Vietnam: Time limit for imposition of penalties for administrative violations in the field of accounting and auditing

On March 12, 2018, the Government of Vietnam issued the Decree No. 41/2018/NĐ-CP on penalties for administrative violations in the fields of accounting and independent audit.

It is clearly specified in Decree No. 41/2018/NĐ-CP of Vietnam’s Government that:

- The time limit for imposition of penalties for administrative violations in the field of accounting is 2 years.

- The time limit for imposition of penalties for administrative violations in the field of independent audit is 1 year.

Time limits for imposition of penalties for administrative violations in the field of accounting and independent audit are as follows:

- For completed administrative violations, the time limit starts on the time of completion of that violation;

- For ongoing administrative violations, the time limit starts on the time of discovery of that violation;

- In case of penalties for administrative violations committed by individuals being transferred from presiding authorities, the time limit shall be determined in accordance with Clauses 1, 2 and 3 of Article 3 of this Decree. The time the presiding authority spends on handling the case counts towards the time limit.

- During the period specified above, if the violator deliberately evades or obstructs the penalty imposition, the time limit will be reset to the date on which the violator stops evading or obstructing the penalty imposition.

Decree No. 41/2018/NĐ-CP of Vietnam’s Government comes into effect from May 01, 2018.

-Thao Uyen-

- Key word:

- Decree No. 41/2018/NĐ-CP

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Accountants are required to forge their ...

- 09:25, 27/10/2020

-

- Vietnam: How are fines for enterprises for making ...

- 18:02, 04/09/2020

-

- Vietnam: Penalties for forging or providing false ...

- 14:35, 10/06/2020

-

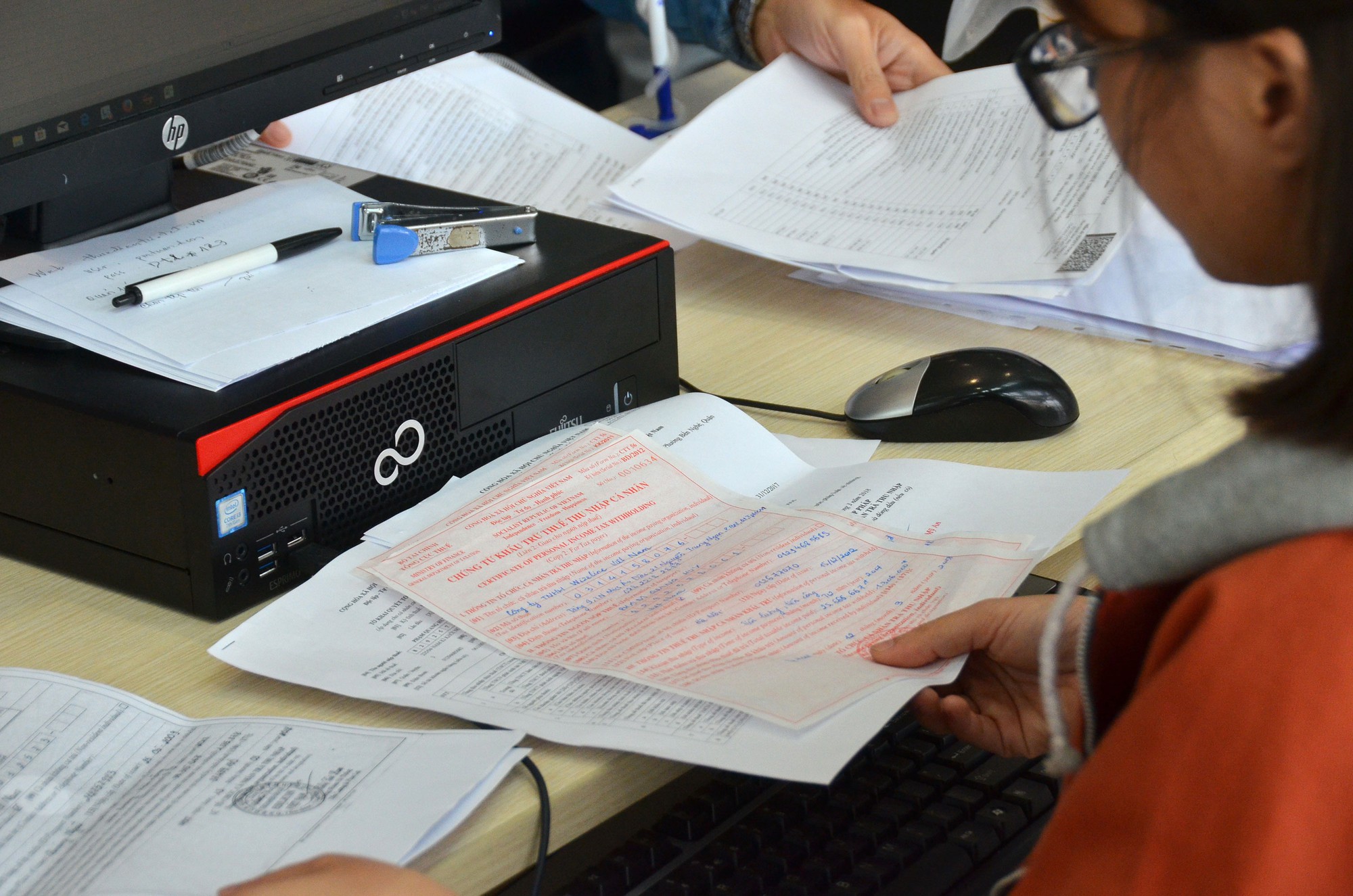

- Vietnam: Red signatures on accounting records ...

- 12:14, 10/06/2020

-

- Update: Fines for violations against regulations ...

- 19:22, 04/05/2020

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents