What are the regulations on indemnities for compulsory civil liability insurance by motor vehicle owners in Vietnam?

What are the regulations on indemnities for compulsory civil liability insurance by motor vehicle owners in Vietnam? What must be included in the applications for claim for compulsory civil liability insurance by motor vehicle owners in Vietnam? - Phuong Linh (Phu Yen)

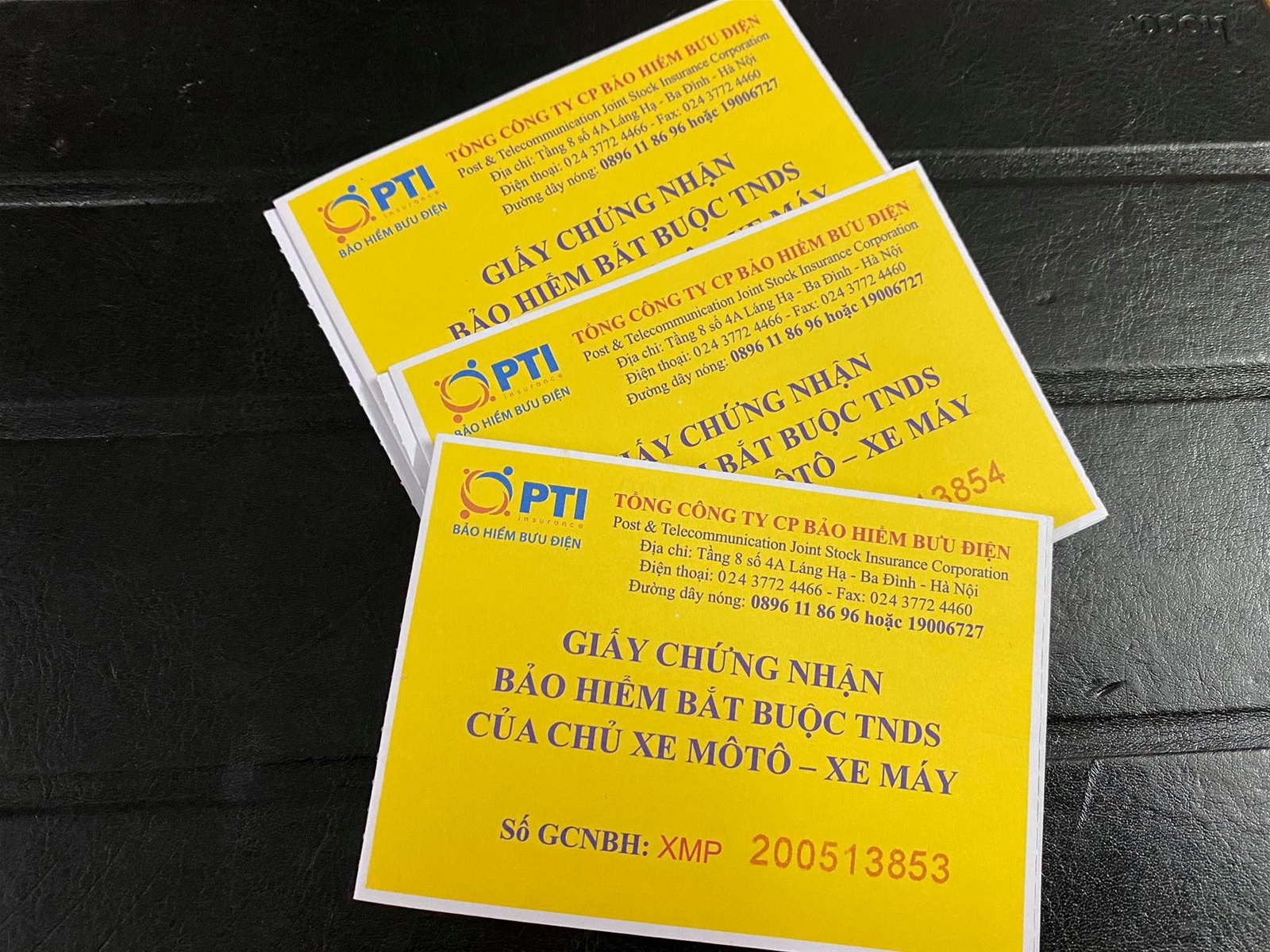

What are the regulations on indemnities for compulsory civil liability insurance by motor vehicle owners in Vietnam? (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. What are the regulations on indemnities for compulsory civil liability insurance by motor vehicle owners in Vietnam?

