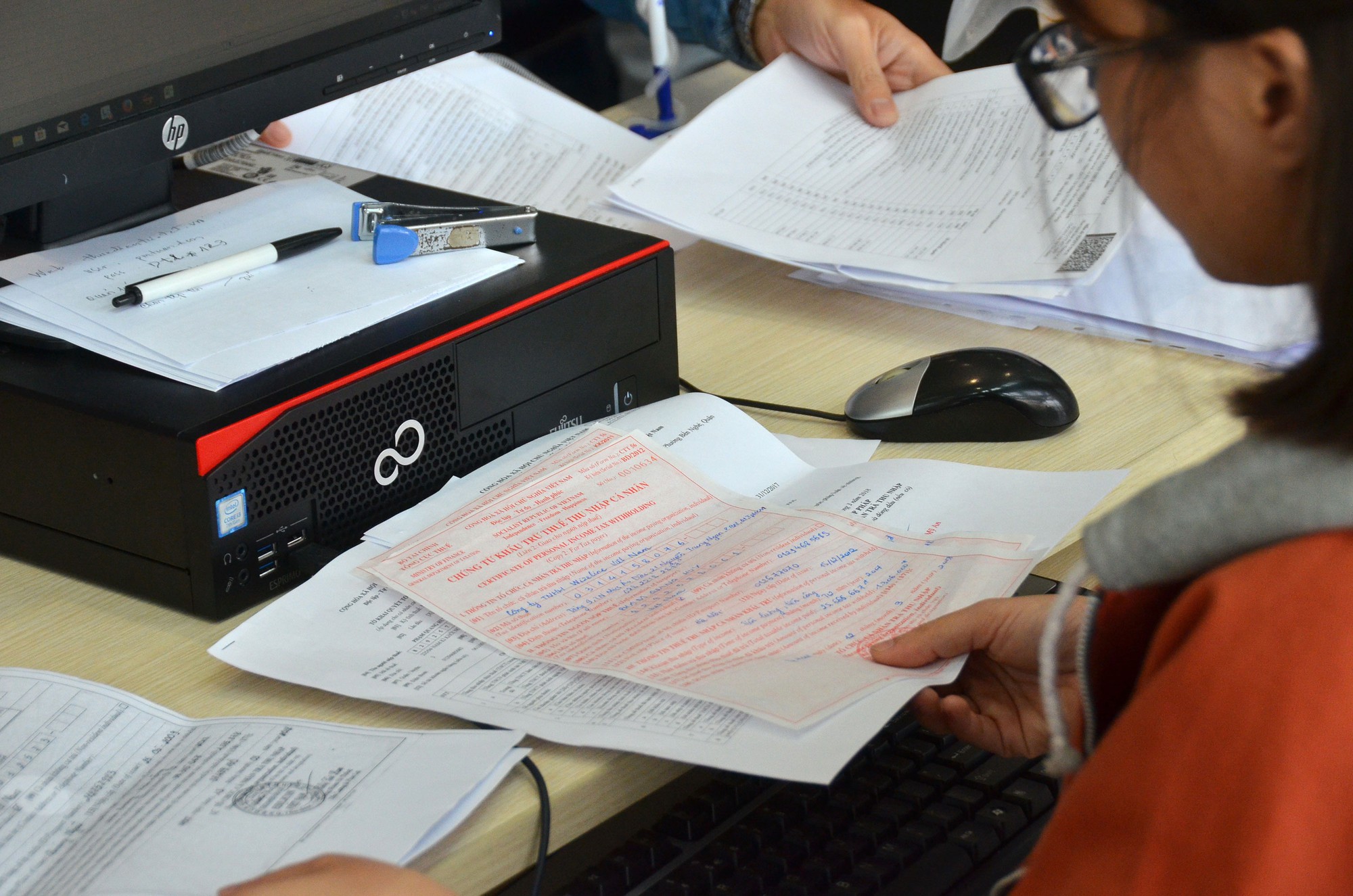

- Vietnam: Red signatures on accounting records shall be fined up to VND 5 million

- 12:14, 10/06/2020

- This is a notable content of Decree No. 41/2018/NĐ-CP of Vietnam’s Government on penalties for administrative violations in the fields of accounting and independent audit, effective from May 01, 2018.

-

- Update: Fines for violations against regulations on auditing works according to Vietnam’s regulations

- 19:22, 04/05/2020

- I want to know about penalties for violations against regulations on auditing works according to current Vietnam’s regulations. How are specific fines? Ms. Nguyen Ngoc Ha in Hanoi sent a question to LAWNET for support.

-

- Vietnam: Summary of fines for violations against regulations on accounting practice

- 09:10, 02/05/2020

- In order to assist Customers and Members to understand the current Vietnam’s regulations on sanctioning administrative violations related to the accounting field, LAWNET would like to summarize all penalties for violations against regulations on accounting practice in the table below.

-

- Vietnam: Summary of violations and corresponding fines in accounting works

- 08:55, 02/05/2020

- Decree No. 41/2018/NĐ-CP of Vietnam’s Government provides penalties for administrative violations in the fields of accounting and independent audit. This Decree has specified violations and corresponding fines in accounting works as follows:

-

- Vietnam: Can husband and wife work in the same accounting department in the company?

- 11:45, 22/04/2020

- This is a question asked by many couples who share the same accounting profession, have the desire to work in the same company to facilitate work and the same rhythm of life. So, according to the current Vietnam’s law on accounting, is it illegal for husband and wife to work in the same accounting department for the company?

-

- Vietnam: Time limit for imposition of penalties for administrative violations in the field of accounting and auditing

- 15:55, 18/09/2018

- On March 12, 2018, the Government of Vietnam issued the Decree No. 41/2018/NĐ-CP on penalties for administrative violations in the fields of accounting and independent audit.

-

- Vietnam: Note 20 mistakes about Signatures that accountants and auditors often make

- 16:10, 29/05/2018

- In order to help people avoid mistakes in the working process, LAWNET would like to share 20 signature violations that accountants and auditors often make and the corresponding penalty for each violation, which are specified inDecree No. 41/2018/NĐ-CP of Vietnam’s Government.

Most view

SEARCH ARTICLE