Vietnam: Severance tax-liable objects and entities eligible for severance tax exemption

Severance tax-liable objects are natural resources within the land, islands, internal waters, territorial sea, contiguous zones, exclusive economic zone, and continental shelves under the sovereignty and jurisdiction of Vietnam.

1. Legal basis for regulating severance tax

- Law on Severance tax No. 45/2009/QH12

- Decree No. 50/2010/ND-CP dated May 14, 2010 of Vietnam’s Government

- Circular No. 152/2015/TT-BTC of the Ministry of Finance of Vietnam

2. What is the severance tax?

The purpose of severance tax is to limit resource losses in the process of exploitation and utilization, while also creating a source of state budget revenue and regulating the interests of different population groups in resource utilization.

3. Severance tax-liable objects

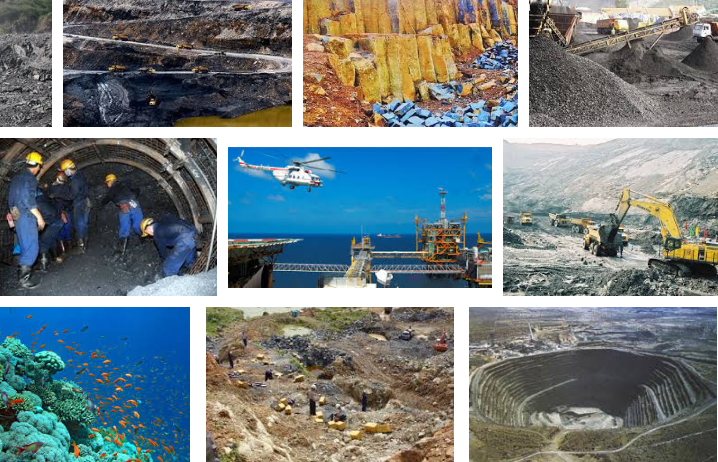

Severance tax-liable objects are natural resources within the land, islands, internal waters, territorial sea, contiguous zones, exclusive economic zone, and continental shelves under the sovereignty and jurisdiction of Vietnam, including:

- Metallic minerals.

- Non-metallic minerals.

- Products of natural forests, including plants and other products of natural forests.

- Natural aquatic products, including marine animals and plants.

- Natural water, including surface water and groundwater other than natural water used for agriculture, forestry, aquaculture, salt production, and seawater used for cooling machines.

- Natural bird’s nests other than those collected from construction of houses to attract and raise natural swifts to collect their nest.

4. Cases of exemption from severance tax

- Entities extracting natural marine organisms.

- Entities extracting branches, firewood, bamboo, rattan, etc. serving everyday life.

- Entities extracting natural water for hydroelectricity generation serving everyday life of households and individuals.

- Natural water extracted by households and individuals serving their everyday life.

- Land areas given/leased out to organizations and individuals and used on the spot; earth used for leveling, construction of security, military works, dykes.

Source: dangkydoannghiep.org.vn

- Key word:

- Law on Severance tax 2009

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam’s frame severance tax tariff

- 10:48, 03/09/2018

-

- Vietnam: Cases of severance tax exemption and ...

- 11:20, 12/12/2017

-

- Severance tax-liable objects according to Vietnam ...

- 11:35, 07/07/2016

-

- Law on Severance tax 2009 of Vietnam: Regulations ...

- 11:48, 01/01/2016

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents