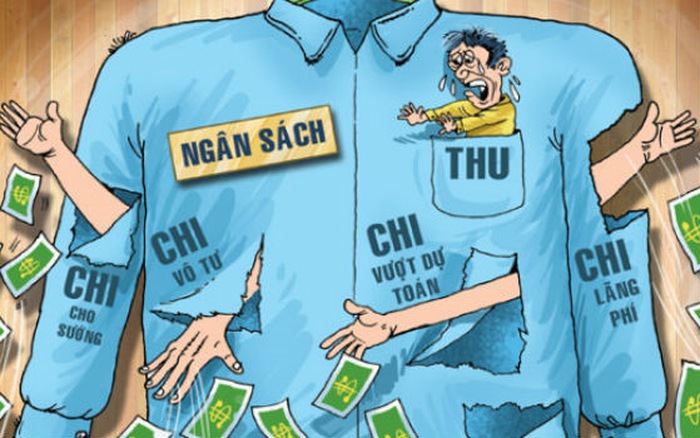

Vietnam: Some notes on budget revenue and expenditure estimates in 2012

Recently, the Ministry of Finance of Vietnam has issued Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012.

According to Article 5 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, based on the 2012 budget revenue and expenditure estimates assigned by the Prime Minister and the People's Committee, estimating units level I of the central budget and local budget levels shall allocate and assign estimates of budget revenues and expenditures to the attached budget-using units in accordance with the provisions of Decree No. 60/2003/ND-CP dated June 06, 2003 of Vietnam’s Government detailing and guiding the implementation of the State Budget Law, Circular No. 59/2003/TT-BTC dated June 23, 2003 of the Ministry of Finance of Vietnam guiding the implementation of the Decree No. 60/2003/ND-CP and additional guidance in this Circular (report to financial authorities according to form No. 1a, 1b and 1c attached to Circular No. 177/2011/TT-BTC). Here are a few points to note:

- Within 07 working days from the date of receipt of the plan for allocation of budget estimates, the financial authority must issue a written notice of the verification results. If after 07 working days, the finance agency has not yet commented as to agree with the agency's allocation plan, the unit shall send it to the finance agency. In case the financial authority agrees with the allocation plan, heads of budget-allocating agencies or units shall spot estimates for budget-using units under their control, and jointly send them to finance agencies and State Treasuries of the same level (according to forms No. 2a, 2b and 2c attached to this Circular) and the State Treasury where the transaction is made (send through the budget-using unit in detail for the unit). If the financial authority requests the adjustment, within 03 working days from the date of receipt of the document from the financial authority, the allocating agency or unit shall receive, adjust and send it back to the financial agency for agreement; in case of disagreement on the adjustment content, report it to the competent authority for consideration and decision as prescribed in Point 1.5, Section 1, Part IV of Circular No. 59/2003/TT-BTC dated June 23, 2003 of the Ministry of Finance of Vietnam.

- In case after December 31, 2011, because of difficulties and obstacles, the cost estimate unit level I has not finished allocating the assigned estimate, the unit must report to the finance agency at the same level for consideration and permitting to extend the time for allocating the estimate. For reasons due to the unit's subjectivity, the time for allocating the estimate will last until January 31, 2012 at the latest; past this time limit, the financial authority shall summarize and report to the competent authority to reduce the expenditure estimate of the unit for transfer to another agency or unit, or to add to the budget reserve in accordance with the Government's regulations. For reasons due to objective reasons, beyond the authority of the unit, such as without the approval of the competent authority on organizational structure, mechanism for performing tasks, etc., the estimated unit level I must estimate the completion time for the finance agency to extend the allocation time, but no later than March 31, 2012; past this time limit, the remaining unallocated budget will be handled similarly to the above-mentioned subjective reasons.

- When allocating and assigning estimates to budget-using units, level-I budget estimation units must pay attention to allocating to repay amounts already advanced, temporarily granted, and receivables under decisions of competent agencies; in case the unit fails to allocate an estimate for these receivables, the financial agency shall notify in writing the agency or unit for reallocation, and concurrently notify the State Treasury agency of the same level to temporarily not grant funding until the allocation is received in accordance with the above provisions.

- In case in January 2012, the budget-using unit has not yet been decided by a competent authority to assign an estimate. finance agencies and the State Treasury shall temporarily provide funds for performing expenditure tasks to budget-using units under the provisions of Article 45 of Decree No. 60/2003/ND-CP dated June 06, 2003 of Vietnam’s Government. After January 31, 2012, the finance agency and the State Treasury shall temporarily stop providing funding to budget-using units (except for special cases requiring written opinions of the same-level financial agencies).

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents