Circular 78/2021/TT-BTC of Vietnam

-

- Highlight notes when choosing an e-invoice service provider in Vietnam

- 16:53, 05/11/2021

- According to Official Dispatch 4144/TCT-CS dated October 28, 2021, the General Department of Taxation introduced 10 new contents about electronic invoice of Circular 78/2021/TT-BTC, including criteria to select an organization providing services on e-invoices.

-

- 10 new points in Circular 78/2021/TT-BTC of Vietnam on electronic invoices and documents

- 10:22, 05/11/2021

- The General Department of Taxation of Vietnam has just released Official Dispatch 4144/TCT-CS sent to Tax Departments of provinces and cities about the introduction of contents new at Circular 78/2021/TT-BTC instructions on invoices and documents.

-

- Outstanding notes when authorizing e-invoices in Vietnam from July 1, 2022

- 08:30, 19/10/2021

- The seller of goods or the provision of services is an enterprise, economic organization, or other organization that is authorized to authorize a third party (the party that has an affiliated relationship with the seller and is eligible to use e-invoices and not in the case of discontinuing the use of e-invoices) to make e-invoices for the sale of goods and services.

-

- Schedule to apply electronic invoices under Vietnam's Circular 78/2021/TT-BTC

- 09:20, 30/09/2021

- Circular 78/2021/TT-BTC stipulating the schedule for implementing E-invoice application details are as follows:

-

- Instructions for e-invoices generated from the cash register in Vietnam

- 16:42, 29/09/2021

- Circular 78/2021/TT-BTC recently issued by the Ministry of Finance of Vietnam has regulated identify some notable new points about e-invoices. In it, there are regulations on electronic invoices generated from cash registers connected to electronic data transfer with tax authorities.

-

- Instructions for identifying symbols on e-invoices in Vietnam

- 10:55, 29/09/2021

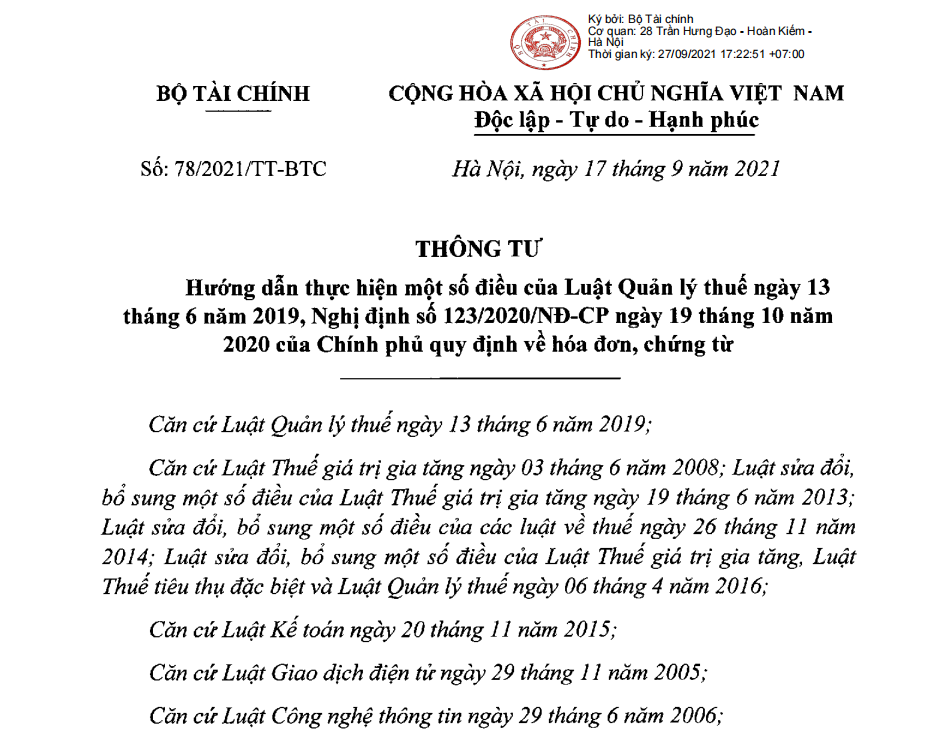

- Recently, the Ministry of Finance of Vietnam has promulgated Circular 78/2021/TT-BTC instructions on some contents of invoices and documents as prescribed at Law on Tax Administration 2019 and Decree 123/2020/ND-CP. In particular, a number of contents about e-invoices such as denominator symbols and e-invoice symbols are guided very specifically.

-

- Vietnam: Circular 78/2021/TT-BTC has been issued guiding the implementation of electronic invoices

- 08:55, 29/09/2021

- The Ministry of Finance of Vietnam has promulgated Circular 78/2021/TT-BTC on direction guide to implement some things of the Law on Tax Management, Decree 123/2020/ND-CP on invoices and documents.

Most view

SEARCH ARTICLE