Circular No. 132/2018/TT-BTC

-

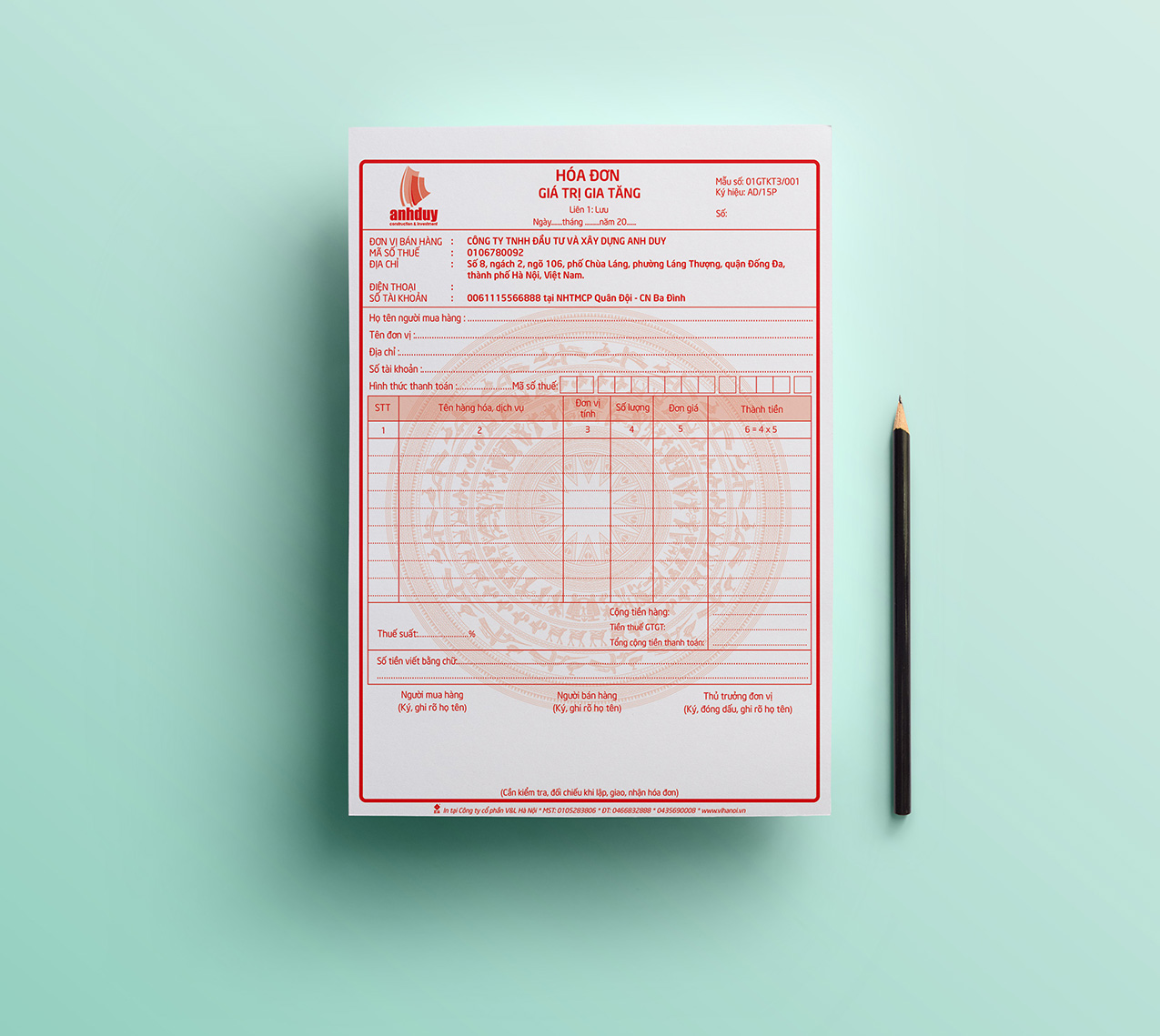

- Vietnam's new regulations on sales invoices of extra-small enterprises

- 12:50, 11/01/2019

- The Ministry of Finance of Vietnam issued Circular No. 132/2018/TT-BTC providing guidance on accounting regimes of extra-small enterprises.

-

- Extra-small enterprises may design forms of accounting documents

- 11:39, 11/01/2019

- This is a notable content specified in Circular No. 132/2018/TT-BTC of the Ministry of Finance of Vietnam providing guidance on accounting regimes of extra-small enterprises.

-

- Summary of forms of accounting books of extra-small enterprises in Vietnam

- 15:22, 10/01/2019

- Recently, the Ministry of Finance of Vietnam issued Circular No. 132/2018/TT-BTC providing guidance on accounting regimes of extra-small enterprises.

-

- Extra-small enterprises in Vietnam are not required to have chief accountants

- 14:37, 10/01/2019

- This is a featured content of Circular No. 132/2018/TT-BTC of the Ministry of Finance of Vietnam providing guidance on accounting regimes of extra-small enterprises.

-

- Guidance on application of accounting regimes to extra-small enterprises in Vietnam

- 15:17, 09/01/2019

- Recently, the Ministry of Finance of Vietnam issued Circular No. 132/2018/TT-BTC providing guidance on accounting regimes of extra-small enterprises.

-

- Accounting regimes of extra-small enterprises in Vietnam

- 09:51, 06/12/2018

- The Draft Circular providing guidance on accounting regimes of extra-small enterprises is currently open for comments on the Government's electronic portal, which applies to extra-small enterprises in Vietnam, including those that pay corporate income tax based on the income tax calculation method and the percentage method on revenue from the sale of goods and services.

Most view

Notable documents of Vietnam in the previous week (from March 10 to March 16, 2025)

Notable documents of Vietnam in the previous week (from March 10 to March 16, 2025) Guidelines on the implementation of the Decision of the President of Vietnam on amnesties in 2025; visa waivers for citizens of 12 countries from March 15, 2025 to the end of March 14, 2028; etc., are notable contents that will be covered in this bulletin.

- Notable new policies of Vietnam effective from the end of March 2025

- Notable new policies of Vietnam to be effective as of the start of April 2025

- Notable documents of Vietnam in the previous week (from March 24 to March 30, 2025)

- Notable documents of Vietnam in the previous week (from March 31 to April 6, 2025)

SEARCH ARTICLE