Circular No. 80/2019/TT-BTC

-

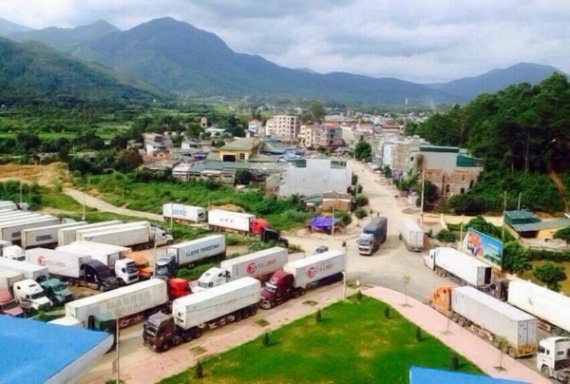

- What are the responsibilities of Vietnam’s customs authorities in management of goods trade and exchange of border inhabitants?

- 09:53, 19/11/2019

- This is a notable content of Circular No. 80/2019/TT-BTC of the Ministry of Finance of Vietnam on customs procedures, tax administration, fees and charges with respect to export and import goods according to Decree No. 14/2018/ND-CP dated 23 January, 2018 of Government on elaborating border trade activities.

-

- Vietnam: Customs inspection with respect to import and export goods of border inhabitants from January 01, 2020

- 09:42, 18/11/2019

- This content is specified in Circular No. 80/2019/TT-BTC of the Ministry of Finance of Vietnam on customs procedures, tax administration, fees and charges with respect to export and import goods according to Decree No. 14/2018/ND-CP dated 23 January, 2018 of Government on elaborating border trade activities.

-

- Vietnam: Guidelines for customs procedures applied to import and export goods of border inhabitants

- 09:26, 18/11/2019

- Recently, the Ministry of Finance of Vietnam issued Circular No. 80/2019/TT-BTC on customs procedures, tax administration, fees and charges with respect to export and import goods according to Decree No. 14/2018/ND-CP dated 23 January, 2018 of Government on elaborating border trade activities.

-

- Vietnam: New customs procedures applied to import and export goods of border inhabitants purchased by traders in bulk

- 09:09, 18/11/2019

- This is a notable content of Circular No. 80/2019/TT-BTC of the Ministry of Finance of Vietnam on customs procedures, tax administration, fees and charges with respect to export and import goods according to Decree No. 14/2018/ND-CP dated 23 January, 2018 of Government on elaborating border trade activities.

Most view

SEARCH ARTICLE