Vietnam: The calculation of liquid reserve ratio

On July 31, 2018, the State Bank of Vietnam issued Circular No. 16/2018/TT-NHNN, which specifies the calculation of liquid reserve ratio.

According to Circular No. 16/2018/TT-NHNN of the State Bank of Vietnam, the calculation of liquid reserve ratio is based on the following formula:

Where:

- Highly liquid assets are determined according to the Appendix 3 hereof;

- Total liability denotes total liability entry on a balance sheet minus:

+ Refinanced loans made by the State Bank through discount on valuable papers, loans pledged by valuable papers (minus the refinanced loans made by the State Bank based on bonds issued by Vietnam Asset Management Company); overnight loans made through the interbank electronic payment system; forward sale of valuable papers through open market operations of the State Bank; forward sale of valuable papers through open market operations of the State Bank.

+ Credit extensions of other credit institutions and foreign bank branches through forward sale, discount, re-discount and pledged loans: (i) valuable papers used in the State Bank's transactions; (ii) bonds or treasury bills issued by or issued under the guarantee by the Governments or Central Banks of countries rated at least “AA” by an international credit rating agency (Standard & Poor’s, or Fitch Rating) or other corresponding rank of other independent credit rating organizations.

Notably, highly liquid assets and total liability are calculated in VND, including VND and other freely convertible foreign currencies converted into VND according to the exchange rate regulated.

View details at Circular No. 16/2018/TT-NHNN of the State Bank of Vietnam, effective from July 31, 2018.

-Thao Uyen-

- Key word:

- Circular No. 16/2018/TT-NHNN

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Items of medium and long-term fund

- 13:57, 15/08/2018

-

- Exchange rate between a foreign currency and Vietnam ...

- 11:50, 11/08/2018

-

- Vietnam: Basis for applying exchange rate between ...

- 15:06, 02/08/2018

-

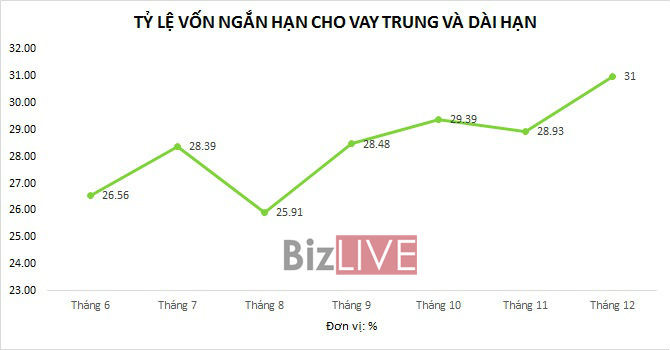

- Vietnam: Calculation of the maximum ratio of short ...

- 11:58, 01/08/2018

-

- Vietnam: What are included in the short-term fund ...

- 14:08, 30/07/2018

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents