Circular No. 152/2015/TT-BTC

-

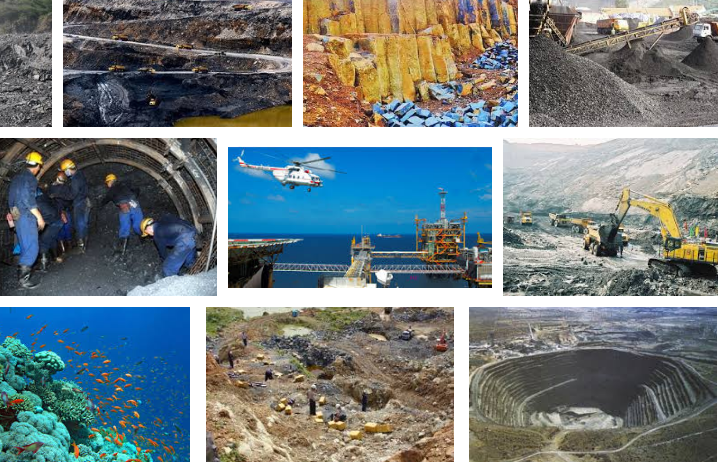

- Severance tax-liable objects according to Vietnam’s current regulations

- 11:35, 07/07/2016

- On November 25, 2009, the National Assembly of Vietnam approved the Law on Severance tax 2009, which provides for severance tax-liable objects, severance tax payers, severance tax bases, and severance tax declaration, payment, exemption and reduction.

-

- Law on Severance tax 2009 of Vietnam: Regulations on taxpayers

- 11:48, 01/01/2016

- According to Vietnam’s regulations, severance tax payers include organizations and individuals that exploit severance tax-liable natural resources.

-

- Vietnam: 6 cases of severance tax exemption

- 14:29, 18/12/2015

- Recently, the Ministry of Finance of Vietnam issued Circular No. 152/2015/TT-BTC providing guidelines on severance tax. According to this Circular, cases of severance tax exemption include:

-

- Vietnam: Cases of reduction of severance tax

- 14:26, 15/11/2015

- On October 02, 2015, the Ministry of Finance of Vietnam issued Circular No. 152/2015/TT-BTC providing guidelines on severance tax. According to this Circular, cases of reduction of severance tax include:

-

- Vietnam: Basis for severance tax calculation according to Circular No. 152/2015/TT-BTC

- 17:21, 06/10/2015

- This is a notable content specified in Circular No. 152/2015/TT-BTC providing guidance on severance tax that was issued on October 02, 2015 by the Ministry of Finance of Vietnam.

Most view

New organizational structure of the Ministry of Foreign Affairs of Vietnam from March 1, 2025

New organizational structure of the Ministry of Foreign Affairs of Vietnam from March 1, 2025The article below will provide the content of the new organizational structure of the Ministry of Foreign Affairs of Vietnam from March 1, 2025.

- Principles for establishing the electricity pricing framework in Vietnam from February 01, 2025

- Economic-technical norms in the assessment of marine sand mineral resources in Vietnam

- Principles for implementing specific policies to resolve projects in Ho Chi Minh City, Da Nang, Khanh Hoa

- Promulgation of the Regulation on environmental safety distance for residential areas in Vietnam

SEARCH ARTICLE