Decree No. 14/2018/ND-CP

-

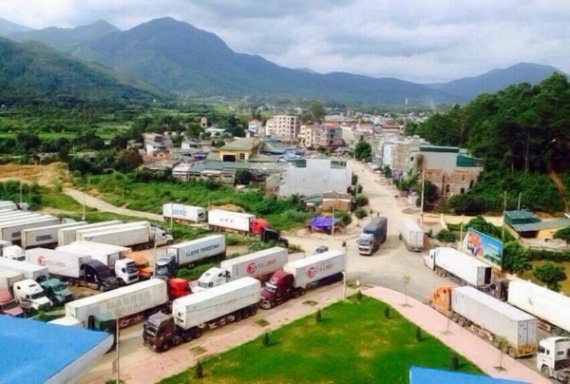

- Vietnam: New customs procedures applied to import and export goods of border inhabitants purchased by traders in bulk

- 09:09, 18/11/2019

- This is a notable content of Circular No. 80/2019/TT-BTC of the Ministry of Finance of Vietnam on customs procedures, tax administration, fees and charges with respect to export and import goods according to Decree No. 14/2018/ND-CP dated 23 January, 2018 of Government on elaborating border trade activities.

-

- Vietnam: Fundamental contents of goods traded at border markets

- 15:58, 21/05/2018

- According to Decree No. 14/2018/ND-CP of Vietnam’s Government, goods traded at border markets shall be goods allowed to be sold in Vietnam according to regulations of law.

-

- Vietnam: Entities eligible to trade in goods at border markets

- 15:52, 24/03/2018

- According to Vietnam’s regulations, “border market" means either a border market, a checkpoint market or a marketplace in a checkpoint economic zone located in a commune whose administrative boundary overlaps the national land border with import, export or trade in goods conducted by bordering traders or residents.

-

- Vietnam: Cross-border trade in goods by traders

- 15:35, 21/03/2018

- On January 23, 2018, the Government of Vietnam issued Decree No. 14/2018/ND-CP on border trade activities, of which one of the notable contents is the regulations on cross-border trade in goods by traders.

-

- Taxes, fees and charges applicable to traders conducting cross-border trade in goods

- 15:45, 27/02/2018

- This is one of the notable contents of Decree No. 14/2018/ND-CP of Vietnam’s Government dated January 23, 2018. So, what exactly are these regulations?

-

- Vietnam: Payment in border trade activities

- 15:30, 30/01/2018

- On January 23, 2018, the Government of Vietnam issued Decree No. 14/2018/ND-CP on border trade activities, which specifies payment in border trade activities.

-

- Cross-border trade in goods according to the Law on Foreign trade management of Vietnam

- 11:08, 30/01/2018

- On January 23, 2018, the Government of Vietnam issued Decree No. 14/2018/ND-CP on border trade activities. According to this Decree:

Most view

.Medium.png) Notable new policies of Vietnam effective from the end of March 2025

Notable new policies of Vietnam effective from the end of March 2025Increase of allowances for commanding titles of militia and self-defense forces from March 23, 2025; amendments to Decree 132 on tax administration of enterprises engaged in related-party transactions; etc., are notable policies that will be covered in this bulletin.

- Notable new policies of Vietnam to be effective as of the start of April 2025

- Notable documents of Vietnam in the previous week (from March 24 to March 30, 2025)

- Notable documents of Vietnam in the previous week (from March 31 to April 6, 2025)

- Notable new policies of Vietnam effective as of the middle of April 2025

SEARCH ARTICLE