Indemnities for compulsory civil liability insurance by motor vehicle owners are as follows:

- Specific indemnities for loss of health and life are determined according to corresponding types of injury or damage under Schedule for health and life indemnities under Annex I attached to this Decree or according to agreements (if any) between the insured and victims or victims’ heirs (in case the victims are dead) or victims’ representatives (in case the victims are incapacitated according to judicial decisions or underage as prescribed in the Civil Code) but must not exceed the corresponding indemnities specified under Annex VI attached to this Decree. In case judicial decisions are made, judicial decisions shall prevail as long as the corresponding indemnities specified under Annex VI attached to this Decree are not exceeded.

In case the damage to health and life is caused by multiple motor vehicles, indemnities shall be determined by degrees of fault of motor vehicle owners as long as the total indemnity does not not exceed the maximum coverage.

For accidents which are entirely caused by third party as determined by competent authorities, indemnities for health and life insurance coverage rates for the third party shall equal 50% of the indemnities specified under Annex VI attached to this Decree or agreements (if any) between the insured or victims’ heirs (in case victims are dead) or victims’ representatives (in case victims are incapacitated according to judicial decisions or underage) but must not exceed 50% of the indemnities specified under Annex VI enclosed herewith.

- Specific indemnity for an accident is determined based on actual damage and degree of fault of motor vehicle owner but must not exceed the maximum coverage.

In addition, insurers may reduce up to 5% of indemnities for damage to property in case policyholders or the insured fail to notify insurers about accidents within 5 working days from the date on which accidents occur except for force majeure or objective obstacles or insurers detect that policyholders and the insured fail to notify in case of changes to factors which serve as the basis for calculating insurance premiums during execution of policies, thereby increasing insured risks after insured events occurred.

(Clause 6, 7, Article 12 of Decree 67/2023/ND-CP)

2. Applications for claim for compulsory civil liability insurance by motor vehicle owners in Vietnam

Applications for claim for compulsory civil liability insurance by motor vehicle owners in Vietnam shall compose of the following documents:

(i) Claim forms.

(ii) Documents related to motor vehicles, vehicle operators (certified true copies or copies bearing confirmation of insurers after being compared with originals or photocopies)

- Vehicle registration certificates (or certified true copies and valid original receipts of credit institutions substituting for original vehicle registration certificates during the period in which the credit institutions hold original vehicle registration certificates) or proofs of vehicle title transfer and proofs of vehicle origins (in case vehicle registration certificates are not available).

- Driving licenses.

- ID cards, Citizen Identity Cards, passports or other personal documents of vehicle operators.

- Certificates of insurance.

(iii) Documents proving damage to life and/or health (copies of health facilities or copies bearing confirmation of insurers after being compared with originals or photocopies). Depending on the extent of damage to life, one or some documents below may be included:

- Written proof of injury.

- Medical records.

- Excerpts of death certificates, death notices, written confirmation of police authorities or assessment results of forensic examining bodies in case victims decease while mounting vehicles or decease due to accidents.

(iv) Documents proving property damage:

- Valid invoices and instruments or evidence proving repair and/or replacement of property damaged due to accidents (in case insurers repair and remediate the damage, the insurers are responsible for collecting such documents).

- Documents, invoices and instruments related to additional expenses incurred by motor vehicle owners to reduce the damage or follow instructions of insurers.

(v) Copies of relevant documents of police authorities collected by insurers in fatal accidents for third party and passengers or accidents required to be verified that they are solely caused by third party, including:

Notice of traffic accident investigation, verification, resolution results or notice of accident investigation and resolution results.

(vi) Assessment records of insurers or persons authorized by insurers.

(vii) Judicial decisions (if any).

Policyholders and the insured shall collect and submit the documents prescribed in clauses (i), (ii), (iii), (iv) and (vii).

Insurers shall collect the documents prescribed in clause (v) and clause (vi)

(Article 13 of Decree 67/2023/ND-CP)

Nguyen Ngoc Que Anh

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents